The HPS-CivicScience Economic Sentiment Index (“ESI”) is a “living” index that measures U.S. adults’ expectations for the economy going forward, as well as their feelings about current conditions for major purchases. The primary goal of the Index is to accurately measure movements in overall national economic sentiment and to provide a more sophisticated alternative to existing economic sentiment indices. Unlike other prominent indices that release consumer sentiment estimates infrequently, the HPS-CivicScience Index is updated in real-time as responses are collected continuously every hour, every day. Large-scale cross-tabulation of survey responses and consumer attributes enable more granular analyses than are currently possible through prevailing measures.

Excerpt From the Latest Reading:

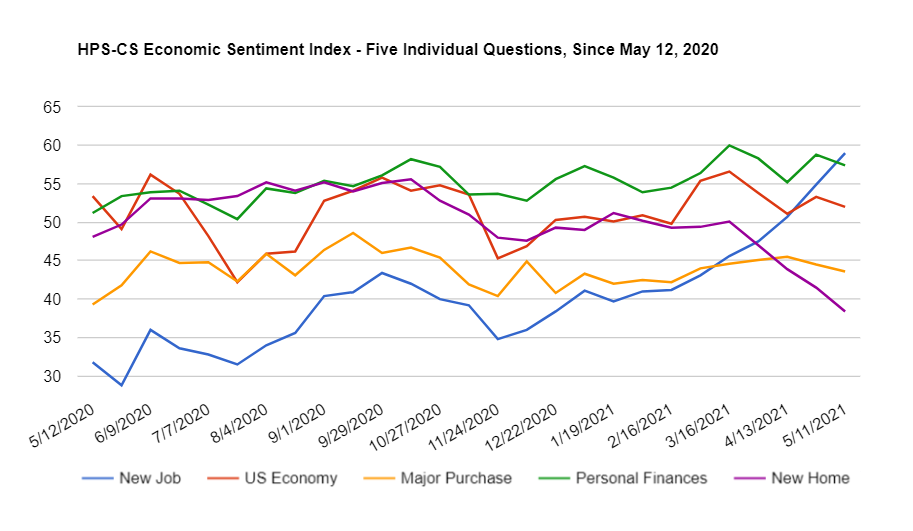

Overall economic sentiment fell for a third time in four readings, as the HPS-CivicScience Economic Sentiment Index (ESI) dropped 0.5 points to 50.1. This week’s reading marks the breaking of two records: Confidence in the job market reached a record high for the second reading in a row (rising 4.1 points to 59.0) even as confidence in the housing market reached a record low, dropping 3.1 points to 38.4.

Although vaccination rates continue to increase and states gradually begin to ease pandemic-related restrictions, the country’s economic recovery faces a variety of headwinds. April jobs numbers released last week landed well below expectations as the unemployment rate increased to 6.1%, while expectations of future inflation reached their highest point since 2013. In addition to record-low confidence in the housing market, the other ESI indicators to fall this reading were:

– Confidence in personal finances dropped 1.4 points to 57.4

– Confidence in the overall US economy dropped 1.3 points to 52.0

– Confidence in making a major purchase dropped 0.9 points to 43.6