TL;DR – Not only has Netflix’s audience grown significantly in the past two years, but the composition of its user base has changed dramatically as well.

Back in May of 2015, we published a detailed study on the profile of Netflix users, as well as people who didn’t use the service yet but appeared poised to do so. Among a ton of other findings were signs of an emerging segment of parents signing up around that time.

Two-and-almost-a-half years later, Netflix Nation has grown and evolved in ways we couldn’t have imagined back then. Today, approximately 50% of U.S. adults watch streaming content on Netflix at least occasionally, while 29% watch a few times per week or more. Compare that to our data in October of 2015, when only 39% of U.S. adults watched Netflix and 23% watched weekly. That’s an addition of several million new Netflix junkies in a fairly short amount of time.

But who are these millions of people? Who has Netflix been luring into their web over the past two years? And what does the next generation of Netflix addicts look like? I’m glad you asked.

At the bottom of this post is a link to a PDF version of what we call a DeepProfile™ report, which details the demographic and psychographic differences between Netflix’s current user base, its user base in October of 2015, and the general U.S. population. We compared the two groups across hundreds of dimensions, from their gender and income to the TV genres they prefer, to the types of restaurants they frequent. All of it has been neatly packaged for you.

But if you only care about what I found interesting, here are some of the notable findings:

- Today’s Netflix population is much more gender-balanced, showing a rise in the number of male users over the past two years.

- The average income of Netflix users has risen significantly.

- One of the biggest jumps (as we saw in the tea leaves) has been among parents, who represented only 32% of users in October 2015 but 48% of users today.

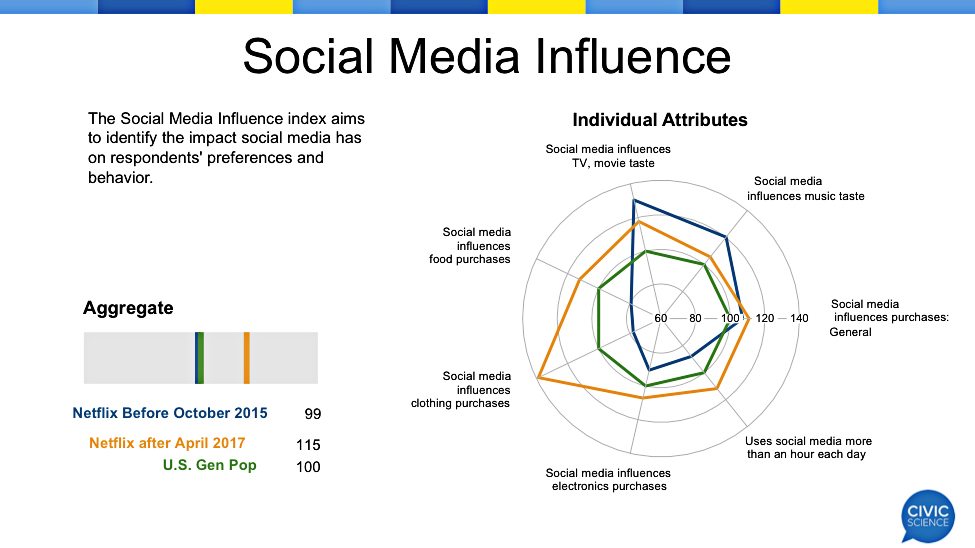

- New Netflix users are much more heavily influenced by social media in their shopping and entertainment decisions, which could explain why they gave in to the Netflix seduction in the first place.

- Early Netflix users were much more price-sensitive than the new generation, suggesting that the platform’s early appeal was its cost relative to other forms of TV.

- New Netflix users are more likely to be foodies, following trends in food and cooking, cooking dinner for their families, and researching recipes online.

- Interestingly, both groups watch TV less than average overall.

- New Netflix users are much more likely to be concerned about things like climate change and buying environmentally-friendly products.

There’s a lot more. Check it out below.

I also took a closer look at the consumers who told us they don’t currently watch Netflix but are planning to. This group represents about 8% of the current U.S. population, up from 7% in our 2015 numbers. No surprise, they’re more likely to be older, particularly 55+. But they’re also more likely to be unemployed, meaning that they could just be waiting to subscribe to Netflix once they have a steady income. People who are documentary fans over-index in this “planning to” segment, which could provide a window into what will push them over the fence. The next wave is much more likely to come from urban centers.

There’s no sign in our data that Netflix’s user growth is going to slow down anytime soon. We’re tracking these population shifts every day, so we’ll know if anything changes. But I wouldn’t be surprised to see Netflix Nation look more and more like the full U.S. population over the next two years.