The PNC-CivicScience Investor Sentiment Index (“ISI”) is a “living,” survey-based measurement of U.S. adults’ current attitudes and expectations related to the U.S. financial markets, investment climate, and market outlook. The primary goal of the ISI is to monitor changes in consumer and investor attitudes, to better anticipate investment trends, market movements, and overall U.S. economic health.

A Snippet of Our Latest Reading:

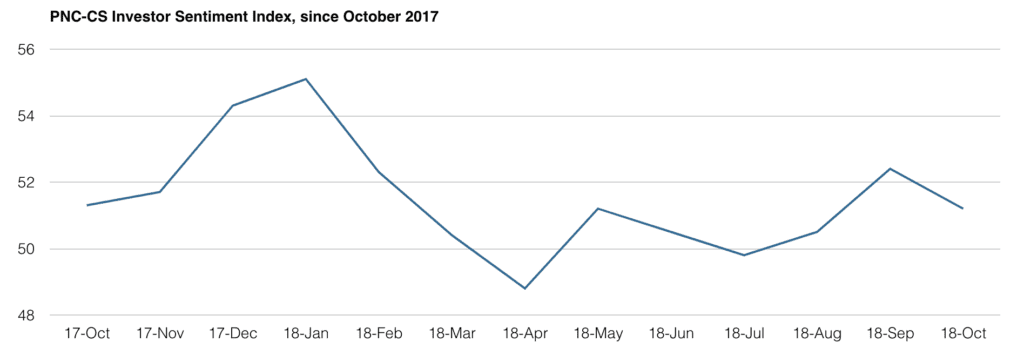

The PNC-CS Investor Sentiment Index (PNC-CS ISI) ticked slightly lower in October after two consecutive months of higher readings. Investor optimism, as measured by the poll, is still easily above the 2018 low reached in April; however, recent momentum slowed as equity markets became more volatile and midterm elections approached. The October 2018 results reflect a generally sanguine outlook regarding the market and the economy, combined with cautious undertones given the myriad uncertainties that must be considered. U.S. real GDP growth remained strong and beat consensus estimates in the third quarter, rising at a 3.5% quarter-over-quarter annual rate. However, real private nonresidential fixed investment, also referred to as capital expenditures, was notably soft. Some slowdown may be expected given the relatively rapid advance in the first half of 2018. We continue to believe the biggest risk to capital investment plans and, by extension, the current business cycle is a deterioration of corporate confidence. Important factors in this regard are the evolution of trade negotiation and the speed at which the Federal Reserve chooses to raise interest rates. Third-quarter earnings season is coming to a close. Blended earnings growth of 25.2% (actual growth combined with consensus estimates) is tracking above the quarter-end consensus estimate of 19.1%. Blended revenue growth of 9.2% continues to move higher as well, supported by strong upside surprises from the Financials and Consumer Staples sectors. Though more companies are reporting actual earnings per share above estimates versus the five-year average, firms are beating estimates by a lower margin over the same time period. The key to individual stock performance this earnings season seems to be forward guidance.

Despite the recent run-up in Treasury yields, we believe rates are unlikely to move meaningfully higher in the near term. In fact, the rolling 60-day correlation between the S&P 500® and U.S. Treasury yields has turned negative. This change has historically preceded lower Treasury yields over the following 12 months. Finally, while a rising term premium could push yields briefly above current levels, we believe the expected terminal federal funds rate of 3.25% will serve as a tether on longer-dated yields, with the inflation expectations and growth components of nominal yields remaining relatively stable.

Individual Poll Questions

Question 1: Six months from now, do you think business conditions overall will be more favorable or less favorable to large, publicly traded companies?

Sentiment surrounding Business Conditions improved slightly in October versus September. The Business Conditions poll reading increased to 54.7 in October versus the prior 54.3. We note that the strong third-quarter GDP report and continued strength in the labor market positively affected corporate outlooks. The poll results continue to suggest that businesses remain optimistic regarding conditions in the next six month period for large, publicly traded companies. Fundamentals for U.S. corporations remain sound, with the economic expansion expected to continue through 2019.

Question 2: When it comes to U.S. stock markets, would you say you feel bullish (optimistic) or bearish (pessimistic) right now?

The PNC-CS ISI Bullish/Bearish sentiment suggests that those poll participants were less bullish about the U.S. stock market in October. After peaking in January at 59.6, just before the stock marketed corrected about 10%, the Bullish/Bearish reading fell to a year-to-date low in April of 52. Since then, the reading had consistently climbed, reaching a level of 57.8 in September. High bullish readings often can be an indicator for the stock market. As in January, this again proved to be the case. In October, the reading fell to 55.4 has stock volatility picked up, with U.S. large-cap stocks suffering their second significant correction of 2018.

Question 3: Six months from now, do you expect to invest in stocks/equities at a higher or lower rate than you are currently investing?

Sentiment towards Personal Investment asks poll participants to consider whether they will be more or less likely to invest in stocks six months from now versus their current view. Individuals are likely to respond to headlines from a more personal view than the business community. Personal Investment sentiment moved lower in October to 43.6, versus the September reading of 45.0. This level is consistent with the readings we have seen from this component of the poll since its inception in