This is just a tiny glimpse of the data available to CivicScience clients. Discover more data.

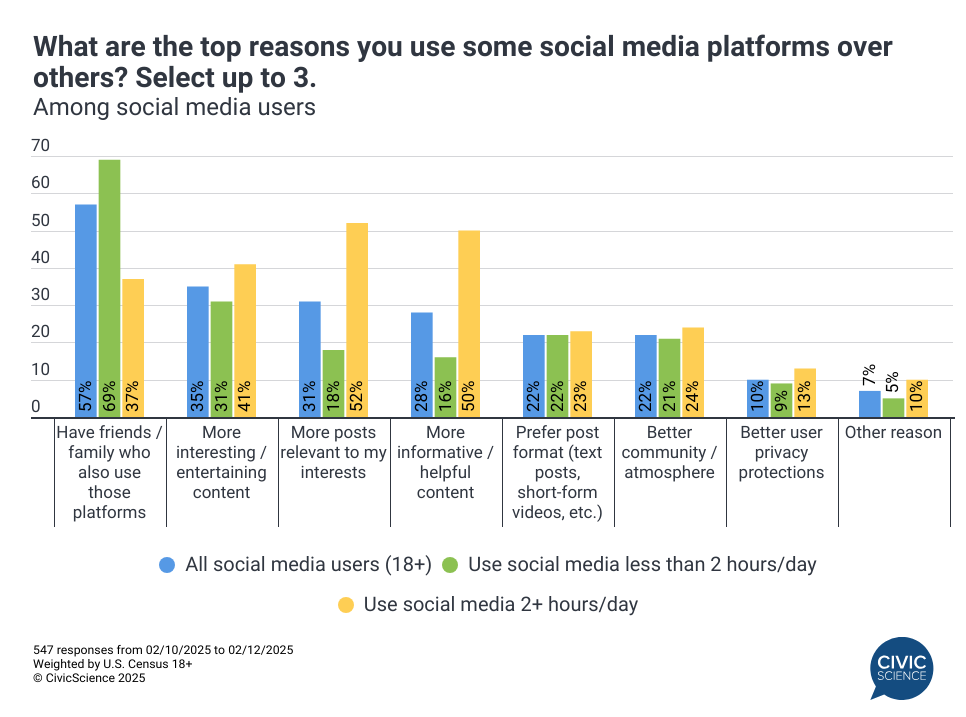

1. Most social media users choose a platform based on friends and family, but motivators differ by the amount of time they spend on social media.

CivicScience data show there are a variety of factors shaping why social media users choose one particular platform over another. For instance, social media users who use social media less than two hours per day are far more likely to choose platforms based on what apps their friends and families are on. Meanwhile, more frequent social media users prioritize finding content that is entertaining and relevant to their interests. At the other end of the spectrum, user privacy concerns are much less likely to shape platform decisions.

The Weekly Pulse report also has exclusive in-depth data on how social media usage motivations change by platform. Join Fortune 500 execs who have access to this data and much more today – get started here.

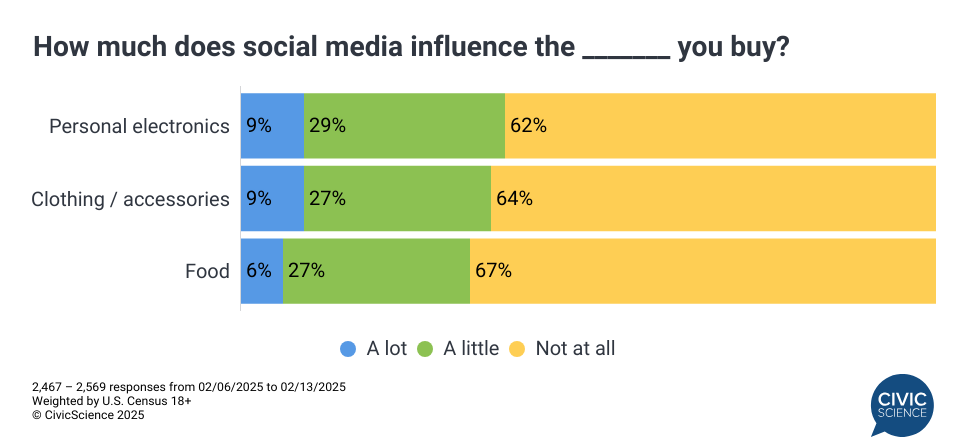

2. Social media’s sway over consumer choices continues to evolve.

Speaking of social media, the latest CivicScience data reveals that the percentage of Americans who say their friends and contacts on social media influence their general purchases has risen from 30% to 42% over the past 10 years. While this percentage has generally hovered between 40%-43% since 2021, additional data show social media wields more influence in certain categories – electronics purchases, for instance, are five percentage points more likely to be swayed by social media than food purchases.

Take Our Poll: To what extent, if at all, are you influenced to eat the same food you see posted on social media?

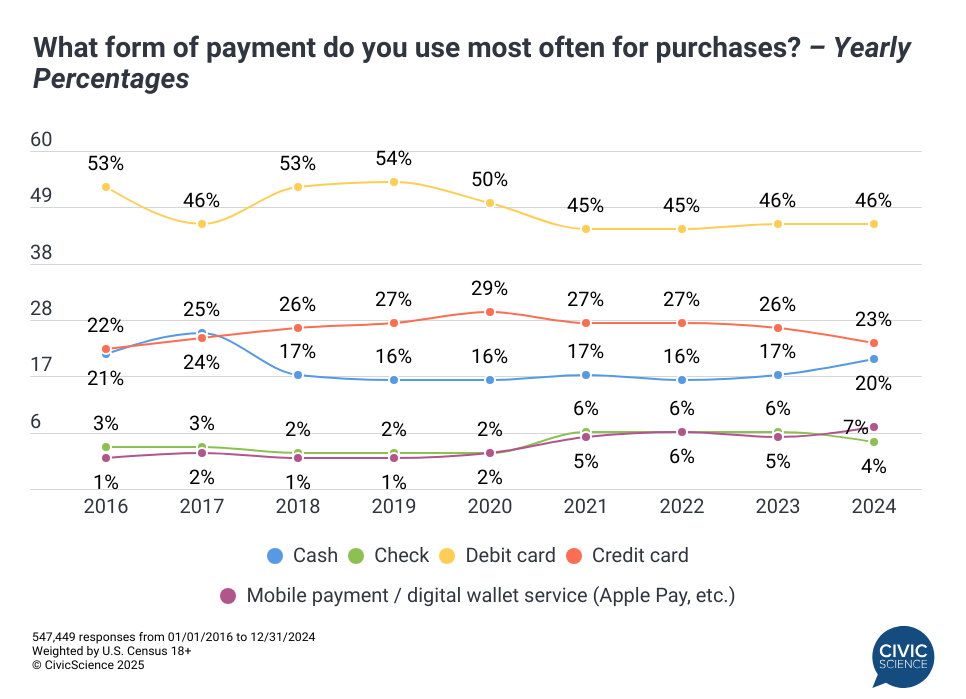

3. Americans are becoming less likely to use credit cards and more likely to rely on cash.

What consumers pay with has also shifted over the past decade. While Americans are most likely to say debit cards are their most common form of payment, this figure has decreased by seven percentage points since 2016 (53% to 46%). Credit cards are the second most used form of payment, but the percentage of people who use them most often has declined by four points from 2022 to 2024. Instead, Americans have grown more likely to pay with cash and mobile payments.

Weigh in: Do you think cash is still important?