This is just a sneak peek at the thousands of consumer insights available to CivicScience clients. Discover more data.

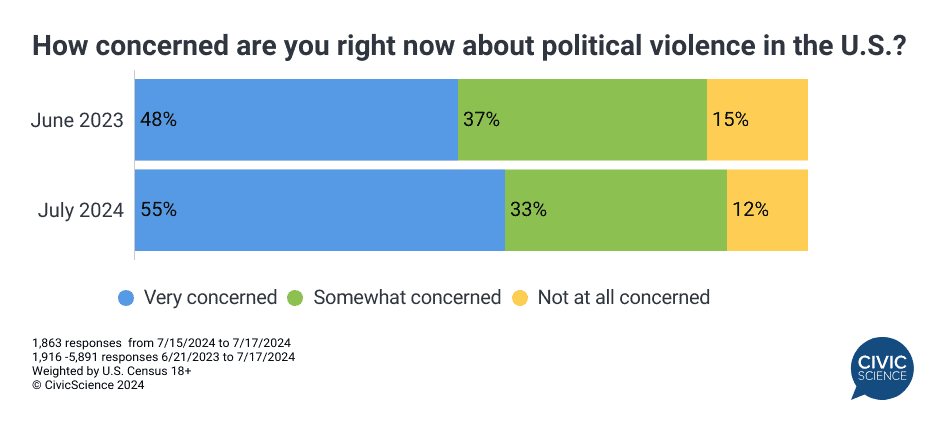

1. Concerns over political violence grow among Americans.

Following the near-assassination of former President Trump at a campaign rally in Pennsylvania, 48% of U.S. adults say they are ‘very’ concerned about political violence in the United States targeting politicians and their families.1

Additionally, general concern about political violence in the U.S. is on the rise. The percentage with strong levels of concern about political violence has risen a noteworthy seven points since June of 2023, with 55% of respondents now ‘very concerned.’ This compares to just 12% who are ‘not at all’ concerned.

Take Our Poll: How concerned are you about political violence occurring in the US in the coming years?

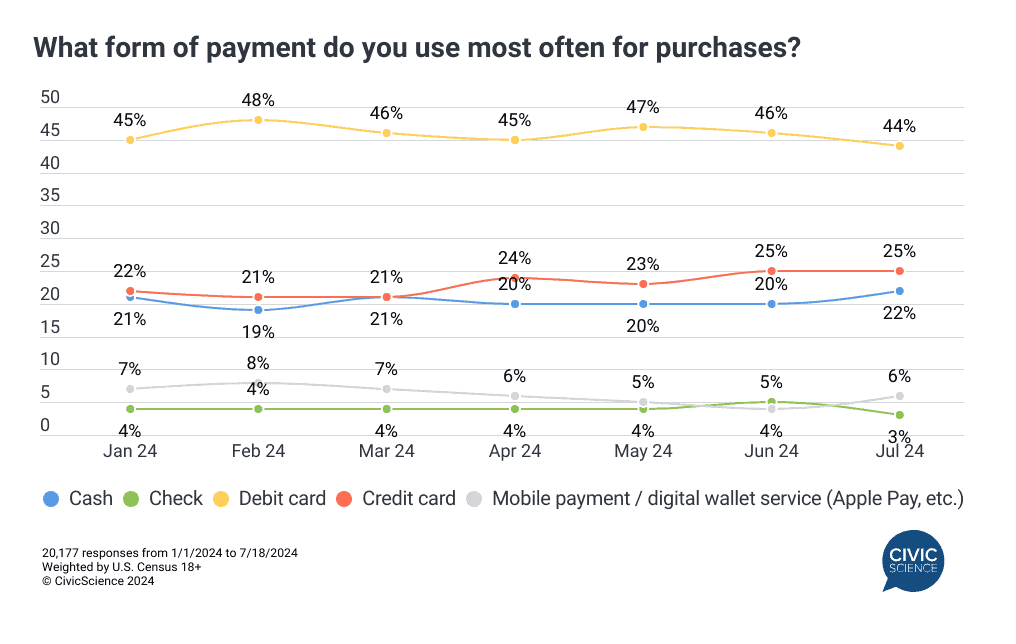

2. Checks are on the way out as an acceptable form of payment, but consumers are far more likely to pay by debit or credit.

Target recently announced it would stop accepting personal checks as a form of payment. CivicScience data show this shift is unlikely to significantly affect U.S. consumers as only 3% prefer paying by check as of July 2024. Debit cards are by far the most popular payment method, followed by credit cards and cash. Like checks, mobile payments are not widely used, with only 6% of shoppers opting for digital wallet apps or mobile payment services.

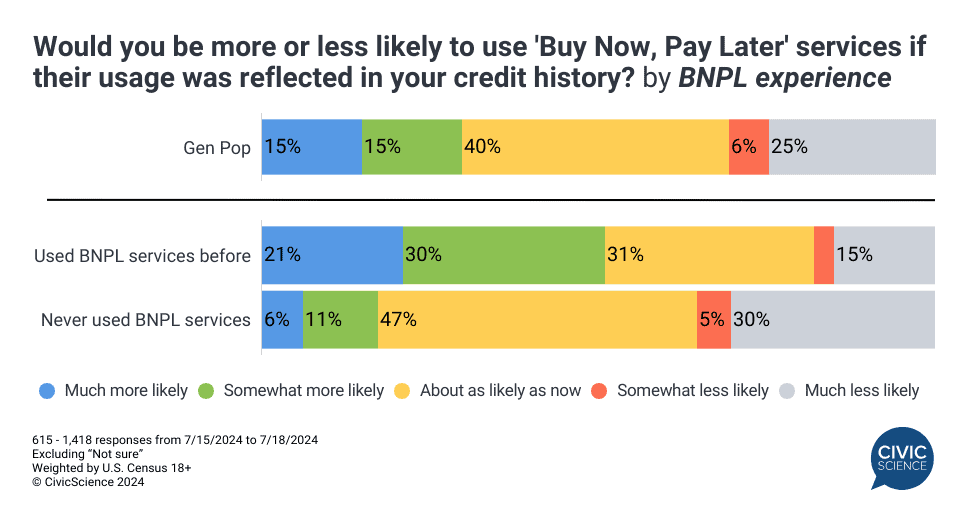

3. Consumers would be more (and less) likely to use BNPL services if doing so could help improve their credit score.

Speaking of payment methods, buy now, pay later (BNPL) services have become increasingly popular in recent years. While some BNPL providers report account activity to credit bureaus, many do not. According to new CivicScience data, 30% of U.S. adults would be more likely to use BNPL services if their transactions impacted their credit score, which jumps above 50% among those who have previously used BNPL programs. However, reporting could be a deterrent to attracting new users, as a nearly equal percentage (31%) of the Gen Pop would be less likely to use them. Additional data indicate consumers from lower-income households show greater interest in BNPL services if they could contribute to improving their credit score.

Let Us Know: How likely, if at all, is it that you will utilize a “buy now, pay later” option in the future?

Attitudes change before behaviors do. CivicScience’s ‘always-on’ 1st-party data tracking makes it easy to identify shifts in consumer behavior before the competition does. See what we can do for your brand.

- 1,863 responses from 7/15/2024 to 7/17/2024 ↩︎