This is just a tiny glimpse of the data available to CivicScience clients. Discover more data.

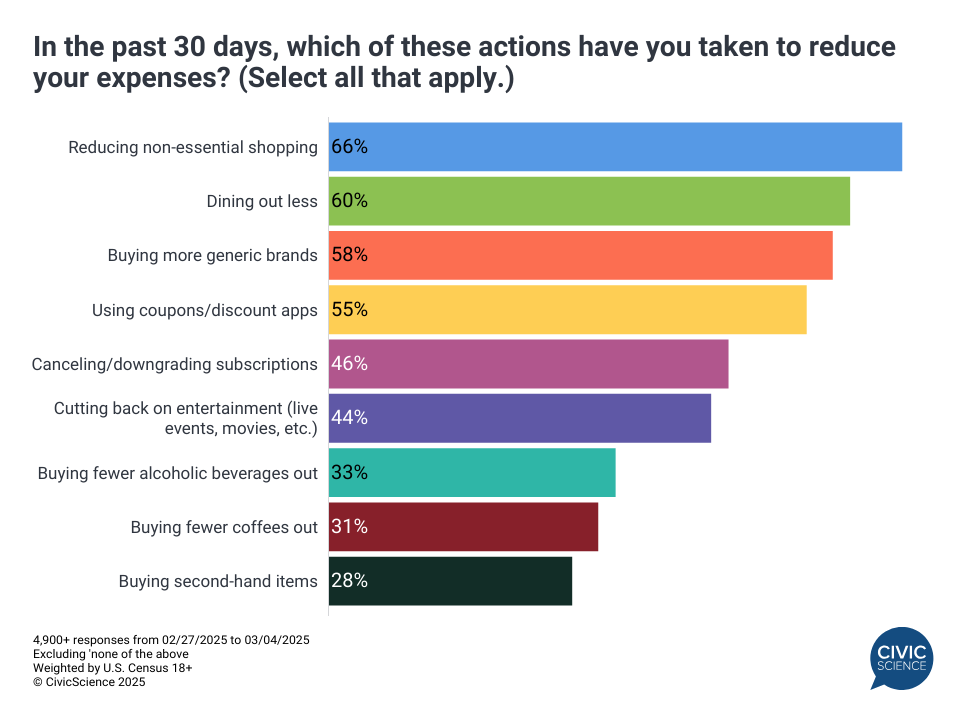

Before President Donald Trump announced that the latest round of tariffs would take effect this week, CivicScience asked Americans how they were cutting back amid rising prices overall. This data highlights several key actions that consumers are taking right now before any impacts the tariffs might have are felt.

Data show that roughly 7 in 10 say they’re cutting their spending in at least one area. The clear and unsurprising leaders revolve around cutting back on discretionary spending, whether it’s non-essential shopping or dining out less. Generic brands, coupons, and discount apps look to be benefiting from efforts to manage expenses.

While noteworthy percentages are cutting back on live entertainment and subscription spending, consumers appear somewhat less likely to sacrifice in these areas. Americans also appear comparatively less likely to have recently reduced the amount they spend on coffee or alcoholic beverages while they are out of the home.

Use this Data: CivicScience clients use this data to help retain and gain customers amid the current economic climate of increased uncertainty.

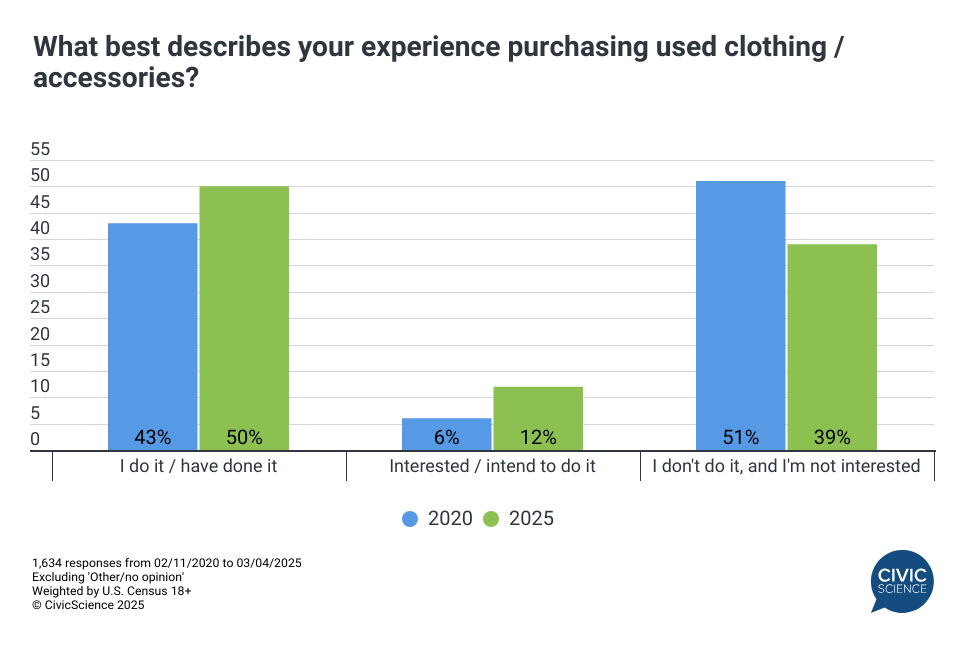

Although buying second-hand items ranked as the least common spending management strategy over the past 30 days, additional data tells a deeper story. As of early March, 50% of respondents said they currently purchase or have purchased used clothing and accessories – a seven-point increase since 2020. Meanwhile, the percentage of those who haven’t yet but are interested and intend to do so has doubled from 6% to 12% over the same period (excluding ‘other/no opinion’).

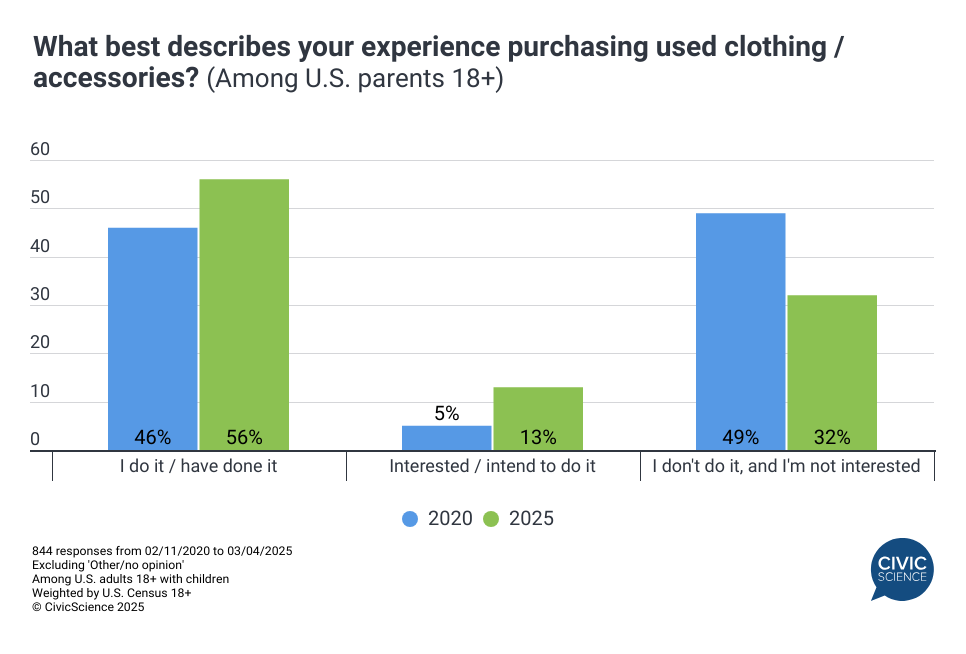

This trend is even more pronounced among U.S. adult parents – 56% say they currently buy or have bought second-hand clothing items, and intent to try them has nearly tripled in five years.

Let us Know: Have you cut any “unnecessary” expenses from your budget this year?

Consumers were already making expected cutbacks in discretionary spending and dining out before the latest tariffs took effect. But should prices increase further as a result, under the radar trends – such as the rising adoption of second-hand clothes shopping – could accelerate. Brands and marketers should stay attuned to these changes, as they may signal longer-term shifts in purchasing habits. Understanding how consumers adapt to financial pressures will be key to staying ahead in an increasingly volatile economic landscape.

See more coverage from CivicScience on how Americans are likely to change their spending habits with the latest tariffs taking effect here.