There’s one topic I’ve been asked about more than any other lately.

It comes up in almost every client or prospect conversation, from retailers to restaurants to healthcare execs to hedge fund managers. Even my friends ask me about it.

It’s not the economy. Not holiday retail. Not the election. Not the Israel-Hamas war.

It’s Ozempic or, more broadly, so-called GLP-1 weight loss drugs.

I first started hearing about it nearly a year ago and didn’t think much of it. Pound-shedding fads come and go, like the Atkins diet or Fen-Phen, for those of you with as much gray hair as I have. I assumed this was one of those.

But this is something different. By most accounts, it’s a miracle drug, notwithstanding the side effects and having zero idea what long-term health risks it could pose. We also don’t know if people will stick with it or whether they’ll lose the weight, stop taking it, and go back to square one. Will we need to be on it for life?

Then there’s the cost. At nearly $1,000/month, it creates a barrier for lower-income Americans – who incidentally over-index as obese. Health insurers have a conundrum too. A few are covering it. They’re betting that future reductions in chronic illnesses, knee replacement surgeries, and other maintenance drugs will save money in the long run. They also assume the skyrocketing popularity will spawn a bevy of Ozempic competitors, dropping the price tag over time.

But this goes far beyond healthcare.

We forget how much of our economy is predicated on our obesity. It’s estimated that over 42% of Americans are obese, and nearly 10% are severely so. We eat more (and more junk), shop at plus-size retailers, and buy exercise bikes that turn into clothing racks. Being overweight makes us tired or even depressed, so we watch more TV or TikTok. You could hypothesize it’s responsible for declining birth and marriage rates – to the extent obesity makes us less attractive to mates.

According to our data, 13% of Americans have already tried a GLP-1 drug and nearly as many are thinking about it. Twenty-two percent don’t know about it yet – but they will. If it proves not to be a fad, the economic implications could be as big if not bigger than AI. Companies like Walmart have reported that they’re already noticing an effect. It could rock the world of CPG, dining, apparel, beauty, gym memberships, fuel costs for commercial airplanes, and, of course, healthcare.

There’s also a lingering question about what the Ozempic craze could do to our emotional well-being. On one hand, feeling and looking better is an endorphin boost. Eating disorders could decline. On the other, we’ve made decent cultural strides around body positivity. Could this set us back? Only time will tell.

Next month, we’re launching a new data product, tracking thousands of GLP-1 users (and intenders), their demographics, lifestyle, shopping and eating behaviors, healthcare, emotional well-being, and even their media habits. It’s not free. But I’ll sprinkle a few interesting insights here from time to time.

You need to pay attention to this.

Here’s what we’re seeing:

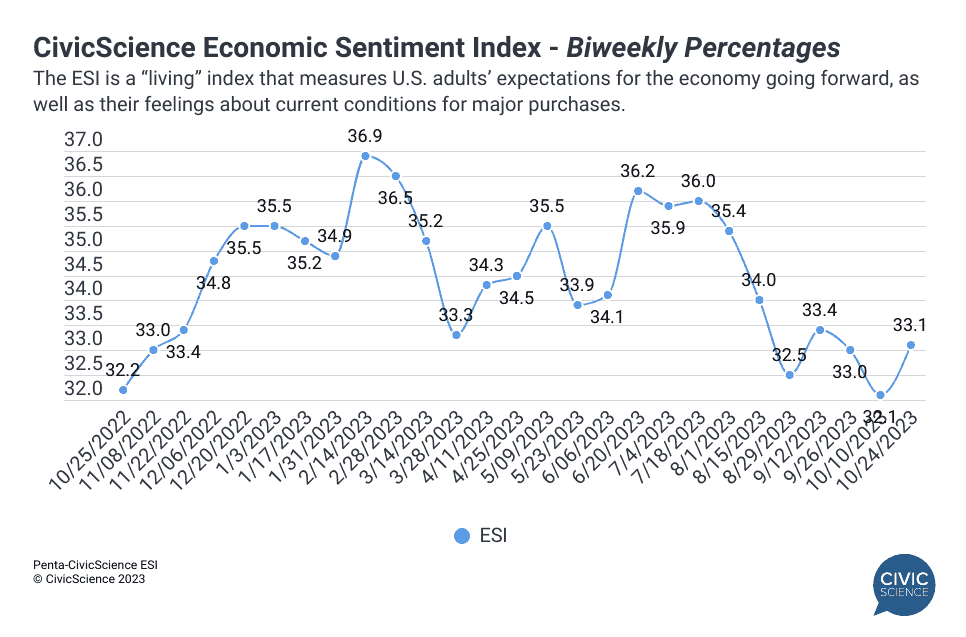

Consumer confidence had a modest uptick. I’ll admit surprise here, as I expected the heightened global unrest of late to weigh on Americans’ financial mood. But no, our Economic Sentiment Index had its first biweekly bounce in almost two months and its largest since June. Confidence in making major purchases (good, right before Christmas) and optimism for the job market were the biggest gainers.

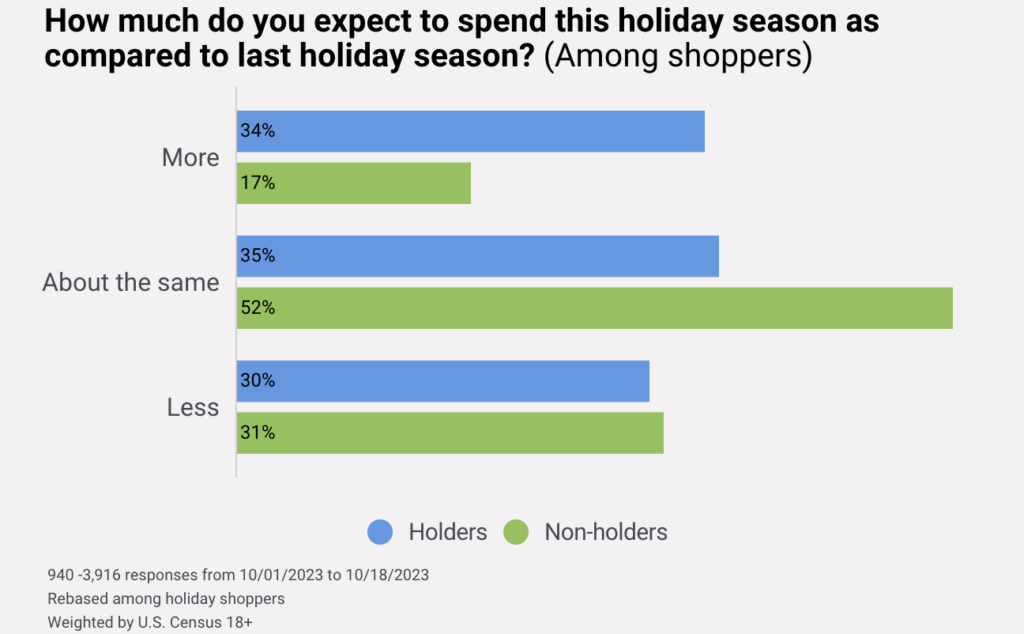

The return of student loan payments doesn’t seem to be dissuading holiday shoppers. Echoing my gloomy rant about the long-term economy last week, it seems that even renewed student loan obligations aren’t dictating more fiscal responsibility going into the holidays. In fact, student debt holders are twice as likely as non-holders to anticipate spending more this year than they did last year – and also twice as likely to take on debt while doing it. The data reinforces another of my common soapbox refrains, however, namely how consumers are making emotion-driven tradeoffs in their shopping behavior. Those debtholders are much more likely than non-holders to be cutting back on other things, like groceries, personal care items, and even streaming subscriptions.

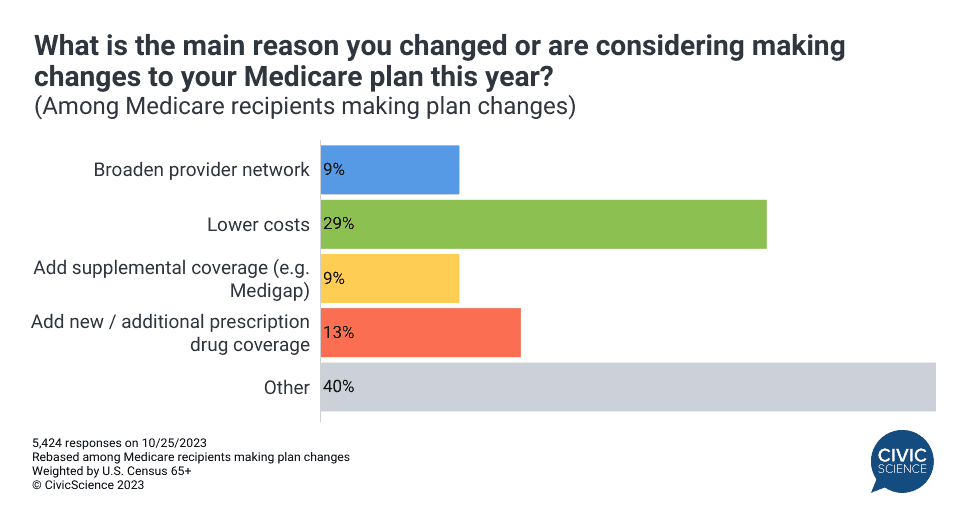

Economic headwinds are driving a lot of Medicare recipients to change plans. As the annual open enrollment period gets underway, our tracking data reveal that 1 in 10 Medicare customers are looking to switch their insurance plans, citing costs as their main motivation (expanded prescription coverage comes in second). Black and Hispanic Americans over-index as likely switchers. The biggest moves are coming from Medicare Advantage customers – they’re nearly 50% more likely than Medicare Parts A or B customers to be shopping.

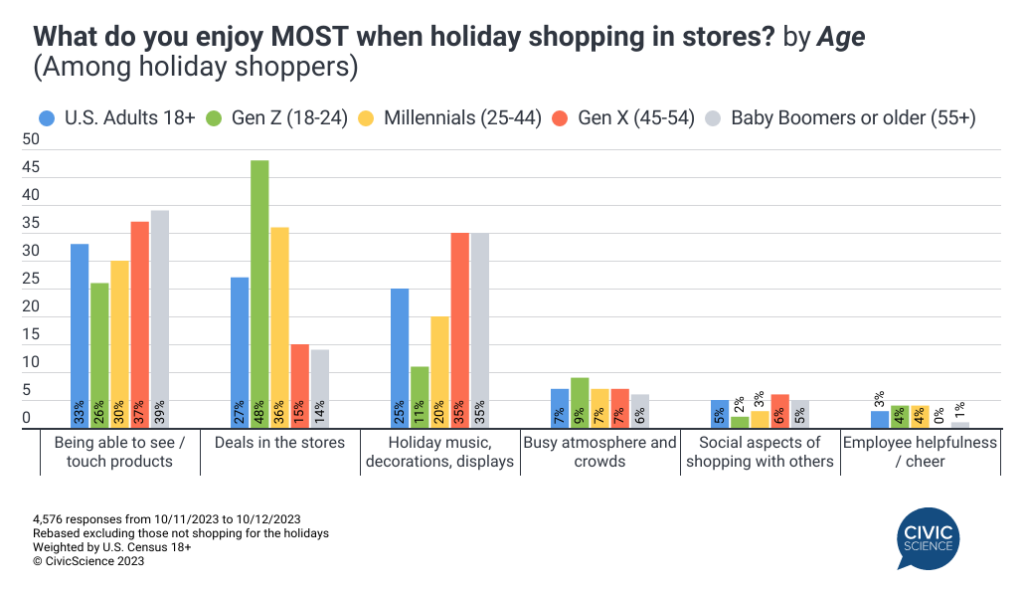

Trust in news is declining again. After completely bottoming out during the 2016 election cycle, Americans’ faith in news sources rebounded until 2020, before beginning to erode again. Today, 43% of U.S. adults say they don’t trust ANY news sources. Like, none whatsoever. Recent declines are attributable to growing distrust in national broadcast news networks, specifically, and local news is again the most trusted source. Also in our 3 Things to Know this week, we looked at whether people really cared about who became Speaker of the House (they didn’t) and how nostalgia brings GenXers and Boomers into stores during the holidays.

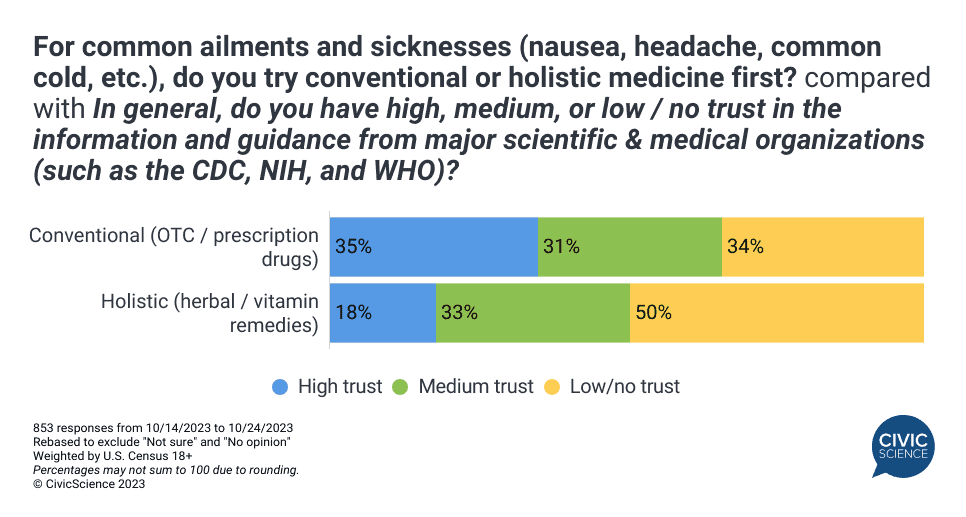

Speaking of trust, the popularity of holistic medicine has been surging since the pandemic. Yet another sign of the times, nearly 1 in 3 Americans say they turn first to holistic remedies – like herbal or vitamin supplements – for common ailments like colds, headaches, or nausea. That represents a big jump from 20% of adults who said the same in 2021. It’s hard to ignore the evidence of causality here. Declining trust in the overall medical establishment since COVID has its fingerprints all over this trend.

More awesomeness from the InsightStore:

- The economy is hitting NHL fans worse than NBA fans, and other big differences between the fan bases as the seasons begin;

- Consumers believe other EV manufacturers are making gains on Tesla;

- Mini-candy bars are by far the most popular Halloween candy to hand out, while Snickers is gaining on Reese’s, and other spooky insights before the holiday;

- Online car buyers love German auto brands and 4 other nuggets of knowledge;

- REI shoppers way over-index as Ozempic users and other REI factoids;

- Taco Bell’s World Series promotion could be a big hit – among Chipotle fans.

The most popular questions this week:

Answer Key: Lots; 6 out of 10; Not even a little; 2 or 3 times; All of them, yes; Definitely open.

Hoping you’re well.

JD

Was this email forwarded to you? Sign up here. If you are new to this list, check out our Top Ten to get caught up.

Want to see weekly insights from the What We’re Seeing through the lens of your customers? Learn how here.