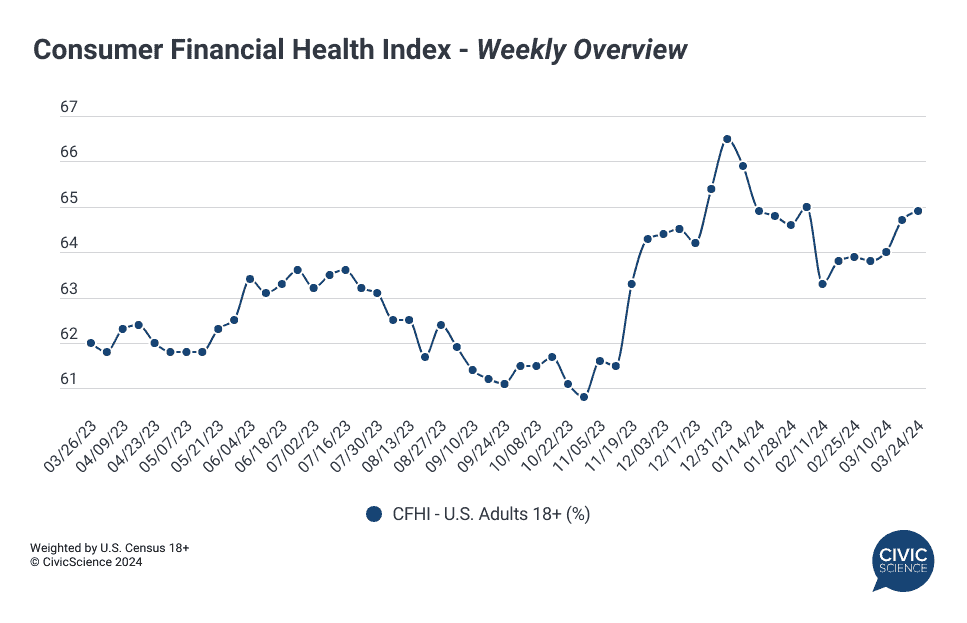

As spring kickstarted the shift into the second quarter, the financial health of U.S. consumers ticked upward. The CivicScience Consumer Financial Health Index (CFHI), which measures the collective financial outlook of the nation, showed week-over-week gains in March. The index climbed 1.6 points from the last week of February to the last week of March, rounding out the month at 64.9%.

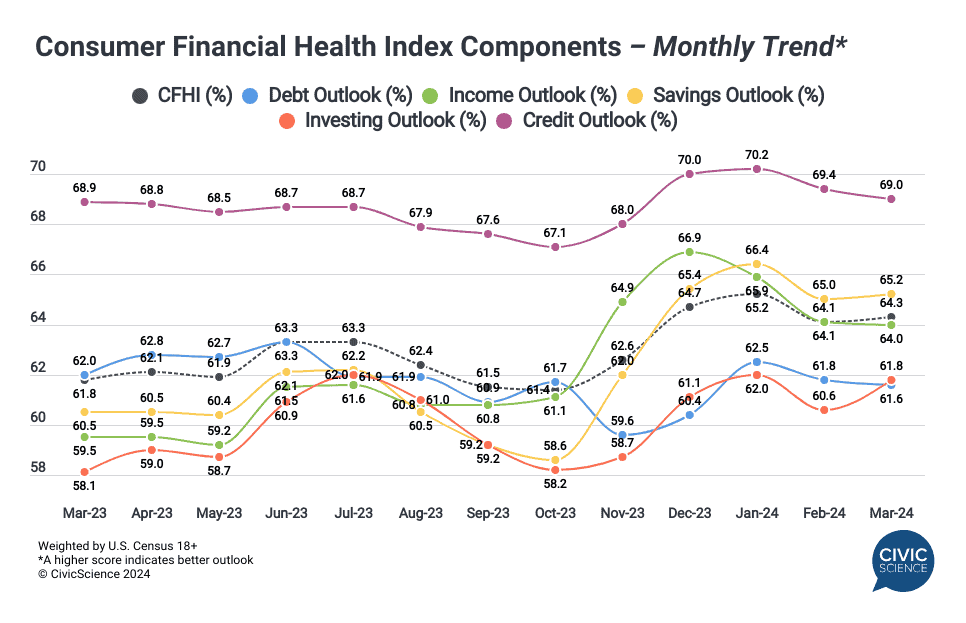

The CFHI tracks shifts in consumer outlook for the next six months in five key financial areas: debt, income, savings, investing, and credit score. As a monthly average, consumer outlook in March grew by a modest 0.2 points from February to 64.3%, surpassing financial outlook this time last year. That boost is largely attributed to increased expectations for the short-term future of consumers’ savings and investments, with investing outlook seeing the strongest gain. However, consumers reported declining outlook for credit scores and debt, while income expectations largely remained stable.

Compared to today, consumers expect in six months time to have:

- More in investments, including retirement savings (2.0% monthly increase)

- More money saved (0.3% monthly increase)

- More in debt (0.3% monthly decrease)

- Lower credit score (0.6% monthly decrease)

- Similar income (0.1% monthly decrease)

Take Our Poll: What is your current savings goal?

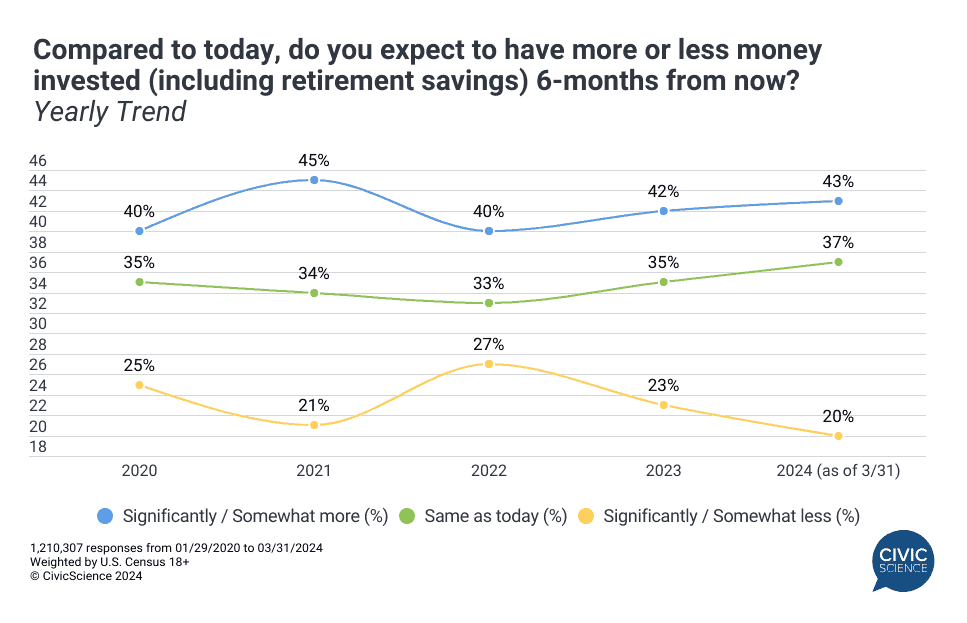

It’s possible that consumers are feeling more hopeful for their investments after receiving tax refunds – a separate study found that 39% of those expecting refunds this year plan to put the money toward savings and investments, up four points from last tax season. A closer look at investing shows that consumers’ investment expectations grew in 2023 and continue to show signs of increasing this year. As of 2024, just 20% of U.S. adults anticipate a decline in investments, the lowest point so far in the last four years.

However, even though more consumers expect to have ‘more’ in savings in the coming months compared to today, additional CivicScience data show a significant percentage (62%) still do not feel they have enough invested, including in retirement savings – a trend which has not shown any improvement in the last three years (n=19K+ responses from 1/1/24 to 4/3/24). This figure rises to 71% among respondents aged 35-54, but remains uncomfortably high among adults nearing or at retirement age: 67% of respondents aged 55-64 and 47% of respondents aged 65+.

What’s more, 39% do not feel they are saving enough to live comfortably when they retire, eclipsing those who do feel confident (38%) for the first time since 2020 (n=7K+ responses from 1/1/24 to 4/3/24). So while Americans may feel more optimistic about investing in the short-term future, many are still not confident in their long-term outlook.

Join the Discussion: Do you have more in emergency savings than in credit card debt?

Attitudes change before behaviors do. To stay ahead of how your customers, key consumer segments, and competitor’s customers are feeling about their finances, get in touch. Learn more about the CFHI here.