Consumer behavior does not exist in a silo. Their decisions are impacted by forces outside the narrow purview of any industry or brand. So how do brands better understand their current and potential customers to ensure they make the right business decisions? In essence, they need consumer-centric information that is trustworthy, timely, and relevant. This is why we partnered with some of our best clients to create The CivicScience 360 Report.

The 360 Report scans the CivicScience database of thousands of always-on questions. It discovers key insights for your brand by comparing them to competitive and consumer segments, identifying differences and similarities, and alerting you to shifts in categories like financial outlook, media consumption, and health and wellness. So you never miss an opportunity or threat.

We ran The 360 Report for The Home Depot and Lowe’s to show how this product works. We uncovered significant insights in three of the verticals that this report offers for these popular home improvement brands.

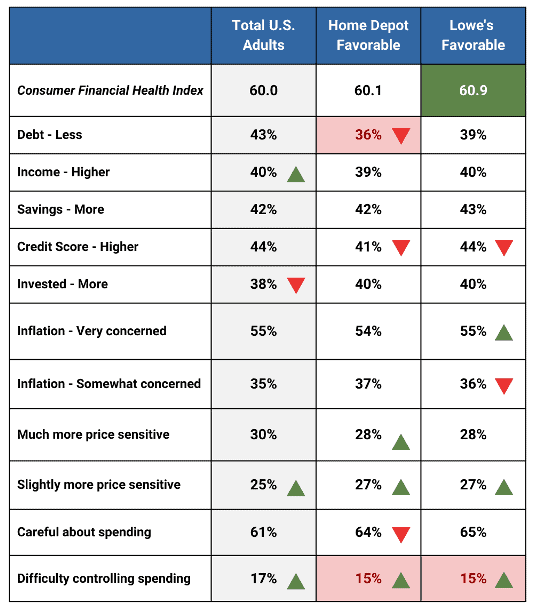

Financial Outlook

Consumers favorable to The Home Depot are slightly more concerned about finances than those favorable to Lowe’s. Price sensitivity is high for most consumers right now. However, price sensitivity increased significantly from last month among The Home Depot customers. While most Americans say they are being more careful about spending, difficulty controlling spending increased from the previous month.

The Home Depot and Lowe’s customers align closely with the national average on the CivicScience Consumer Financial Health Index, although Lowe’s skews a touch higher.

Across the U.S. demographic segments of the general population, young and high-earning consumers feel the most financially optimistic. In contrast, older and lower-earning cohorts show the most profound concern for their financial situations.

The Home Depot / Lowe’s 360 Report

Financial Outlook – October 2022

Shopping Behaviors & Trends

Regarding shopping behaviors, The Home Depot and Lowe’s customers are more likely than the average U.S. adult to research a product on one site and buy on another. They are also less likely to say that price is important and more likely to say the brand is.

Regarding spending in the next month, both saw significant increases from the prior month in spending on toys, hobbies, and gifts and decreases in spending on travel. With the holidays fast approaching, the increase in toy spending is not surprising, but the decrease in travel may indicate less holiday travel this year.

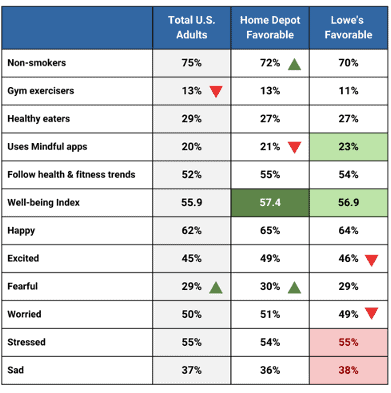

Health & Wellness

The Home Depot and Lowe’s customers are on par with the general population regarding physical health. However, they are both more likely to be smokers. When it comes to emotional well-being, we see some slight differences. Home Depot customers are likelier to express positive feelings in the past month, skewing higher on happiness and excitement. This is reflected in their Emotional Well-Being Index being higher than both the average consumer and Lowe’s customers this month.

The Home Depot / Lowe’s 360 Report

Health & Wellness – October 2022

About the 360 Report

In the time it takes to read this, your customer and the world around them will change.

Only CivicScience paints an always-on, ever-evolving, 360-degree picture of your current and potential customers – ensuring you never miss an opportunity or risk.

Enter the 360 Report, a premiere product offering for CivicScience clients. The report:

- Delivers a complete and timely view of trends and shifts in consumer attitudes, lifestyle, and intent.

- Predicts consumer behavior and powers more forward-looking strategies and marketing investments, maximizing growth and profitability.

- Provides invaluable, timely knowledge to accelerate decision-making and give you a unique competitive edge.

- Alerts you to trends and changes as they happen, ensuring you never miss an opportunity or threat.

Ready to build your custom 360 Report? Start here.