A little over five years ago, every marketer wanted to know how to reach the Millennial generation. That interest gave way to the younger Gen Z age group, followed by the even younger Gen Alpha. But the digital natives who came into adulthood during the Great Recession now make up the largest living U.S. generation, surpassing Baby Boomers by 2020. In particular, those born in 1990 and 1991 – or the “peak Millennials” as they’ve been dubbed by The New York Times – represent the largest population segment, outnumbering Americans born in any other year. That makes this Millennial subset of those turning 33 and 34 in 2024 one wielding a significant amount of economic influence.

Consumer data often focuses on the Millennial generation as a whole, but what do we know about ‘peak’ Millennial consumer traits and how they are shaping the economy?

For one, Millennials born from ’90 to ’91 face a tough housing market at an age when many consider a first home purchase. The median age for first-time homebuyers keeps increasing each year, from age 33 in 2021 to age 35 today, according to data from the National Association of Realtors.

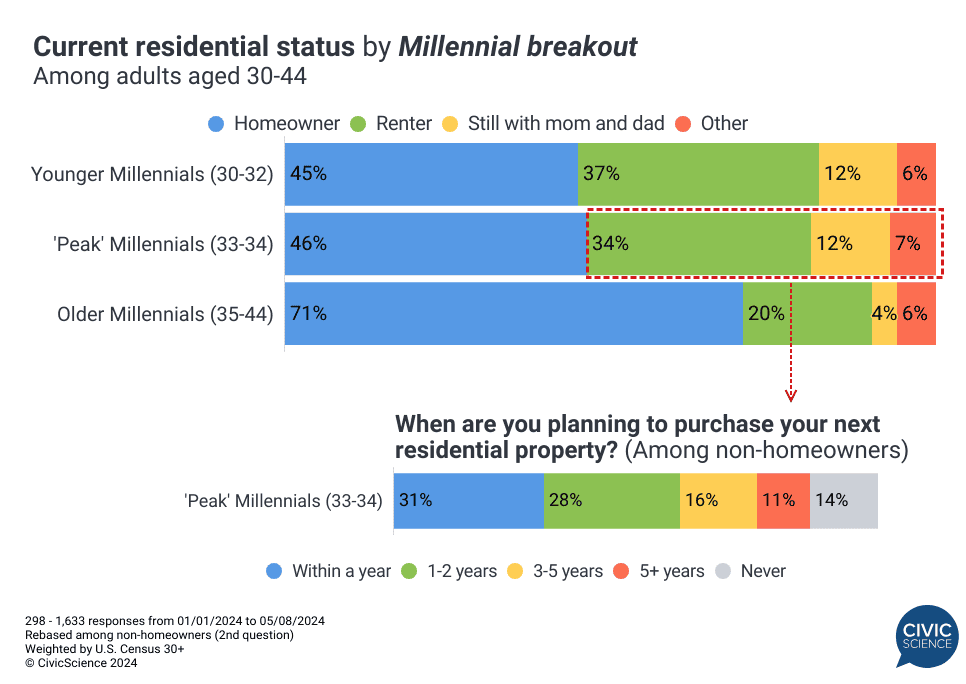

CivicScience data show 46% of peak Millennials (33-34) report they are homeowners in 2024, just a hair ahead of those aged 30-32 and well behind older Millennials. Of the 54% who are renters or still living at home, a little over half of this group are looking to purchase a home within the next two years.

Although most peak Millennials are looking to become homeowners, current market conditions make that goal a challenge. Additional data show that a plurality of peak Millennials who are in the market to buy a new home say they are holding off due to high home prices, and secondly from a lack of available homes for sale, more so than interest rates.

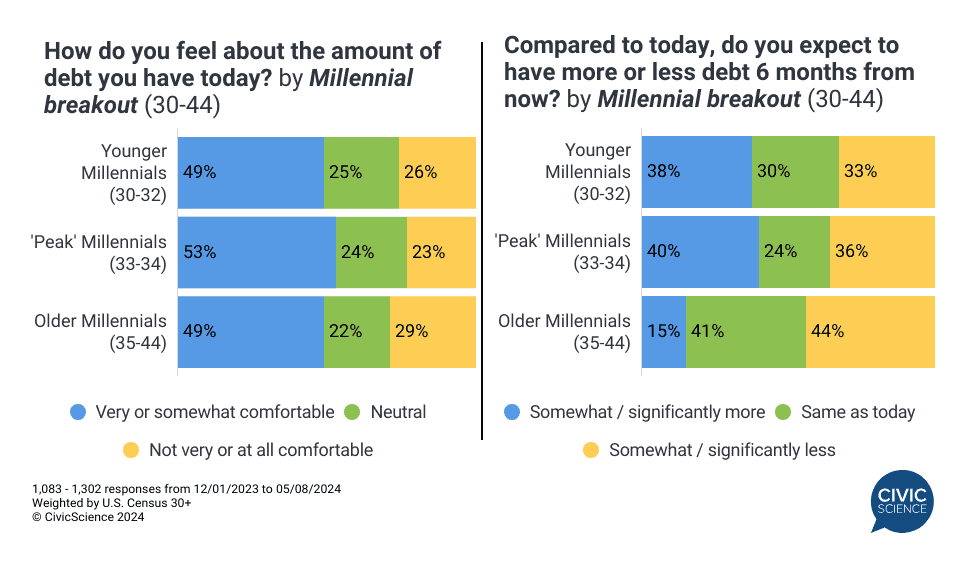

Debt is also another important factor shaping the lives of peak Millennials. Twenty-three percent of this age group report they are carrying student loan debt, and nearly 3-in-4 borrowers are at least ‘somewhat’ concerned about being able to pay off their loans. However, they’re carrying less debt and are also less worried about it than Millennials aged 30-32.*

In fact, peak Millennials are the most likely of their generation to feel comfortable overall with the amount of debt they have. While 40% expect that they will take on more debt in the next six months, a nearly equal percentage expect that they will have less (36%).

Clearly, peak Millennials are not a homogenous group, but they do exhibit certain traits when it comes to homebuying and debt load that stand out against 30-somethings younger and older than them.

Take Our Poll: Do you identify with the fellow members of your generation (i.e., Baby Boomers, Gen X, Millennials, etc.)?

Stay tuned for additional insights from CivicScience about peak Millennials. For more consumer insights we won’t publish, including access to more than 500K questions in the CivicScience InsightStore™, get in touch.

*n=870 responses from 01/01/2024 to 05/08/2024