CivicScience engages directly with consumers, collecting over one million survey responses daily, to turn real-time insights into high-performing advertising campaigns. See how leading brands use CivicScience to drive campaign performance here.

The Super Bowl may have come and gone, but the busy month of February in the sports world rolls along. The NBA All-Star Game (ASG) is up next on the docket in North America amid the ongoing Milano Cortina Winter Olympic Games. Self-declared intent data from CivicScience offers a preview of the likely NBA ASG audience and what it means for brands and advertisers hoping to reach them once the All-Star festivities end. Here’s what Americans are telling CivicScience about the game this year:

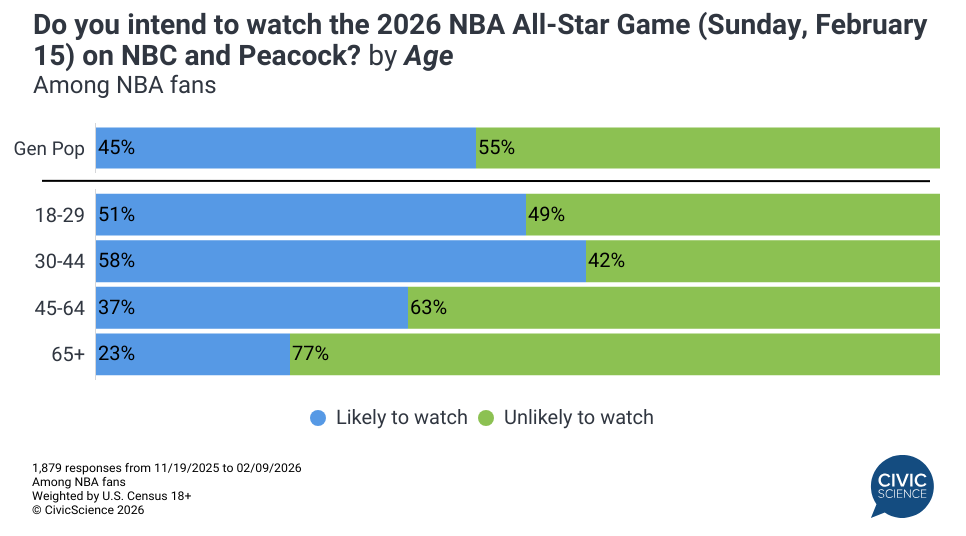

The latest survey data from CivicScience reveals that nearly half (45%) of NBA viewers say they will ‘definitely’ or ‘probably’ watch the All-Star event. NBA fans under 45 look to be the most engaged, led by 58% of Millennials (30-44). Nearly half (47%) of male NBA fans are likely to watch, compared to 41% of female fans.

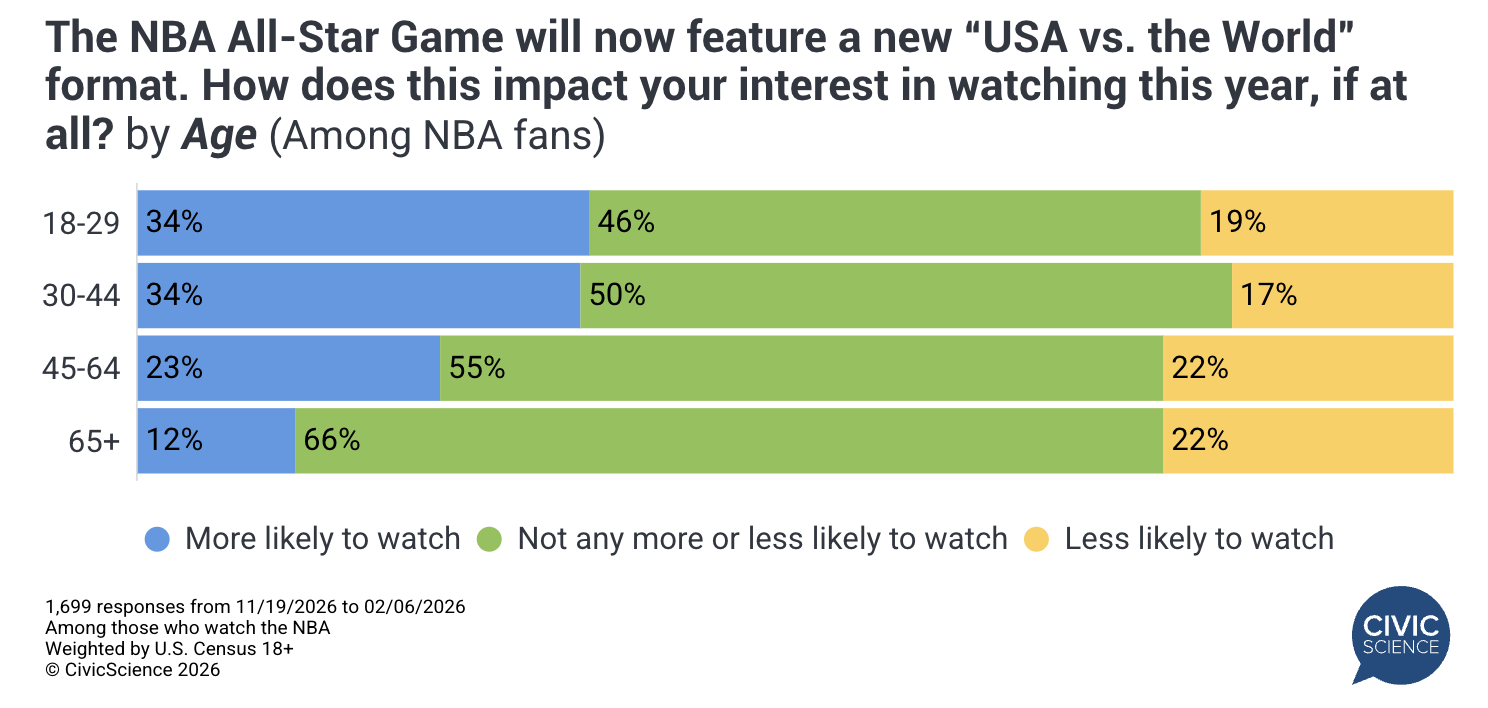

The game’s new U.S. vs. World tournament format—inspired by the NHL’s Four Nations Face-Off—is key in shaping engagement this year. While many fans (52%) remain neutral about the format, 29% are ‘more’ likely to watch because of the new international tournament, outpacing those deterred by the change (20%). This format shift is particularly effective in drawing younger audiences, as 34% of both Gen Z and Millennial fans report increased interest.

The Audience Intelligence CivicScience Delivers

Beyond basic demographics, CivicScience pinpoints exactly what drives the high-value NBA All-Star Game audience. These fans represent a year-round opportunity for brands, not just a one-time spike.

Here is what distinguishes NBA All-Star Game viewers from those who don’t plan to tune in.

- Strong Buying Intent: 75% of viewers say they plan to buy sports team-branded merchandise in the near future, led by t-shirts, sweats/hoodies, and jerseys.

- Early Adopters: 56% say they usually try new products before others do, which is 24 points higher than non-viewers. They’re also more than 2.5 times as likely to report being ‘very’ open to trying newly launched brands.

- Food and Cooking Trendsetters: 32% follow trends and current events in food and cooking ‘very’ closely, more than three times higher than those who won’t watch the game. Viewers are also more than twice as likely to say they ‘love’ to cook.

- Mobile Phone Carrier Switching: 58% of viewers are likely to switch mobile carriers in the next 3 months, 30 points higher than non-viewers.

The NBA All-Star Game is poised to attract nearly half of the league’s fans, particularly younger fans energized by the new international format. But the game’s advertising value extends far beyond a single weekend’s viewership. This audience consists of trendsetters who drive purchasing decisions, embrace new brands, and actively switch providers—making them ideal targets for sustained campaigns.

Through CivicScience’s granular audience insights like these, advertisers can identify and engage high-intent consumers in any industry across the touchpoints that matter most, transforming event-based awareness into lasting brand relationships.