The Gist: Some reports say that Amazon isn’t captivating fashion followers, and our data seem to tell a similar story. When looking at 20 brands and retailers that over-index against the general population over the years, Amazon has moved down the list. Others, such as Forever 21 and Bloomingdale’s, have climbed the ladder.

This week, I read an article in Bloomberg saying that Amazon is doing a great job selling clothes, but it’s not doing a great job selling fashion. Its most common items are from brands like Hanes, rather than those catering to a different audience. I wondered – is this true? Are fashion fanatics shopping elsewhere, or is Amazon a prime shopping destination for those on all ends of the Sex and the City spectrum?

The data were surprising, and led me on a broader path.

But first, Amazon.

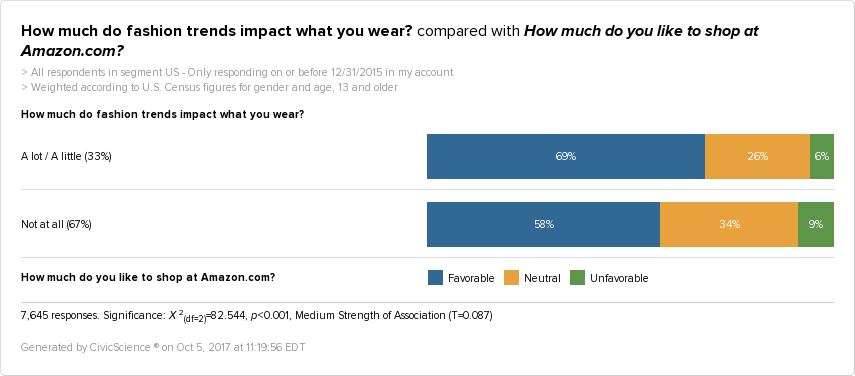

Initially, I found that fashion followers – which for the purposes of this post I consider to be anyone who says that fashion trends affect what they wear either a lot or a little – have had a slight but noticeable drop in their favorability towards Amazon. Check it out:

Pre-2016:

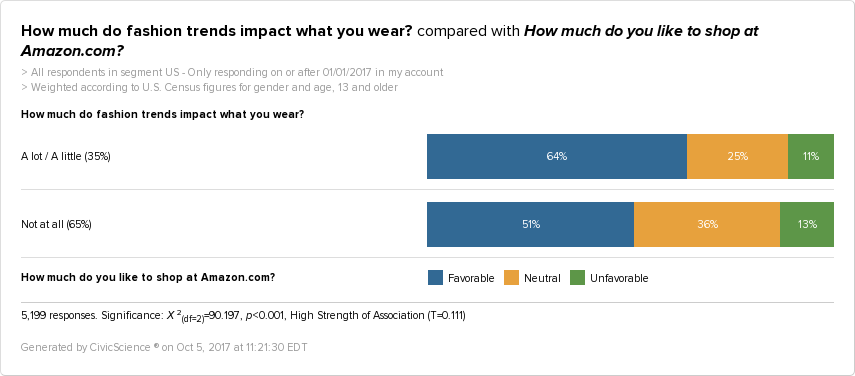

Post-2017:

As you can see, 69% of fashion followers had a favorable view of shopping on Amazon before the start of 2016, while the same is true for only 64% this year.

That said, the majority of fashion followers, overall, still have a favorable view of Amazon.

So, is there some truth to the article I read? Yes, but….

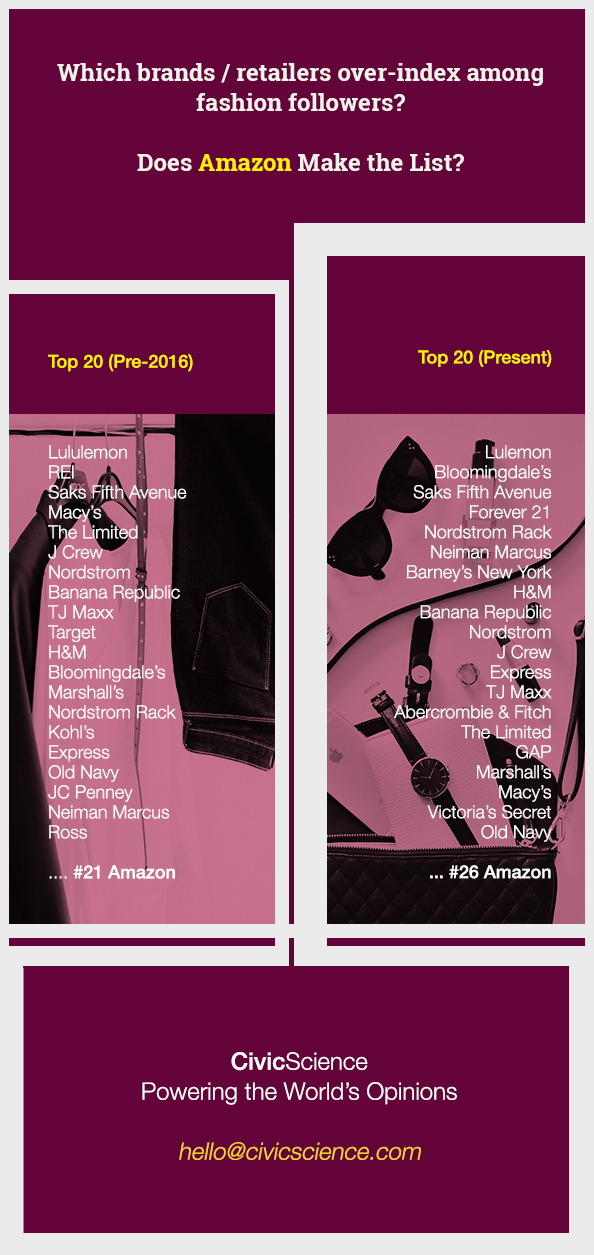

I wanted to know what brands and retailers over-index against the general population when we focus solely on fashion followers, and specifically if Amazon makes the list.

Check it out:

Top 20 Brands / Retailers Pre-2016:

Before the start of 2016, here were 20 brands that over-indexed among fashion followers (i.e. those who like or love to shop there), when compared to the general population.

- Lululemon

- REI

- Saks Fifth Avenue

- Macy’s

- The Limited

- J Crew

- Nordstrom

- Banana Republic

- TJ Maxx

- Target

- H&M

- Bloomingdale’s

- Marshall’s

- Nordstrom Rack

- Kohl’s

- Express

- Old Navy

- JC Penney

- Neiman Marcus

- Ross

And just missing the cut off at #21: Amazon.

Did the company make the list today?

Post-2017

This year, here are the 20 brands that over-index among fashion followers (i.e. those who like or love to shop there), when compared to the general population.

- Lulemon

- Bloomingdale’s

- Saks Fifth Avenue

- Forever 21

- Nordstrom Rack

- Neiman Marcus

- Barney’s New York

- H&M

- Banana Republic

- Nordstrom

- J Crew

- Express

- TJ Maxx

- Abercrombie & Fitch

- The Limited

- GAP

- Marshall’s

- Macy’s

- Victoria’s Secret

- Old Navy

And now at #26: Amazon.

So, these numbers seem to support the recent research that Amazon is not quite captivating fashion-forward consumers.

To take a more visual look at how these lists have changed over the years, check out the infographic below. Important note: by no means am I graphic designer, so I hope you’ll bear with me on the design

[shade-open-form]

[shade-close-form]