The conversation around underwear is changing. Once a subject rare-discussed, Victoria’s Secret brought underthings mainstream with its annual televised fashion show. Nowadays, the conversation changes again–from a perspective of inclusivity and size diversity on the runway.

Victoria’s Secret has come under fire recently for comments deemed to be less than inclusive. A less than stellar Vogue interview, coupled with another quarter of falling sales likely led to the resignation of CEO Jan Singer.

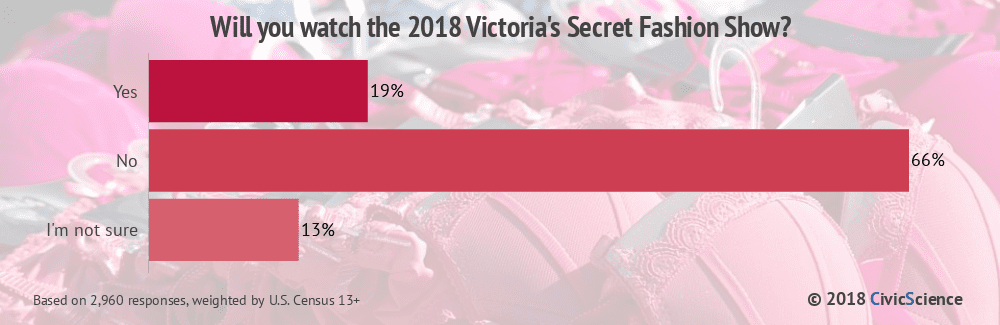

With the negative press around the brand, what viewership should be expected during the 2018 televised special? And what, if anything, does this mean for the brand’s sales? CivicScience asked nearly 3,000 Americans about their intent to tune in.

Victoria’s Secret Fashion Show Viewership

19% of respondents plan to watch the Victoria’s Secret Fashion Show next month. Of those who intend to watch, 54% are female, 46% male.

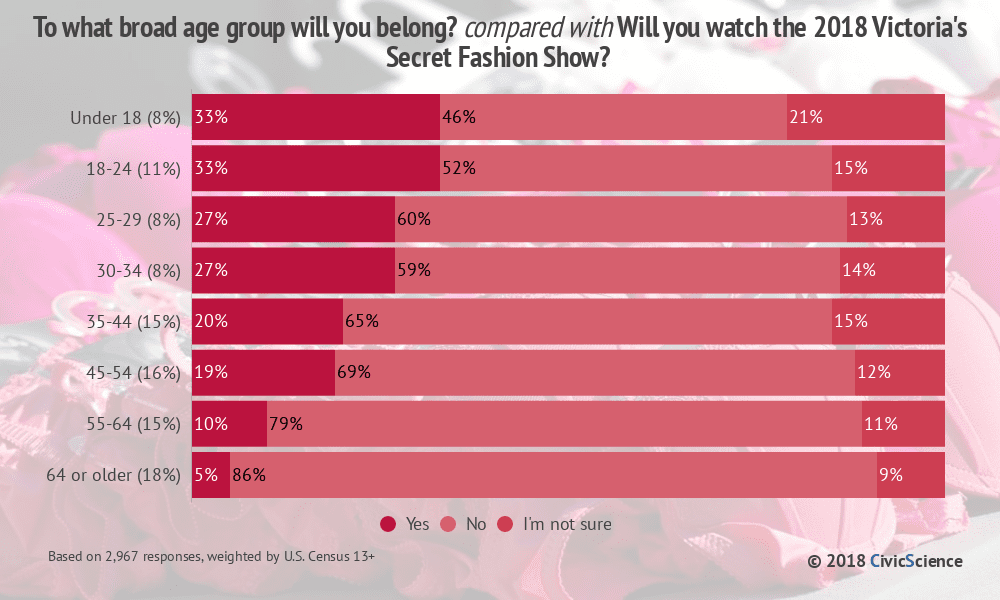

What might be most telling is the age breakdown of intended viewers.

There’s a strong connection between age and intent to watch. The younger the viewer, the more likely he or she is to respond with ‘yes’ or uncertainty. Gen Z and young Millennials are most likely to watch, with each subsequent age group being less and less likely to tune in.

Considering age, it can’t be ignored that Victoria’s Secret wields a lot of influence on the younger set. If criticism of the brand’s show is to be believed, these young viewers are being exposed to what many say are unhealthy body standards, with a lack of diversity or size inclusion.

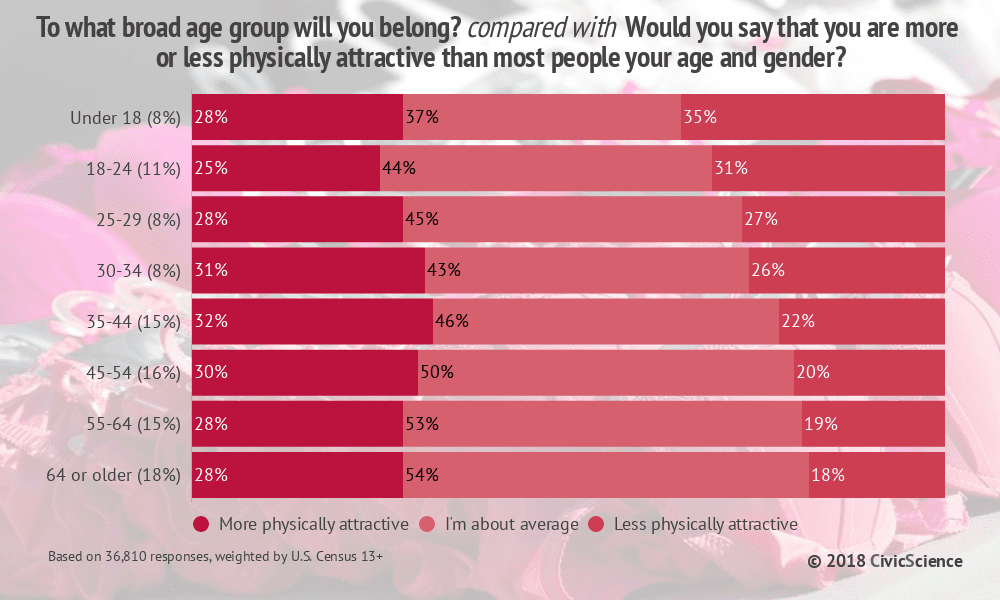

Consider the following data.

There’s a strong correlation between age and insecurity around physical attractiveness. It’s not hard for most to remember the awkwardness of being a teen. That, coupled with CivicScience research which found that people under the age of 18 are 4x more likely to think we should retouch models more, sets young people up with unrealistic expectations of body and self.

VS has a chance to spread a message to a young and engaged audience, and the brand has stood by its decision not to expand size offerings and excluding diverse body types. If seeing is believing–what are young people to believe about themselves after what they see on the Victoria’s Secret runway?

These viewing habits might have a lasting impact on young people. It’s unlikely Gen Z’s interest will save Victoria’s Secret’s declining sales, but the brand could have a lasting impact on the way young people view themselves and others.

Victoria’s Secret and Brand Favorability

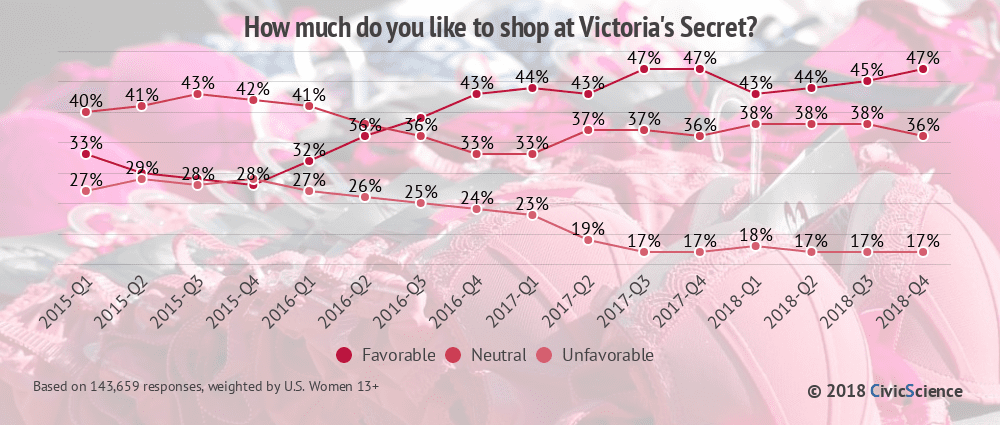

Controversy aside, it’s worth noting that the Victoria’s Secret Fashion Show is the likely cause for a boost in brand favorability among women around Q4 each year.

In Q4 2016, the brand saw a rise in favorability to 43%, a high Victoria’s Secret had yet to see in the time CivicScience has been tracking the brand. Similarly, Q4 2017 saw Victoria’s Secret brand favorability hit a high of 47%, which the brand is again trending towards (47%) in Q4 2018. Clearly, the TV special, as well as the advertising around it, boost brand favorability for women, at least temporarily. In Q1 2018, favorability dropped 8%, back to its previous high of 43%.

The Victoria’s Secret Fashion Show seems to be a double-edged sword. The brand gains fans, at least temporarily, and has the attention of a young audience, but not necessarily for the right reasons. In a media landscape where viewers feel empowered to call out brands and influencers for perceived injustices, will Victoria’s Secret Fashion Show viewers feel called to express concern? Given the most recent stories around size inclusion and Victoria’s Secret, it’ll be worth revisiting how long the boost in favorability lasts, and if this boost leads to the rise in sales the brand needs.

The holiday season is far from over, and CivicScience will continue to track the trends around Victoria’s Secret brand sentiment, and women’s fashion at large.