This is just a sneak peek at the thousands of consumer insights available to CivicScience clients. Discover more data.

High fast-food prices are taking a toll on customers and the QSR industry alike. In May, 63% of U.S. adults said they’ve noticed that prices have gone up ‘a lot’ at their favorite fast-food restaurants – the highest point seen since CivicScience started tracking the question. So it’s no surprise that 55% of consumers also said they were cutting back spending on dining out at that time, up from 49% in May 2023.

Weigh In: Do you agree or disagree with the idea that “fast food is becoming a luxury” in the U.S. due to pricing?

To bring customers back into the fold, several of the biggest QSR chains rolled out new limited-time value meals this summer, at price points from $5 to $7. Those include McDonald’s Meal Deal, Burger King’s Your Way Meal, and Starbucks’ Pairings Menu. Many chains are sparring with a variety of different value menu items as well, including new breakfast offers.

How are these value meal promotions performing among customers? Here’s what current consumer polling data show from a comparison of value meal deals from five leading quick-service restaurants:

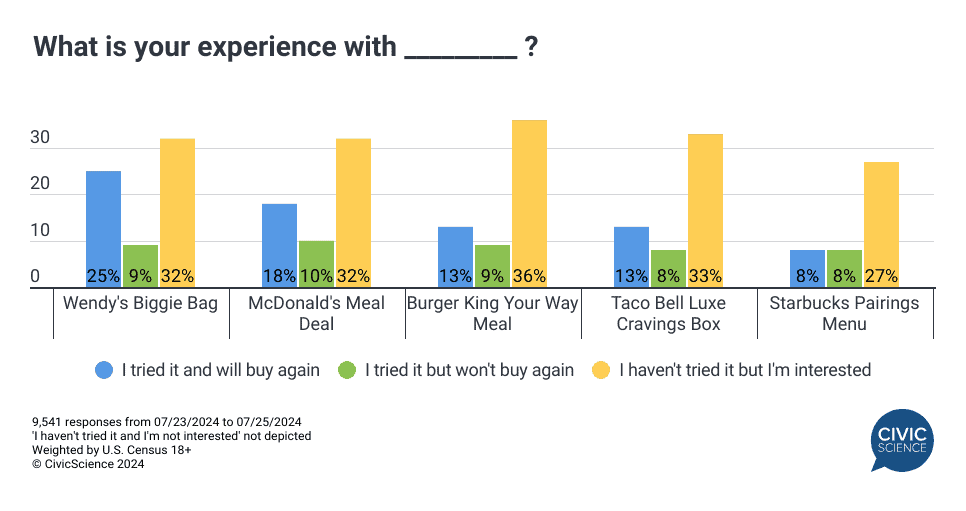

- Wendy’s Biggie Bag for $5 ranks as the most popular, with nearly a third of U.S. adults having tried it. The Biggie Bag has been around for years, which could account for its popularity, but the chain recently added a free Frosty to sweeten the deal.

- McDonald’s Meal Deal for $5, which is a brand new offer, has also attracted a lot of attention – 28% of consumers have tried it, the majority of whom would purchase one again. An additional one-third of consumers are interested in trying the Meal Deal.

- Roughly 1-in-5 have tried Burger King’s Your Way Meal for $5 and Taco Bell’s Luxe Cravings Box for $7.

- Starbucks Pairings Menu offer, where customers can pair a beverage with a croissant for $5 or a breakfast sandwich for $7 was the least popular among the deals, with 16% of people having tried it and half saying they would be unlikely to order it again.

Demand for value menu items reaches a new high among diners.

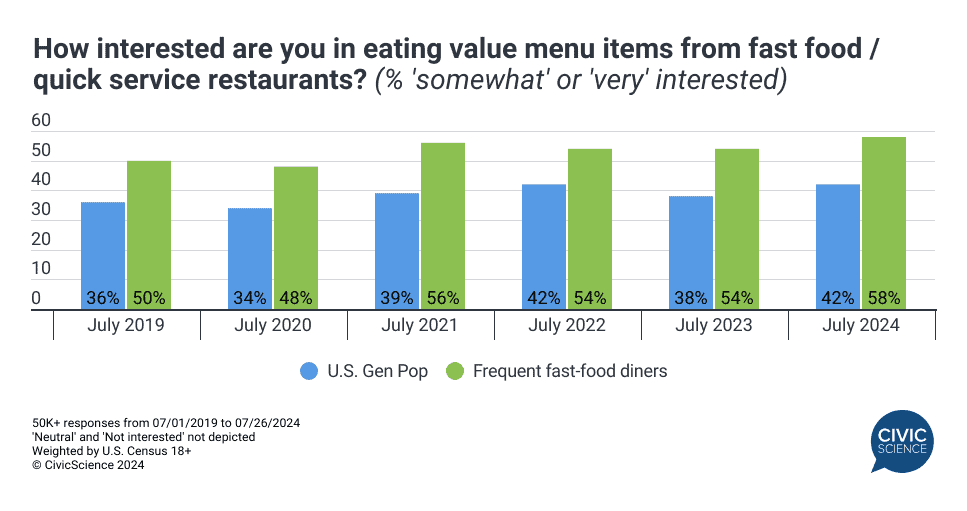

Interest in value menu items has fluctuated over the years but is higher now than before the pandemic. While interest among the general population hasn’t grown in the last two years, regular fast-food diners show greater interest in 2024. This July, 58% of regular fast-food diners (who order fast-food at least monthly) report they are interested in eating value items from QSR establishments.

An analysis of the five chains studied shows that McDonald’s customers are the most likely to be interested in trying value menu items, while Starbucks customers are the least interested.

Take Our Poll: Which fast-food restaurant do you think has the best value menu?

How much is too much?

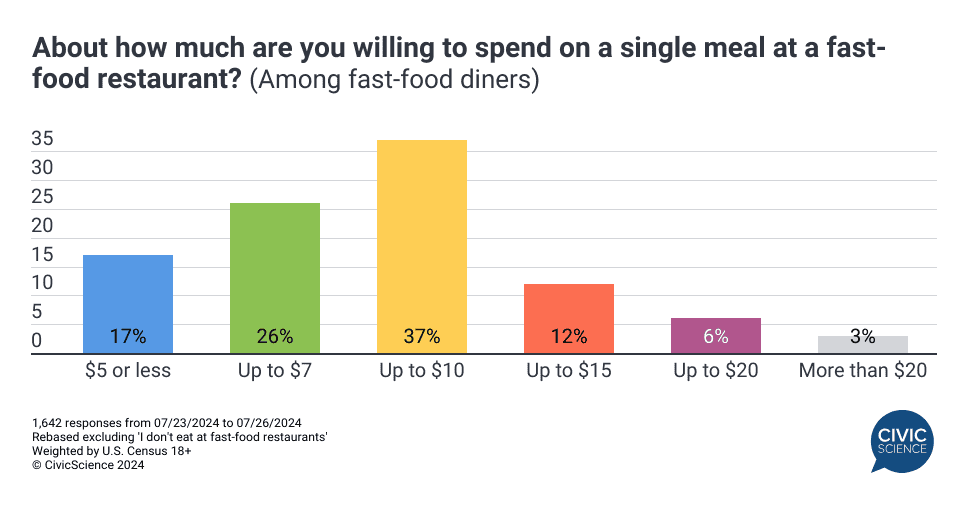

When it comes to dining at fast-food restaurants, 37% of consumers say that they are comfortable spending up to $10 on a single meal, with nearly one-quarter who say they aren’t willing to spend more than $7. Upwards of $10, the pool of willing customers shrinks drastically. Most consumers will avoid having to spend more than $10 on a fast-food meal.

As consumers look for ways to save but still indulge in fast food, value meals could offer sweet relief. A total of 34% of people who eat fast food say they would be ‘much more likely’ to order from fast-food restaurants if they routinely offered more value meal prices and options. That’s even higher among people who already eat fast-food at least once a month (39%).1

Don’t forget about food delivery apps.

In a segment of people who are interested in value meals and value menu items – which includes customers who have tried one of the value meals from the five fast-food chains listed above, and those who are interested in trying them – nearly one-third regularly order from food delivery apps. That’s well above the national average of 20%. In efforts to appeal to more customers, including those who aren’t likely to visit in person, QSR companies offering value meals could have a big advantage among food delivery app users such as DoorDash users.

The value meal ‘wars’ may just be getting started. Although many value meal promos are set to be limited-time offers, data show fast-food consumers are highly welcoming of the price cuts and want to see more of these kinds of deals in the future. Interest is high in value menu items, including interest in most of the specific value meal promos included in the poll, with Starbucks being the exception.

See beyond the data – With CivicScience, you can leverage insights like these to build highly targeted audience segments for successful advertising campaigns. Learn how with our free eBook.

- 1,640 responses from 07/23/2024 to 07/26/2024 ↩︎