CivicScience engages directly with consumers, collecting over one million survey responses daily, to turn real-time insights into high-performing advertising campaigns. See how leading brands use CivicScience to drive campaign performance here.

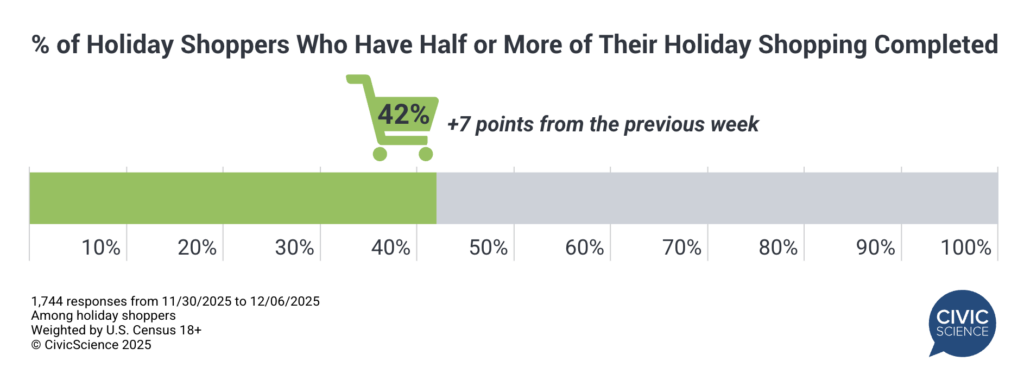

With Thanksgiving sale shopping officially in the books, the latest week of tracking shows that 42% of holiday shoppers say they’re at least halfway done with their gift buying – a seven-point increase from the previous week, which captured only the early days of the sales events.

As we continue through the peak of holiday shopping, here are three insights brands and advertisers should keep a close eye on to engage consumers effectively:

1. Online holiday gift-buying stays strong, yet frequency could dip amid shifting in-store shopping priorities.

Online shopping remains a major force during the holiday season, but CivicScience data suggest shoppers may be relying on it less than in previous years – making it critical for advertisers to effectively engage the right consumers online to drive purchases, whether in-store or online.

Nearly 90% of holiday shoppers say they’ll buy at least some gifts online this year. But most of them now expect online purchases to make up less than half of their total holiday shopping. That’s a shift from last year, when a similar percentage planned to shop online, but most expected to make more than half of their purchases digitally.

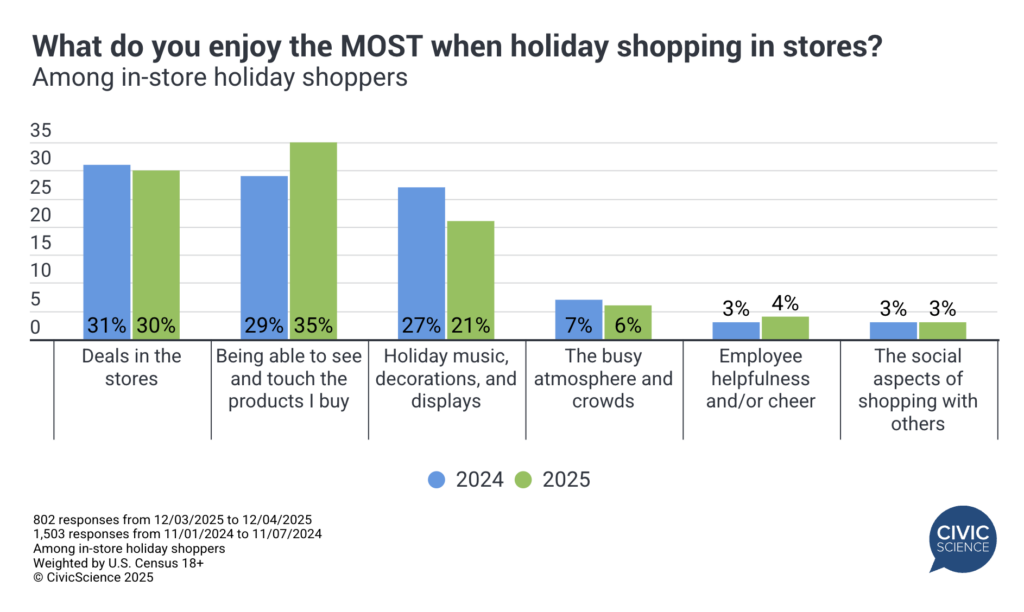

As in-store shopping may increase this year, priorities for in-person shopping are also shifting. In-store deals draw 3 in 10 shoppers, but they have slipped to the second-most common motivator, now trailing the ability to touch products in person, which is up six points from 2024. Meanwhile, a shrinking share says holiday music and decorations are bringing them into stores, though this reason remains a top-three driver.

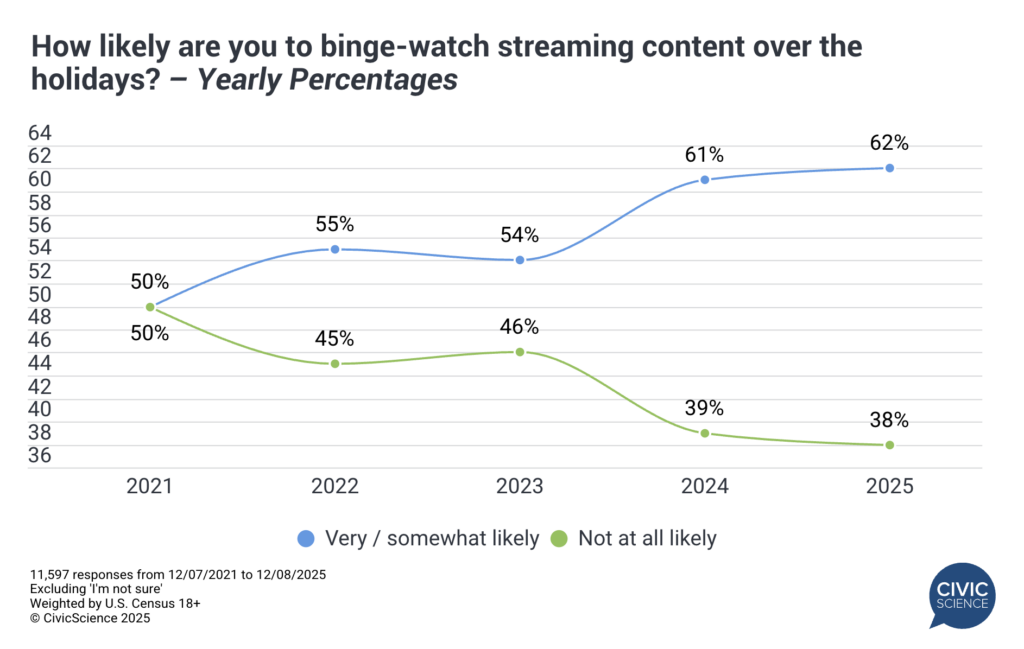

2. Binge-watching content over the holidays has jumped since 2021.

Despite ongoing video subscription fatigue and recent headlines about Netflix or Paramount acquiring Warner Bros. Discovery, CivicScience data show that over 6 in 10 Americans still plan to binge-watch content this holiday season. That’s on par with last year, and more than 10 points higher than five years ago.

Interestingly, and perhaps unsurprisingly, those who are most likely to report subscription fatigue are also the most likely to binge-watch streaming content over the holidays, suggesting that fatigue doesn’t necessarily translate to immediate disengagement.

3. Advent calendar participation rises, with Gen Z leading and Millennials driving the biggest YOY gains.

After years of holding steady, participation in an Advent calendar this season has climbed to 28%, up from 22% last year. Gen Z adults (18-29) continue to show the strongest interest, but the largest YOY shift comes from Millennials aged 30-44, rising nine percentage points since 2024.

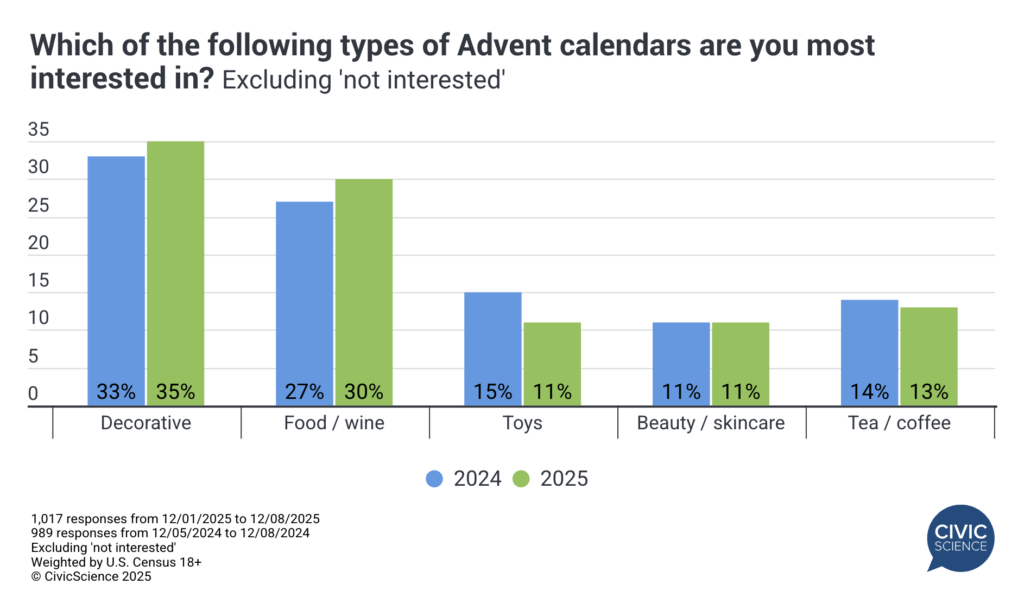

Decorative Advent calendars remain the most popular type, followed closely by food and wine calendars – both of which have seen slight increases from last year. Interest in toy Advent calendars saw a corresponding dip over the same time period, while beauty and tea/coffee calendars have held relatively steady.

With holiday shopping kicking into high gear, CivicScience will continue to highlight three key trends each week that brands, media companies, and advertisers should watch as we head into 2026. Stay tuned for next week’s update.