Last week, Walmart unveiled its new private label premium food brand “Bettergoods.” The brand emphasizes specialty items, plant-based options, and products tailored to specific dietary needs, like gluten-free or free from artificial additives. While some items are already on shelves, Walmart aims to expand the range to 300 products by the end of the year. The new brand comes at a time when overall private label interest is strong. CivicScience data show 70% are shopping private label brands ‘somewhat’ or ‘very’ often, up seven percentage points from September 2023 (excluding those answering ‘not sure’ and ‘does not apply’). This percentage jumps to 79% when focusing specifically on Walmart shoppers and Walmart’s private label brands like Great Value (excluding those not sure).

Bettergoods Cooking Up Strong Early Interest

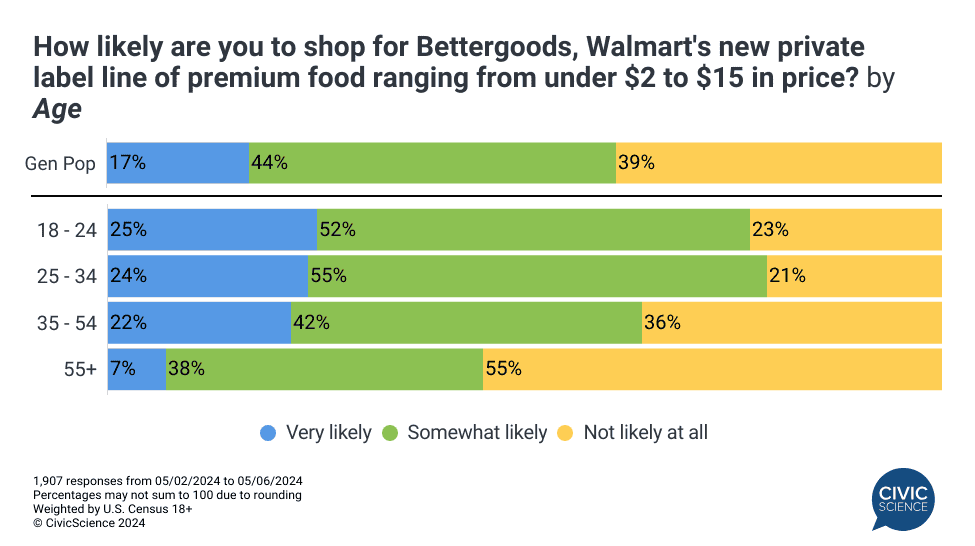

New CivicScience data show preliminary interest in Walmart’s new private label brand is quite strong, with 61% reporting they’re likely to shop for the line, including 17% who are ‘very’ likely to do so. Much like CivicScience’s September polling of private label interest, adults under 35 are the most likely to be interested in shopping Bettergoods products.

Bettergoods’ introduction seems well-timed amidst consumers’ rising preference for store-brand grocery items. Data show 45% of respondents are purchasing store-brand over name brands at least ‘somewhat’ more often than they did last year – 21% of whom are doing so ‘much’ more often than last year.

Take Our Poll: Will you try Walmart’s Bettergoods brand?

Customers of Walmart Rivals Have Their Eyes on Bettergoods

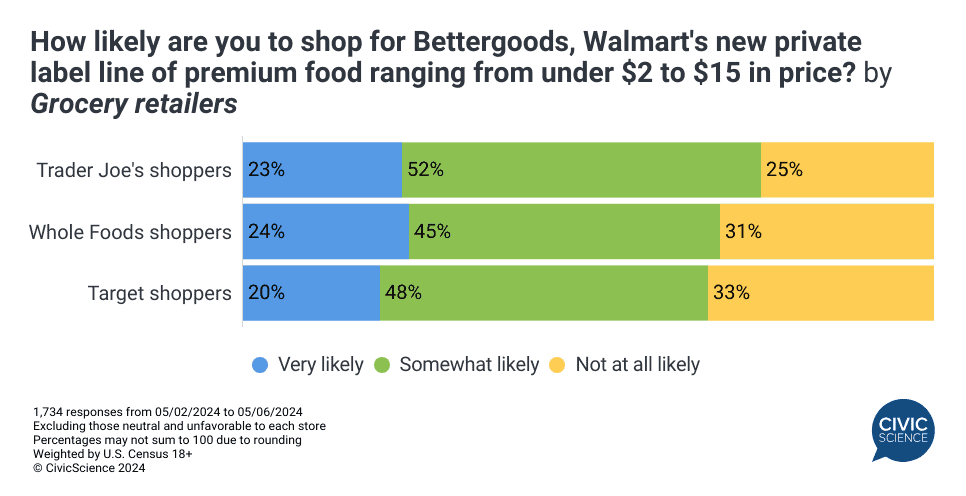

Sure, Bettergoods is already generating significant interest among Gen Pop shoppers, but what about Walmart’s competitors? Additional CivicScience data show Bettergoods is also a major draw among customers of each of its biggest rivals including three-quarters of Trader Joe’s shoppers. Whole Foods and Target also have reasons to be concerned, with 69% and 68% of their respective customers each eyeing the new Walmart brand.

The Pull of Visually Appealing Packaging

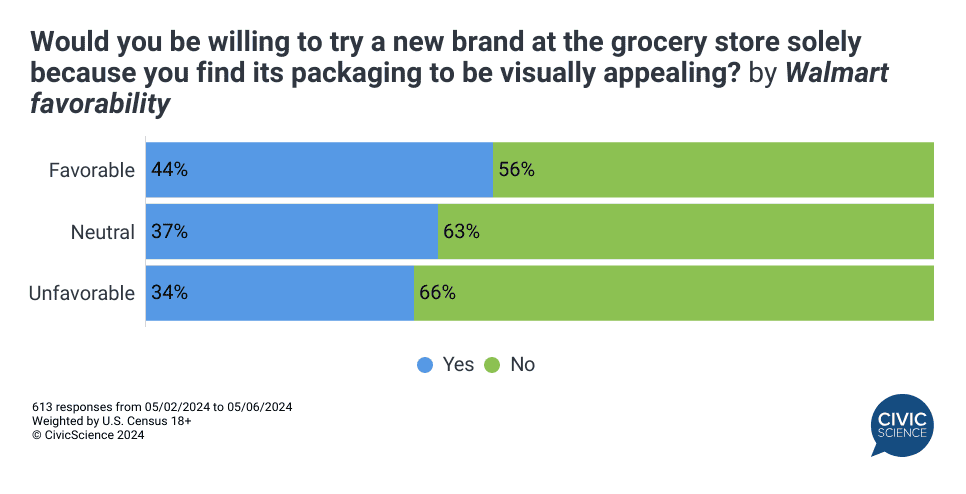

One of Walmart’s points of emphasis with Bettergoods is its distinct packaging designed to stand out from its other private label brand, Great Value. The effort may have the potential to resonate with Walmart shoppers who might otherwise not be familiar with the brand – 44% of those who shop at Walmart say they are willing to try a new product simply because they found it to be visually appealing, 10 points higher than non-shoppers.

Cast Your Vote: Which of the following national grocery chains has the best store-brand snacks?

In an industry still grappling with inflationary pressures, Walmart has struck gold with its recent foray into premium foods. While consumers increasingly seek affordable yet high-quality food choices, the big question remains: Can the retail giant effectively leverage this opportunity to attract more customers, especially those loyal to its competitors?

Want to anticipate how your consumers respond to new and breaking developments in your industry, like Walmart’s Bettergoods? CivicScience clients can stay one step ahead thanks to the InsightStore database of over 500k crossable questions. See it in action here.