CivicScience engages directly with consumers, collecting over one million survey responses daily, to turn real-time insights into high-performing advertising campaigns. See how leading brands use CivicScience to drive campaign performance here.

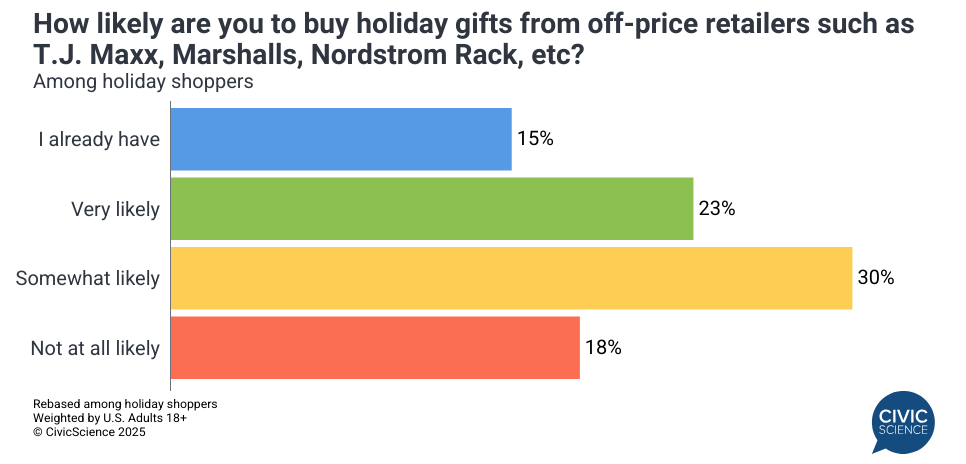

New consumer-declared CivicScience data show that 38% of holiday shoppers have already visited or are ‘very’ likely to shop at off-price retailers, such as T.J. Maxx, Marshalls, Nordstrom Rack, and Saks OFF 5TH, for gift buying this season. But not all off-price experiences are created equal. Here’s how two luxury off-price giants – Nordstrom Rack and Saks OFF 5TH – stack up when it comes to attracting the most valuable holiday shoppers.

1. Big Spenders: Saks OFF 5TH Edges Ahead of Nordstrom Rack

Among shoppers from each retailer, both attract substantial holiday spending increases this year, but Saks OFF 5TH shows slightly more momentum:

Saks OFF 5TH: 54% of customers plan to spend ‘more’ this holiday (vs. 14% spending ‘less’) compared to last year

Nordstrom Rack: 50% of customers plan to spend ‘more’ this holiday (vs. 17% spending ‘less’)

The difference is modest but notable: Saks OFF 5TH customers demonstrate a nearly 4:1 ratio of spenders increasing their budgets versus those decreasing them, while Nordstrom Rack’s ratio is closer to 3:1. Both maintain identical percentages of customers planning to spend about the same as they did last year, at 32%.

The takeaway: Both retailers capture significant holiday spending increases among their fan bases, with Saks OFF 5TH’s segment showing marginally stronger spending confidence.

2. Brand Loyalty: Nordstrom Rack Cultivates Stronger Devotion—And Here’s Why

Nordstrom Rack: 42% of its shoppers describe themselves as ‘very’ loyal to their favorite brands

Saks OFF 5TH: Just 28% of Saks OFF 5TH shoppers say the same

Nordstrom Rack’s audience is significantly more brand-loyal, and the reason becomes clear when examining the factors driving that loyalty:

Quality wins for Nordstrom Rack: 41% of customers cite quality as their top reason for brand loyalty, 10 points higher than Saks OFF 5TH customers

Service wins for Saks OFF 5TH: 25% of favorable consumers prioritize service in their brand loyalty, compared to just 19% of Nordstrom Rack fans

Both retailers attract deal-seeking shoppers at nearly identical levels (around 28-30%); however, Nordstrom Rack stands out for stronger brand loyalty, driven by customers’ higher emphasis on quality. Meanwhile, Saks OFF 5TH fans are more likely to be ‘somewhat’ loyal (57% vs. 48%), suggesting they’re more open to switching between retailers based on deals and inventory availability.

3. Digital Ad Engagement: A Split Decision

Nordstrom Rack shoppers notice ads slightly more consistently: 58% of favorable Nordstrom Rack consumers say they notice digital ads ‘always’ or ‘often’ while browsing websites

Saks OFF 5TH shoppers notice ads frequently: 57% of favorable Saks OFF 5TH consumers report the same behavior

The difference is negligible, but both retailers benefit from audiences that are highly engaged with digital advertising, which is critical for holiday campaign effectiveness.

4. The BNPL Sweet Spot: Both Capture the Same Audience

Fifty-four percent of each retailer’s customers say they’re more likely to use Buy Now, Pay Later services this holiday season compared to last year.

Both off-price retailers attract the same type of flexible payment adopter—likely younger, deal-seeking shoppers who want to spread holiday spending across multiple pay periods. For marketers, this signals a prime opportunity to promote BNPL options in holiday campaigns for either retailer.

5. How to Reach These Shoppers: Cord-Cutting is the Norm

If you’re planning holiday campaigns targeting these off-price shoppers, here’s a critical media planning insight:

Saks OFF 5TH: 84% of customers have already cut the cord and moved to streaming-only services

Nordstrom Rack: 78% of customers have done the same

Digital video, streaming platform advertising (such as Netflix, Hulu), and connected TV are essential for reaching these consumers. Traditional broadcast and cable TV buys will have severely limited reach among off-price retail shoppers.

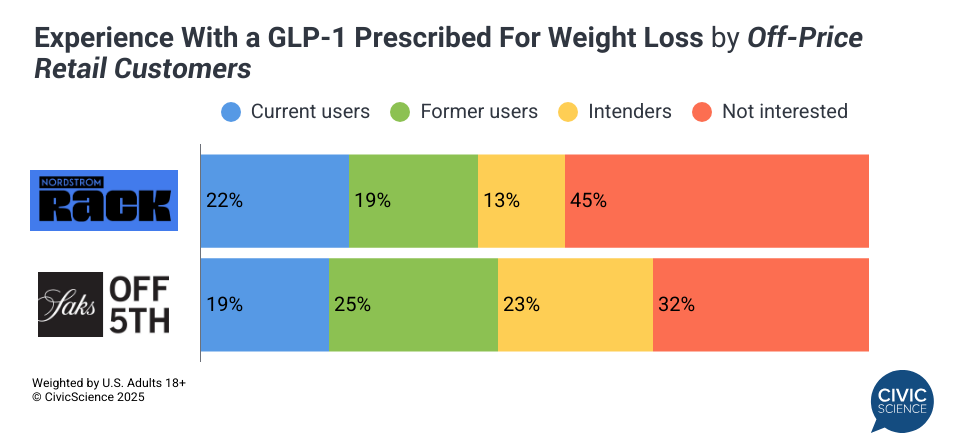

6. The GLP-1 Factor: Saks OFF 5TH Shows Greater Interest in Weight-Loss Drugs

Here’s an unexpected demographic insight:

Saks OFF 5TH: 23% of customers are interested in trying GLP-1 medications, such as Ozempic, for weight loss

Nordstrom Rack: Just 13% of customers express the same interest

Saks OFF 5TH’s customer base shows nearly double the interest in weight-loss medications compared to Nordstrom Rack’s audience. Combining current and former users, 44% of Saks OFF 5TH’s customers have some engagement with GLP-1 medications, versus 41% for Nordstrom Rack.

The data suggests Saks OFF 5TH may be attracting consumers who are actively thinking about or investing in body transformation—shoppers who might be looking to refresh their wardrobes as part of that journey and seeking premium brands at accessible price points. CivicScience’s complete GLP-1 dataset reveals that shoppers taking this medication are purchasing different types of clothing compared to when they first started taking a GLP-1.

What This Means for Marketers

Nordstrom Rack attracts a larger base with stronger brand loyalty, higher perceived quality, and more engaged digital ad attention. Its shoppers are confident spenders this holiday, with many planning significant increases.

Saks OFF 5TH differentiates through superior service perceptions. It attracts a similar profile of BNPL-friendly, digitally engaged shoppers—but faces a steeper unfavorability challenge and a less brand-loyal customer base. Its customers are also the most likely to have already cut the cord (84%), making streaming and digital-first media strategies essential for the company. For retailers, both off-price giants offer access to high-value holiday shoppers ready to spend. The question is, how does your brand fit in the mix?