It’s been nearly 30 years since craft brewing’s patron saint, Jimmy Carter, de-regulated the beer market and subsequently started the craft beer revolution. And, in a similar path that was forged by Silicon Valley pioneers earlier in the decade, what began as a garage-only endeavor has now exploded into a multi-billion dollar enterprise. As anyone who has been in a bar or at a party in the last decade can attest, the craft market has grown exponentially. In fact, it’s doubled from a 5% market share in 2010 to 11% in 2014 — the first time ever that craft has had double digit market share.

As you can imagine, this explosion of sales and encroachment on the traditional beer behemoths has not gone unnoticed: Anheuser-Busch InBev, MillerCoors, and other massive beverage corporations have begun to strike back at craft, launching communications campaigns to embrace their macro image, or outright acquiring the competition. In 2015 alone, popular craft brands such as Ballast Point, Elysian Brewing, and Firestone Walker were all acquired. In December, AB InBev purchased three craft brewing companies in a single week: Four Peaks Brewing Company, Camden Town Brewery, and Breckenridge Brewery.

As fans of consumer insights and hoppy deliciousness, our natural curiosities took over.

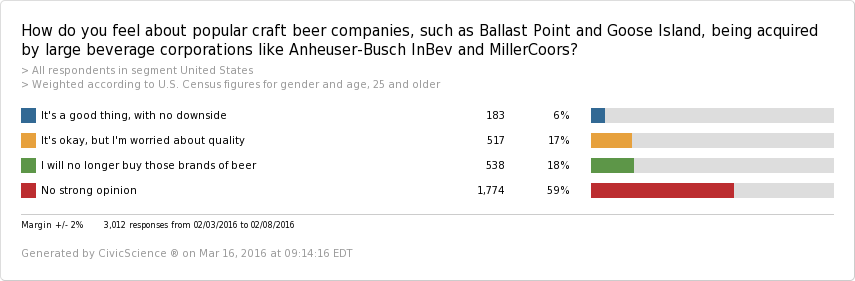

The first and most obvious read in the data above is that most US Adults of legal drinking age couldn’t care less. They have no strong opinion on the matter. However, the remaining 41% of legal drinkers in the US should give beer conglomerates pause: very few of them see this as an unmitigated success, and most either have reservations about the acquisitions or state outright that they will no longer purchase the acquired brands.

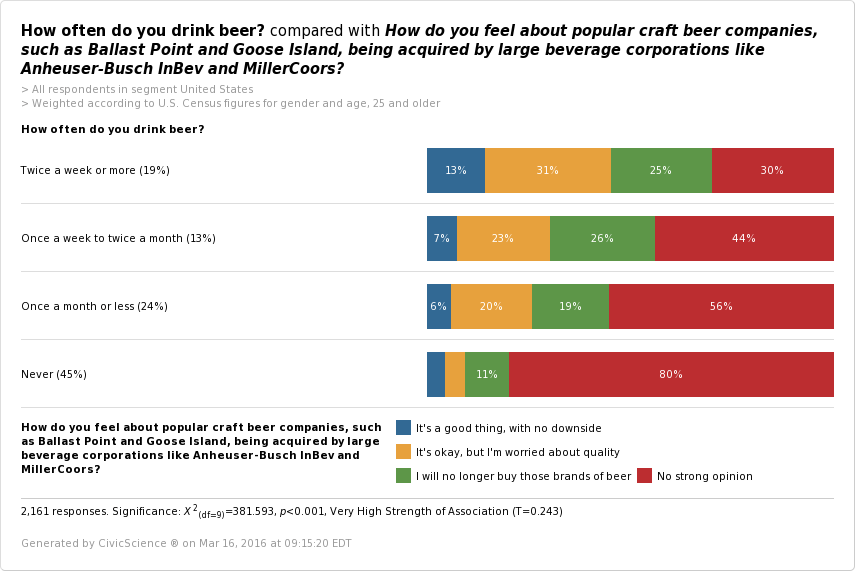

Compare the results with beer drinking behaviors, and the results become even more instructive:

As you can clearly see in the data cut above, those who have no strong opinion are dominated by those who rarely or never drink beer. In other words, the majority of the people who don’t care are outside of the target market for a large beverage company. On the other hand, those who do drink beer are more likely to have an opinion about the issue, and the more beer they drink, the stronger that likelihood gets.

So, what do steady (2x per week or more) beer drinkers think? More than half (56%) express some reservations, with one in four of them swearing off those brands for good. In other words, the big beer corporations are acquiring a hot commodity, but may be immediately eliminating what makes it appealing to their target market as soon as they get their hands on it.

With that in mind, beer conglomerates are faced with a quagmire: how do they compete with the rise of craft without cannibalizing their own business? Mitigating the concerns of their most crucial market by ensuring quality is maintained is a start, but one can’t help but wonder if acquisitions are the wrong path altogether. As it stands now, big beer companies are paying two massive costs: the tangible cost of the acquisition itself, and the less tangible cost of diminished brand equity among their most coveted customer.