CivicScience keeps a pulse on the latest beauty trends through our database of over 130 million consented profiled respondents. If you’re interested in seeing more insights like these, register for our U.S. Beauty Buyer webinar.

In the world of wellness, the trends can be hard to keep track of. But one trend that’s gotten more traction recently has been the expansion of high-end skincare treatments, both in spas and at home.

With countless companies introducing at-home skin treatment devices and spas curating increasingly deluxe services with more inclusive pricing, the beauty industry continues to evolve in new ways – but who’s buying? CivicScience dove into the data to track these emerging trends and better understand the ideal skincare consumer in 2024.

At-Home Skincare Devices

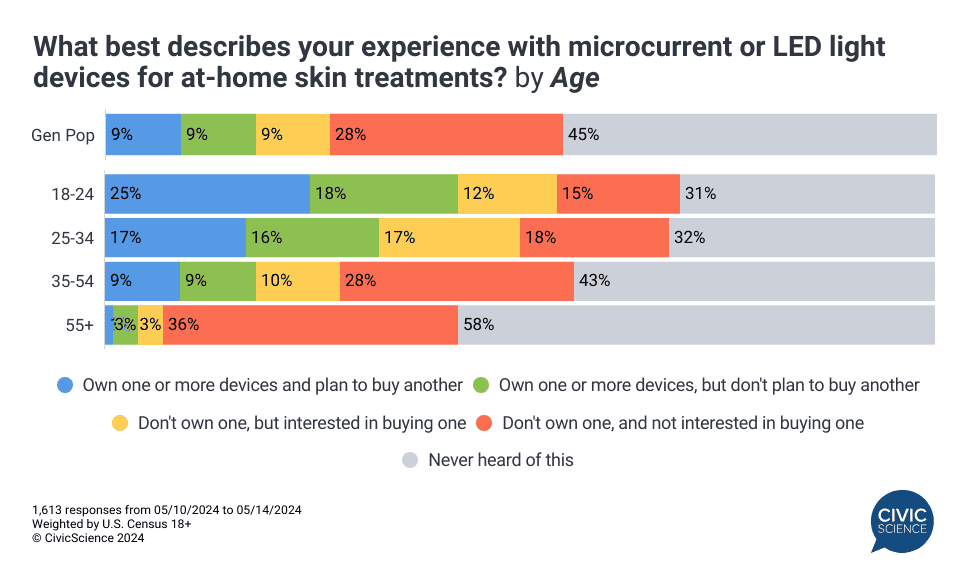

There is a wave of new at-home skincare devices available on the market, such as those from NuFace, Solawave, and Skin Gym, that use microcurrent or LED light for a variety of purposes, including to target fine lines and wrinkles, boost collagen, and prevent breakouts. As the data show, 18% of U.S. adults currently own a microcurrent or LED device for at-home use. Among those, half plan to buy another device. Additionally, 9% of respondents don’t yet own an at-home skincare device, but plan to do so.

And although many at-home skincare devices often boast their anti-aging properties, it’s Gen Z adults who are the most likely to have purchased one and be interested in buying another. Among non-owners, younger Millennials express the greatest interest in trying one of these devices.

Take Our Poll: Do you use microcurrent or LED light devices for at-home skin treatments?

Facial Spas

Of course, at-home products are just one arm of skincare treatment. Facial spas are another emerging model for delivering treatments, including membership-based chains such as Glowbar and FaceGym, which offer skincare treatments at more accessible price-points than other high-end spas. These businesses tout the importance of regular facials to fight the signs of aging, as opposed to relying exclusively on injections like Botox and fillers.

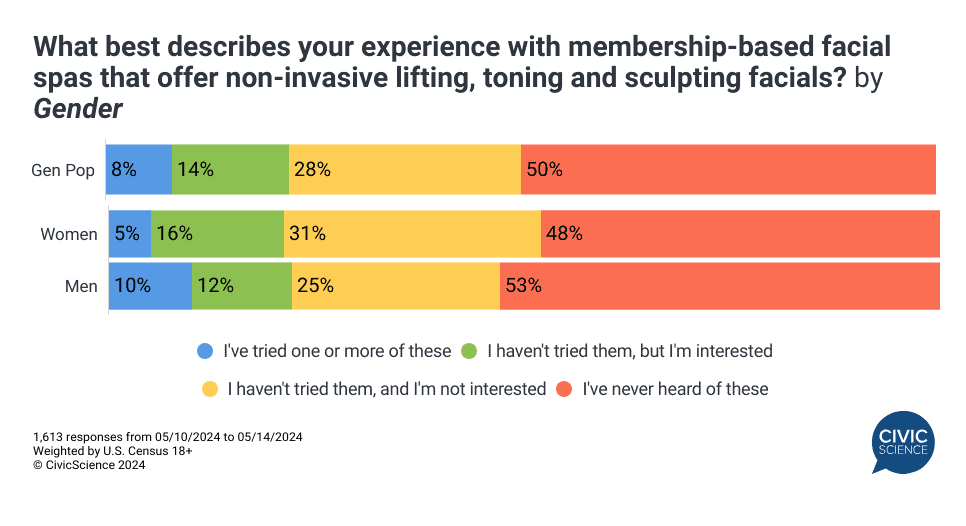

When it comes to membership-based facial spas, CivicScience data show 8% of U.S. adults have tried them, while 14% plan to do so. And, perhaps surprisingly, men are twice as likely as women to have already given these a try.

Given the astronomical heights to which skincare treatments can climb, these kinds of membership-based spa services are often touted as an accessible option for those on a budget. And while the data confirms this, showing strong interest from respondents earning $50K or less annually to try these services (16% intend to try them), it also shows that those with more disposable income see the appeal and are the most likely to have already tried them.

At-Home Vs. Spa Skin Treatments

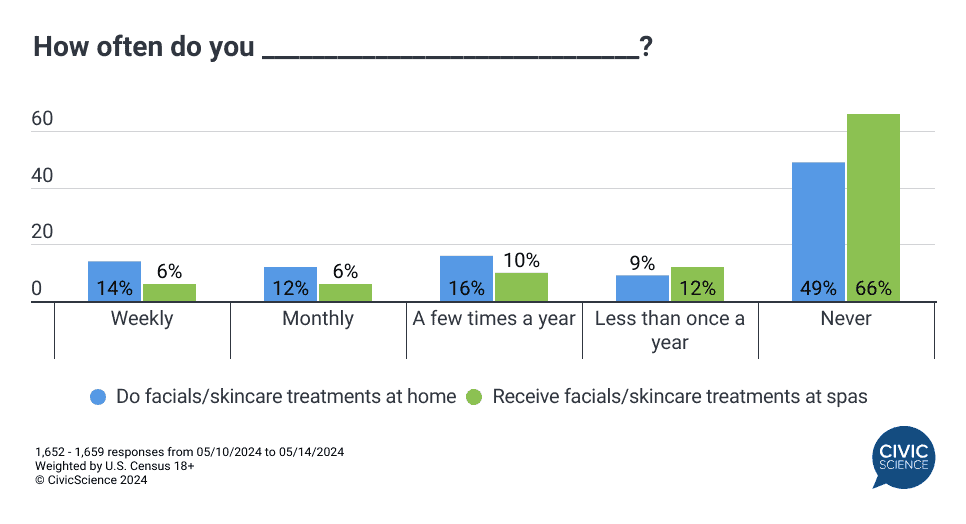

But, when you get down to it, is there a clear winner between spa and at-home facial treatments? While there are many ways to answer that question, new data looks at visitation frequency.

Currently 12% of U.S. adults do facials or other skin treatments at spas at least monthly or more, while 26% do the same at home. So while the two serve different needs, it’s clear that the world of at-home skincare devices has an eager audience of potential clients, looking to experience a transformation that’s more than skin deep.

Join the Conversation: How often do you go to a professional for beauty services?

That said, spas aren’t going anywhere anytime soon. They’re of particular interest to men, with more men getting weekly spa facials than women, while women are more likely to do at-home facial treatments. So clearly, the market for both women and men’s spa services and at-home skincare devices has room to grow.

In light of this, it seems the days when luxury skincare was reserved for the super-rich are moving further into the rearview mirror. Instead, today’s skincare market is eagerly extending both at-home and spa treatments to include new consumers – namely middle-income earners and men – who may have been left out of the skincare conversation in decades past.

Discover a wealth of consumer beauty insights that delve deep into the industry with the CivicScience Beauty Buyer Report. To learn more about how CivicScience’s solutions give clients an edge over the competition, get in touch.