After spending the past two years overhauling many of its in-house brands, Target just announced their next focus will be intimates and sleepwear. The retailer will replace their older intimates’ lines with three new brands this spring, which all focus on inclusivity through expanded size runs. Though bras alone are a $7 billion dollar industry in the U.S., they are surrounded by debate as many bra makers and brands do not offer a wide range of sizes.

To offer expanded size runs in convenient locations—not to mention products attractive in both aesthetics and price-point—is not a common occurrence in the intimate apparel vertical. Other brands are starting to tip their hat to being more size inclusive, like Aerie and ThirdLove, but in some cases, consumers have to pay a high price or sacrifice design.

Target’s move to offer well-designed intimates at affordable prices, and with size inclusivity, will make these brands alluring to many different women right at their local Target location.

Research firm CivicScience ran a series of polls regarding the announcement. These surveys, along with the firm’s trending, always-on polls, paint a clear picture of how this will work out for Target, who no doubt did their own research.

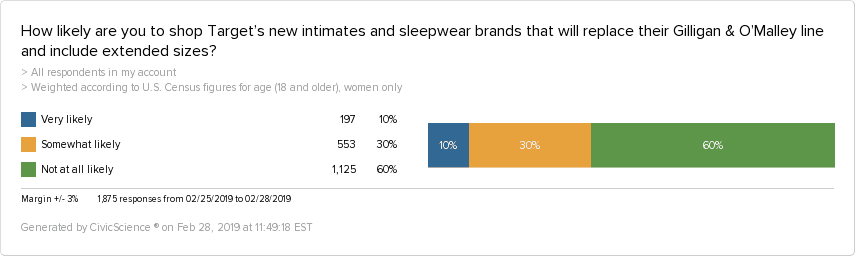

Asking over 1,300 U.S. adult women about the announcement, the study found that 40% of women are likely to shop these new brands at Target.

Of those “very likely” to shop Target’s new intimate drop, CivicScience found it’s more likely to be Millennial women. According to the NPD group, Millennials comprise more than a third of the women’s intimate apparel market.

Consider that, in general, U.S. adult women’s favorability to shopping at Target has grown over time.

And among a recent sample of Millennial women, more than three-fourths of women aged 18-34 (79%) are favorable to shopping at Target (compared to 70% of those age 35-54).

Conversely, the once intimate apparel powerhouse Victoria’s Secret has seen its favorability fall after much volatility, not to mention their sales. This is likely due directly to competition among other brands who appear more inclusive—and affordable—in the eyes of American women.

The recent sample among Millennial women shows that VS is much less favorable among them (55% report being favorable).

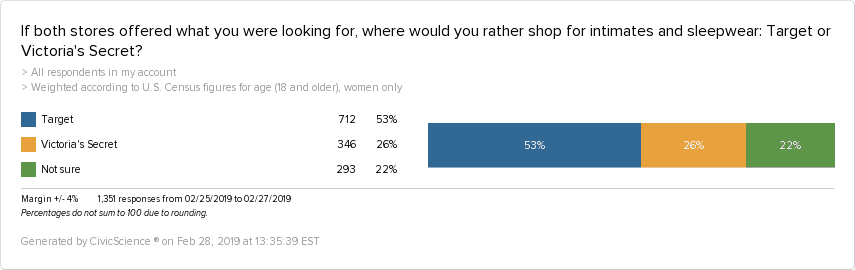

Being direct, CivicScience asked women, all things being equal, if they’d rather shop at Target or Victoria’s Secret for intimates. Women were more than 2x as likely to answer Target over Victoria’s Secret.

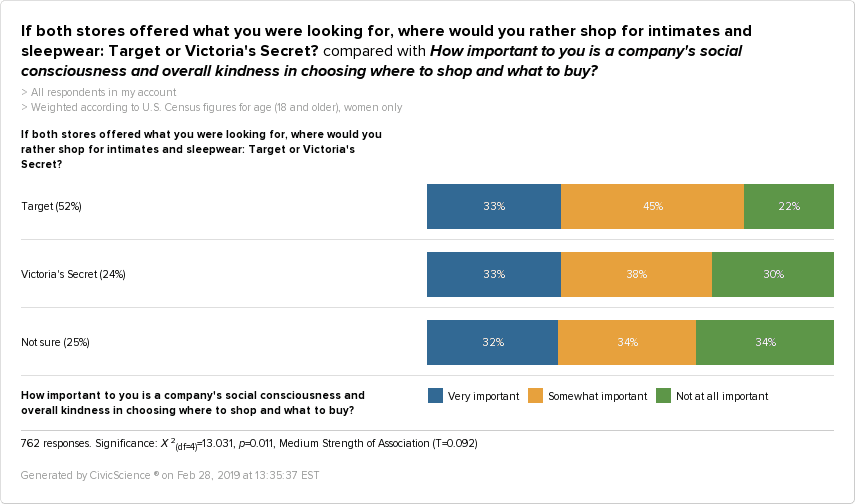

It appears being socially-conscious as a brand does indeed impact this answer. Though across all answer choices the results for those who indicate they find a brand’s social-consciousness ‘very important’ is similar, Target-preferred intimates’ potential customers are significantly more likely to find some level of importance in a company’s social-consciousness.

The study also looked at social consciousness importance among just Millennials, who are most likely to shop Target’s new line. Social consciousness has been steadily important to 80% of this age group since 2015.

It’s clear this investment in the inclusive intimate apparel space is ripe with opportunity for Target. Tracking the brand’s favorability after this launch will be imperative.