As a recent college graduate who, at best, would only consider himself somewhat financially literate, I was eager to find out more about financial literacy in America.

If you’re unfamiliar, financial literacy is the ability to understand how money works throughout many facets of life. It entails the understanding of how to manage it, invest it and even donate it. The U.S. has been increasingly looked down upon for its financial education, only ranking at 14th most financially literate country in the world. Just 37% of adults demonstrated high financial literacy in 2015, as opposed to 42% who demonstrated high financial literacy in 2009. Many economists worry that the lessons from the 2008 financial crisis have too quickly been forgotten and that this financial-forgetfulness may lead to similar events in the future.

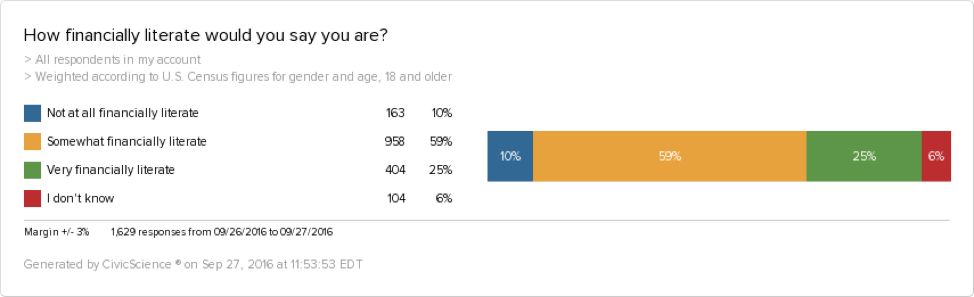

To begin delving into this complex and multi-faceted issue, I took a look at the topline results of the following question.

84% of those we asked consider themselves at least somewhat financially literate. It’s important to note that these numbers are much higher than the national average. This is because we only asked what people consider themselves, but did not make them prove it. If we did, it’s likely that many could not pass a quick financial competence exam.

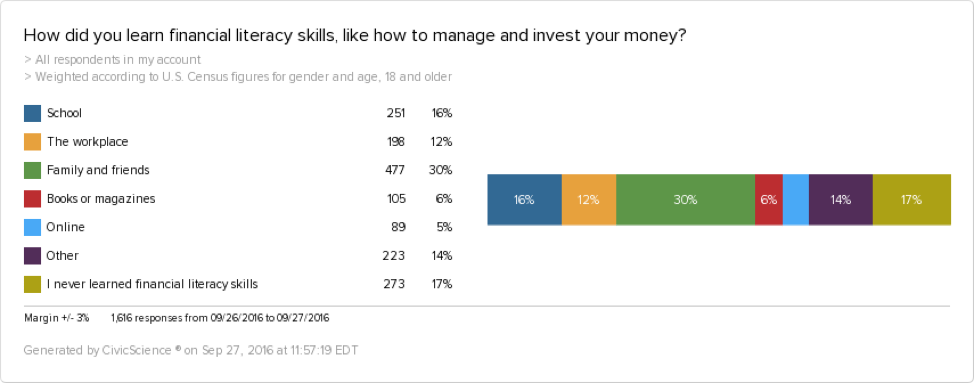

Next, and maybe most importantly, is where people adopt financial literacy skills.

As you can see, the majority of people (30%) learned financial literacy skills from family and friends. The next largest group (17%) says that they never learned financial literacy skills, followed by those who learned these skills in school.

The fact that 17% of people never learned financial literacy skills is bad, and when we consider that many who do consider themselves financially literate are not as learned as they think, it becomes even worse. I find these results in and of themselves fascinating, but let’s dig deeper.

Where People Learn to Be Financially Literate Matters

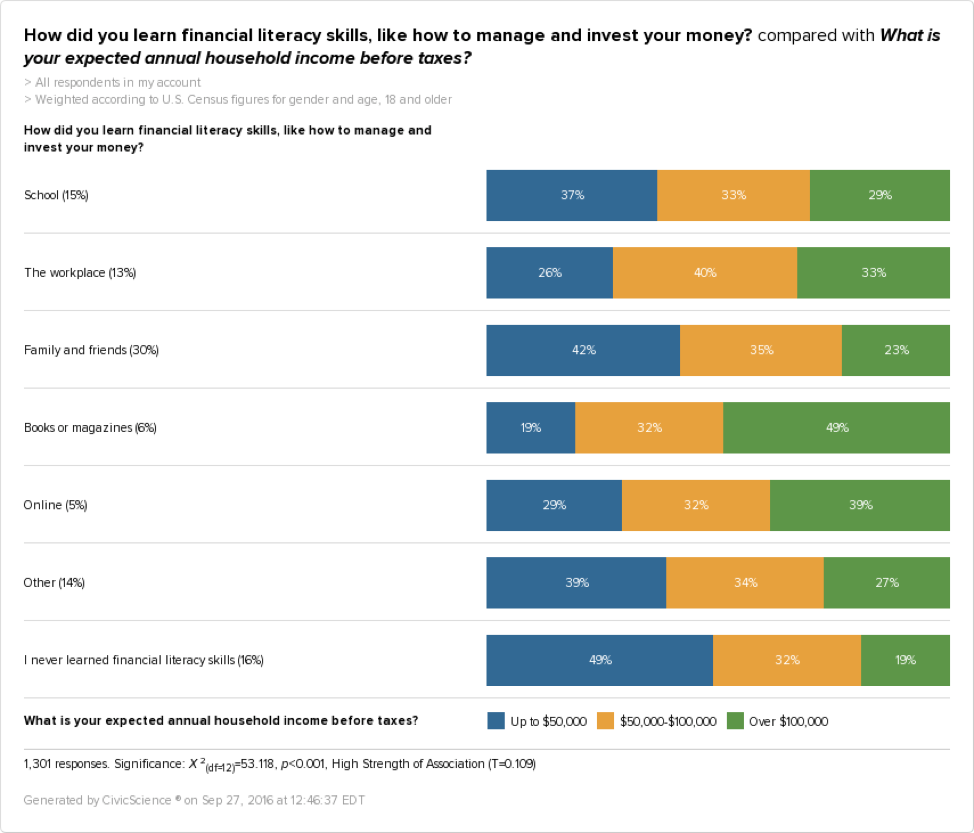

As it turns out, there are many differences according to where people learn financial literacy skills.

Those who never learned financial literacy skills consider themselves the least financially literate. No surprises there. However, the next most financially illiterate group consists of those who learned financial literacy skills in school. This seems to confirm that the financial education in school curricula, if in them at all, is not doing its job to prepare students for the “real world.”

Another surprise is that the group that considers themselves most financially literate consists of those who learned financial literacy skills online. They are closely followed by those who learned from books or magazines.

As I mentioned, however, this competence is self-reported, so let’s continue to dive deeper.

Financial Literacy and Financial Success

Though income is not nearly the only way to measure financial success, it is one way to do so. Although those who learned about finance online consider themselves the most financially literate, are they? If so, we may expect this confidence to show in their financials. After all, financial competency entails knowledge of money management, investment etc. and with that knowledge would presumably come increased income.

Those who learned financial literacy skills from books or magazines have the highest income, as 49% of this group makes over $100k. I find this fascinating. This group is followed by those who learned online. These results are mostly consistent with the previous data.

Besides for those who never learned financial literacy skills, those who learned from family and friends have the lowest income (42%), followed by those who learned from other mediums (39%), and lastly, school (37%).

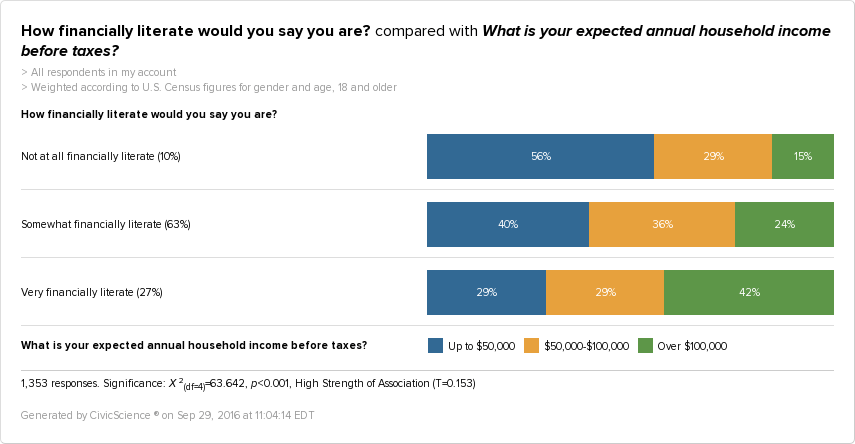

Lastly, we can see that financial literacy heavily correlates to income in general.

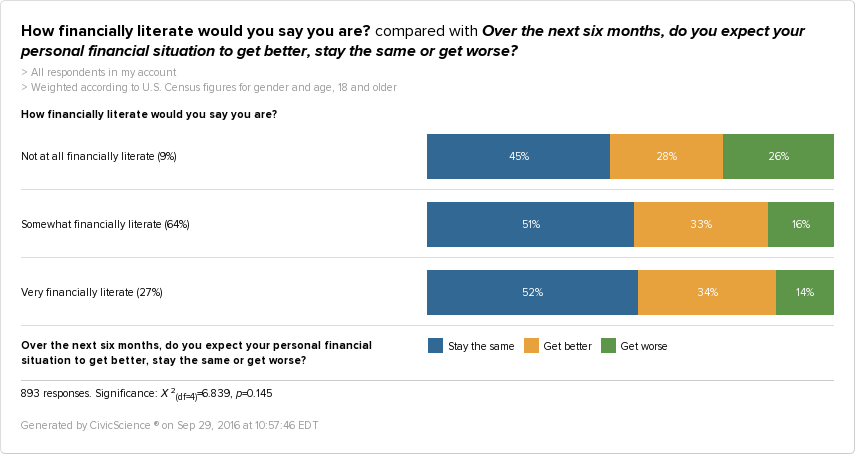

Financial Literacy and the Future

As we’ve seen, financial literacy, and the origins of that financial literacy affect current income – but how does it affect future income?

Those who are not at all financially literate are more likely to expect that their personal financial situation will worsen over the next six months. Conversely, those who are very financially literate are more likely to expect their personal financial situation to improve over the next six months.

This is important for a few reasons, one being the idea of the “self-fulfilling prophecy” – a concept that has been proven time and time again.

People who are financially illiterate are more likely to believe their situation will worsen, and therefore, their situation might genuinely become that much more likely to do so.

If anything, financial literacy promotes confidence in decision-making, which may lead to a better outlook for the future, making that future more likely to happen. However, this is just an inference.

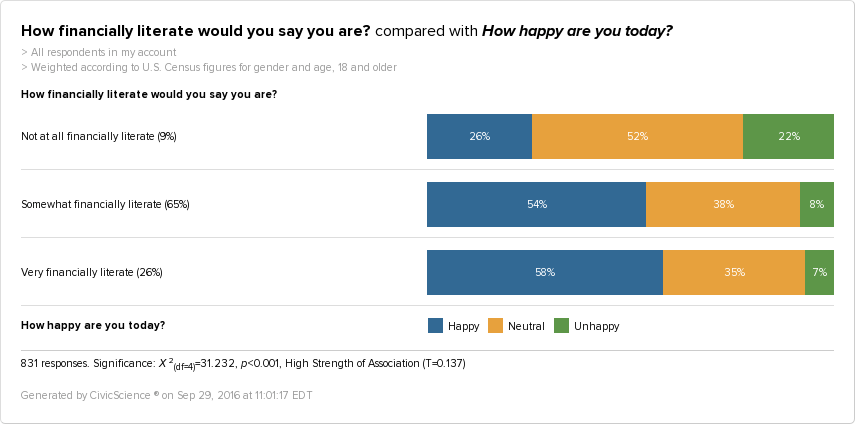

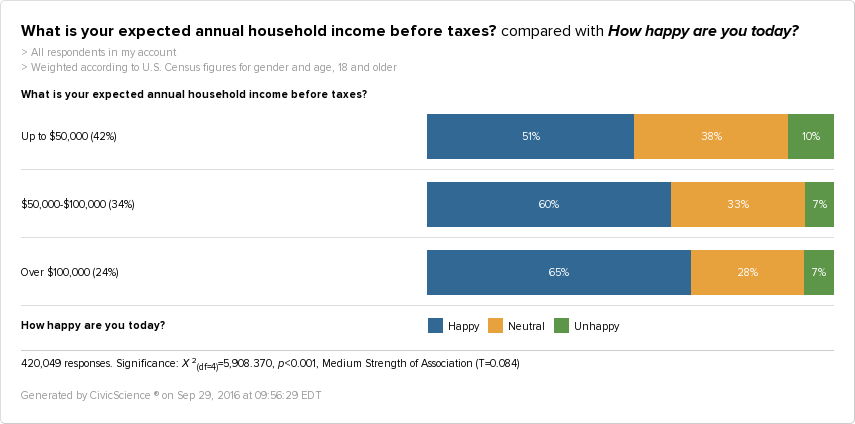

Money Isn’t Everything

Financial literacy does not only influence investments, stocks, and income. It contributes to other everyday aspects of life as well.

As we can see, those who are financially literate are more likely to be happy than those who aren’t. In fact, it is by a somewhat large margin. Though financial literacy does correlate to income, the difference in happiness between those who are not financially literate and those who are exceeds the general correlations between happiness and income.

Other Trends

Those Who Learned Financial Literacy Skills in School

• More than twice as likely to be unemployed

• more likely to go to the movies at least once a month

• More likely to be between 18 and 34 years old

• More likely to live in the U.S. South

Those Who Learned Financial Literacy Skills in the Workplace

• More likely to earn between $50k and $100k each year

Those Who Learned Financial Literacy Skills from Family and Friends

• More likely to eat most often at fast-casual restaurants

• More likely to choose music based on social media influences

• More likely to use Netflix

• Less likely to volunteer at least once a week

Those Who Learned Financial Literacy Skills Online

• More likely to live in the U.S. Northeast

• Less likely to live in the U.S. Midwest

• More likely to be men

• More likely to be between 18 and 34 years old

Those Who Learned Financial Literacy Skills from Other Sources

• More likely to be over 55 years old

• More likely to live in a rural area

Those Who Never Learned Financial Literary Skills

• Much more likely to subscribe to Boost Mobile

• More likely to actively use Twitter

• More likely to rent their homes

• More likely to earn under $50k a year

• Less likely to closely monitor their retirement savings

• Less likely to manage their money very well.

Cashing Out

These numbers provide incredibly value insights into the depth, breadth, and importance of financial literacy. This skill set spans way beyond knowing how to invest money. It encompasses many aspects of our lives that determine health, happiness, and future success.

As we’ve seen, schools may not be doing enough to equip students with the skills needed to navigate finance. This lack of financial literacy puts current and future consumers in danger of being taken advantage of. Fortunately, however, there are a plethora of financial resources online, and those who learn from those sources seem to be doing just fine.