For many U.S. adults, car insurance is just a necessary part of reality. Based on a recent CivicScience study of over 1,700 U.S. adults, 90% are in the market for car insurance, which looks similar to past industry numbers of car ownership among Americans. Current CivicScience data collected over the past year confirms that just under 90% of Americans own/have access to a car.

This overwhelming majority of car ownership among US. adults highlights the importance of the auto insurance market across the country. With so many individuals relying upon car insurance on a daily basis, CivicScience went one step further to better understand what drives an individual to purchase a specific plan. The data underscores not just the current state of car insurance purchasing but sheds some light on what this niche could look forward to in the future.

What Sways the Vote?

When asked to select the top three most important factors when purchasing car insurance between price, coverage, personal recommendation, customer service, location, reputation, and member perks, price came out on top.

No surprise: 68% of U.S. adults consider the cost a high priority.

This factor is most important for adults who are 35+, regardless of income level, who tend to work in professional, technical and medical fields.

Coverage was the next highest ranking category, with 44% indicating this as a key concern.

The same age trend is evident here, indicating that, for many, 35 is the time when coverage begins to matter most. Income and occupation, however, plays a different role. In this case, the largest demographic of those concerned about coverage are middle-income earners–those who earn between $50k and $100k a year–followed by those who make more than $100k and then by those who make less than $50k. As for occupation, it’s the computer, tech and medical workers who tend to prioritize this factor.

Rounding out the top three was reputation and company rating, with 30% of respondents considering this a major focus.

Similar to coverage, reputation gains importance for the 35+ crowd, though it does hold sway for a strong percentage of 18-24-year-olds. Reputation is also most important to middle-income earners, further supporting the data above. And, of those who work, professionals and managers are most concerned over this element of car insurance.

When taken together, these three graphs paint a very precise picture of what auto insurance purchasers want: a price they can afford, coverage for what they need and a reputation of success. This last element especially speaks to a desire for trust. After all, when paying for something on a recurring basis, it seems only reasonable to want to feel confident in where that money is headed.

This data also illuminates that U.S. adults may be taking a relatively no-frills approach when making the choice of where to spend their car insurance money. Other factors such as member perks, personal recommendations, and even customer service rank lower on the scale–though customer service does rank as the fourth most important issue to consider.

Car Insurance Meets Tech Adoption

While the majority of Americans are concerned about the price of their car insurance, only 14% are very willing to save money by allowing their insurer to track their safe driving habits as of February 2019. The evidence shows that this number has only gone down since the last study in June 2017. Despite the fact that money is a major concern for most drivers, it seems that the chance to save simply isn’t worth it for those concerned over data privacy.

This seems to be due, in large part, to concern over the use of personal information. Those who are very willing to use a device like this to lower their premium are the least concerned about their personal information being compromised.

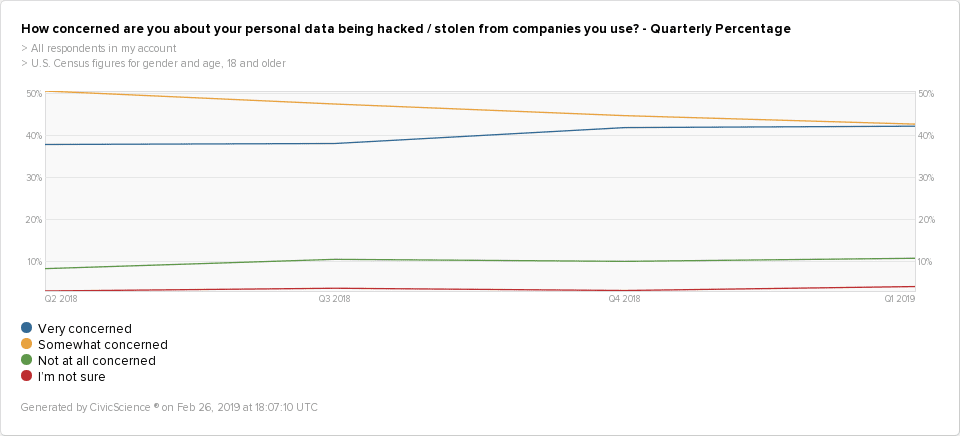

Concern over personal data being compromised has shown a clear increase in the past year. The percentage of those who are ‘very concerned’ has nearly eclipsed the percentage of those just ‘somewhat concerned’ since early 2018.

Car insurance is a highly relevant purchase for the overwhelming majority of Americans. And while most indicate price as a primary determining factor in their policy choice, concerns over money are in no way comparable to concerns over data privacy. Over half of those who indicate price is a top concern for car insurance are not willing to use a tracker to lower costs. When given the choice, U.S. adults would rather maintain some semblance of confidence in the privacy of their personal information, rather than risk their data being compromised in the name of a lower premium.