The Gist: Our data show that 25% of consumers are at least somewhat likely to purchase Hulu’s new live TV service. That percentage is nearly identical to those who are likely to purchase YouTube TV.

Recently, Hulu announced its entry into the live TV streaming market. With its new $39.99 package, subscribers will be able to watch a variety of major broadcast channels, track their favorite shows and sports teams, and gain access to Hulu’s existing on-demand library. As told by Hulu CEO Mike Hopkins, “Hulu can now be a viewer’s primary source of television.”

How will this new service fare in comparison to other live TV streaming platforms, like YouTube TV?

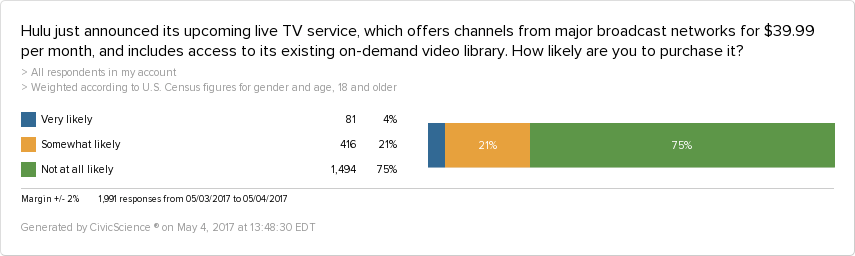

As you can see, 25% of U.S. adults say they are at least somewhat likely to purchase Hulu’s new service.

Those who are “Very likely” to purchase are more likely to be 18-34, while those who answered “Somewhat likely” are more likely to be 35-54. In comparison to those who don’t intend to purchase Hulu’s new service, both of these groups are more likely to use a DVR.

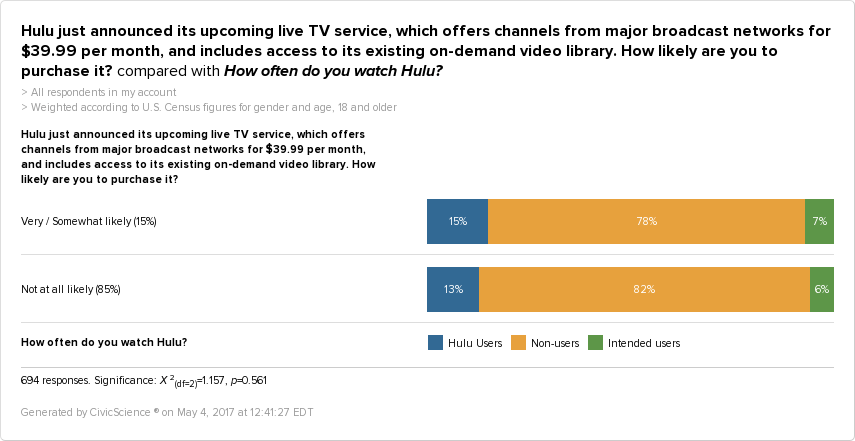

Interestingly, it looks like this offering could bring in many new customers:

85% of those who are at least somewhat likely to purchase the new service are not current Hulu users.

THAT’S GREAT, BUT HOW DOES HULU STACK UP?

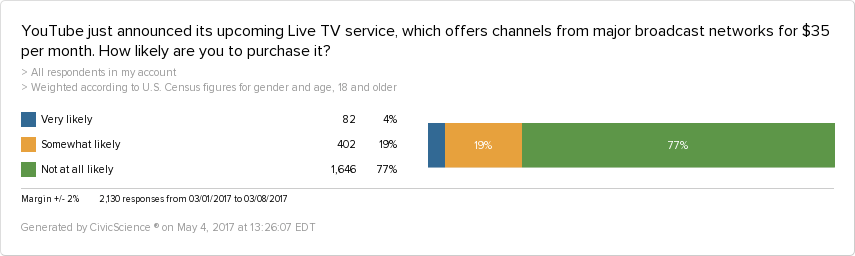

Immediately following the announcement of YouTube TV – which is similar to Hulu in both price and service – we launched a nearly identical question to the one above. Check it out:

4% of consumers said that they were “Very likely” to purchase YouTube TV – which is identical to those who say they are “Very likely” to purchase Hulu’s new service. However, 22% of consumers say they are “Somewhat likely” to purchase Hulu TV, while YouTube TV lags by 2% – though still within the margin of error.

So, it will be interesting to see who wins out, if either of them, in this upcoming battle of the skinny bundles.

Interested in other insights? Check out our recent posts on The New York Times’ new partnership with Spotify, size-inclusivity in retail stores, and the growing trend of smart home assistants.