Generation Alpha – those born in the early 2010s – has recently become a major force in the beauty industry, perhaps even more so than their Gen Z counterparts. A recent report found that Gen A accounted for 49% of skincare sales growth, and previous CivicScience data found that beauty shopping for this age group during the holidays jumped 11 percentage points YoY. Retailers like Sephora and Ulta have also noticed an uptick in younger shoppers – ultimately leading to the naming of the “Sephora Kids” who were trending on TikTok.

The rise of beauty shopping among young Americans has also been a controversial topic. There has been increased discussion about the potential adverse effects on mental health and the risks of using skincare ingredients designed to treat mature skin. Meanwhile, others view the rise of skincare purchases among Gen Alpha as an opportunity for children to learn how to care for their skin at a young age.

Join the Conversation: How much are you willing to spend on beauty products for your child on a monthly basis?

While CivicScience does not survey children under 13 years old, new data uncovers interesting insights on Gen A’s parents (children aged 6-11 years old):

Nearly half of Gen Alpha’s parents have purchased skincare products for their children in the last three months.

Among U.S. adults with children of all ages, 44% have purchased beauty products for their children in the last three months, including skincare, makeup, hair care, and perfume. The top most purchased products are hair care (28%) and skincare (24%); however, these figures jump significantly among parents with younger children. Forty-six percent of parents with children ages 6-11 have purchased skincare products over the last three months for their children – outpacing about 30% who purchased makeup and 20% who purchased perfume for their children. However, hair care was the most purchased beauty product at about 60%.

Gen Alpha’s Parents are brand sensitive.

Gen Alpha’s parents are six percentage points more likely than the Gen Pop to say they’re brand-sensitive when buying health and beauty products. While they are a mix of brand and price-sensitive consumers, Gen Alpha’s parents skew more toward being brand-sensitive (35%) than price-sensitive (25%).

Answer our Polls: Have you ever decided to try a skincare product / trend because it was recommended by a social media influencer, but you ended up regretting it?

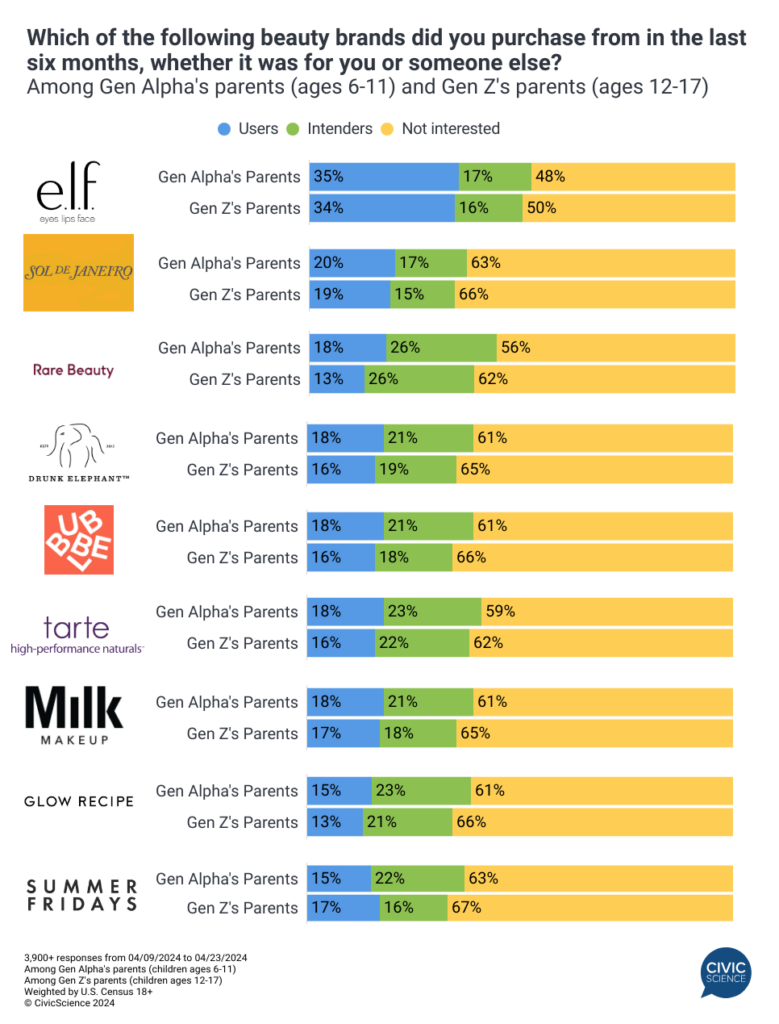

e.l.f. Beauty wins with Gen Alpha’s parents.

A close look at some of the most popular brands among Gen Alpha, including Drunk Elephant and Sol de Janeiro, shows that parents with Gen Alpha children are most likely to have recently purchased products from e.l.f. Beauty. Over a third of parents with children aged 6-11 years old have purchased from the beauty brand in the last six months (35%), and another 17% haven’t but are interested. However, intent to purchase is highest for Rare Beauty products (26%).

Additionally, it’s worth noting that parents with younger children (aged 6-11) are more likely to have purchased from all the brands surveyed (except Summer Fridays) than parents with Gen Z tweens and teens (ages 12-17).

It’s clear that Gen Alpha is shaping the beauty industry. Their brand-sensitive parents are buying beauty products like skincare and makeup more so than the Gen Pop, and they purchase some of the most trendy brands at a higher rate than parents of younger Gen Z children.

How will Gen Alpha influence the beauty industry in the long run? Check out our new Pulse of the U.S. Beauty Buyer Report and other beauty offerings here to navigate key changes in this industry, or connect with us to learn how you can see insights like these through the lens of your customers.