CivicScience engages directly with consumers, collecting over one million survey responses daily, to turn real-time insights into high-performing advertising campaigns. See how leading brands use CivicScience to drive campaign performance here.

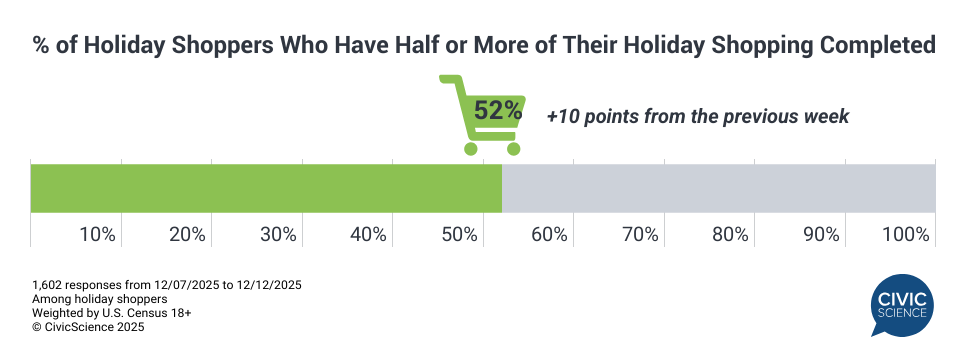

With half of December already complete, the window for holiday shopping is shrinking by the day. CivicScience’s ongoing holiday tracking shows that as of the end of last week, 52% of holiday shoppers say they’re at least halfway done with their gift buying – a 10 percentage point increase from the previous week.

With some shoppers remaining in the decision-making phase of tackling their holiday gift lists, brands and advertisers still have an opportunity to reach consumers before they buy. Here are three key insights to know this week about the holiday season and how to reach them:

1. Big-Box Stores Lead Among Holiday Shoppers, Though Late Shoppers Report Different Retailer Preferences

Big-box stores remain the most popular destination for buying gifts this year; however, shoppers who hadn’t started their shopping as of December 1 are less likely to visit them than those who were already shopping. Instead, late-starting shoppers are more inclined to shop at deep-discount retailers and department stores and are less likely to shop at local/small businesses.

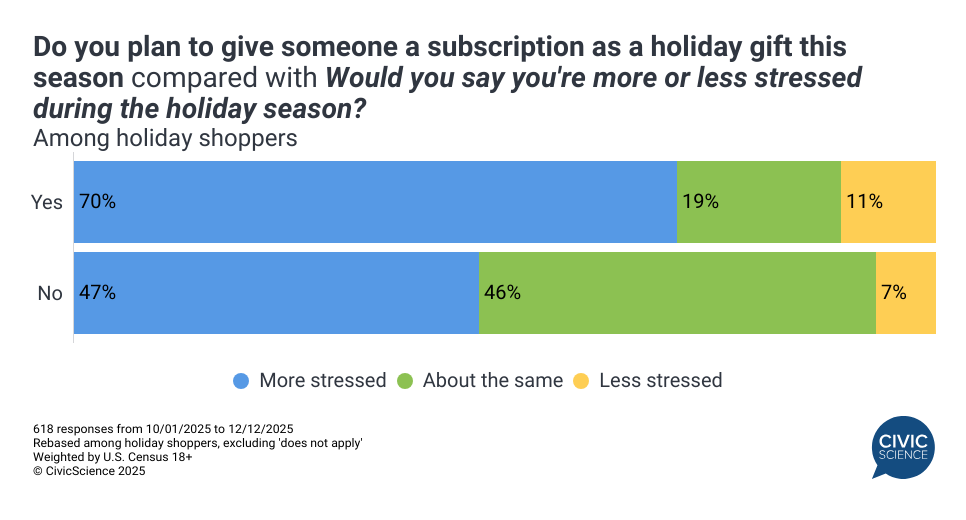

2. Subscriptions Offer an Avenue for Stressed Shoppers

Currently, 22% of holiday celebrators plan to give a subscription as a gift this holiday season – a six percentage point increase since 2023. This option is most popular among Gen Z adults, and since the data show that those who are giving a subscription as a gift this holiday season are 23 percentage points more likely to be more stressed during the holiday season, it’s possible that subscriptions offer a low-stress way to check another recipient off the holiday shopping list.

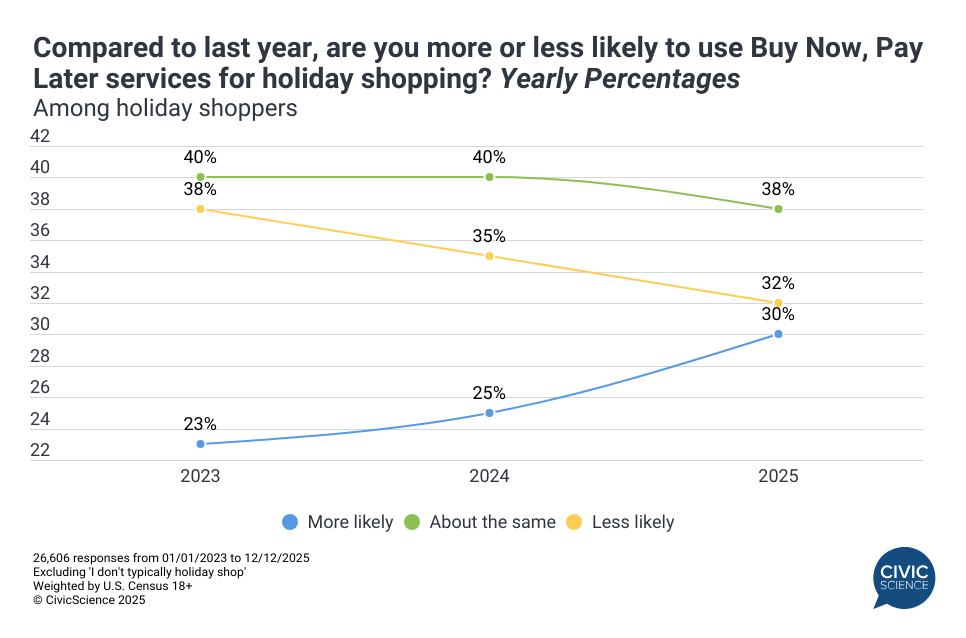

3. Buy Now, Pay Later Options Attract a Bigger Crowd This Year

Buy Now, Pay Later services are in demand this holiday season. Intent to use these services among gift buyers has risen five percentage points since 2024 (from 25% to 30%), indicating that interest remains strong in the current economic landscape. Unsurprisingly, low-income earners are most likely to report using BNPL more this year, as are those who plan to spend more on holiday shopping than they did last year.

Additional data show that shoppers who have not started their holiday shopping in the past 30 days are six points more likely to report greater intent to use BNPL this year, suggesting that brands offering flexible payment options may be better positioned to reach late shoppers.

As the December holidays approach, CivicScience will continue to highlight three key trends each week that brands, media companies, and advertisers should watch as we head into 2026. Stay tuned for next week’s update.