It’s been about seven months since the launch of Disney+, along with the accompanying bundle offer of Disney+, Hulu, and ESPN+ for $12.99 / month.

But how has the bundle performed in the increasingly competitive world of streaming content? According to year-over-year survey data from CivicScience, the number of current subscribers is well below the percentage who said they were “interested” when the bundle was first announced last summer (30%). Just 7% of the 2,171 U.S. adults (ages 18+) surveyed in May said they currently subscribe to the bundle, with another 7% interested.

To give some context, in the month of May, 33% of U.S. adults said they were Hulu subscribers, 30% said they subscribed to Disney+, and 15% subscribed to ESPN+, according to ongoing CivicScience tracking data. That means bundle subscribers likely make up less than one-quarter of total Hulu or Disney+ users, but nearly half of all ESPN+ users.

Breaking It Down by Streaming Service

A Disney+ subscription ($6.99 / mo.) and the most basic Hulu subscription ($5.99 / mo.) are together just one cent cheaper than the three-part bundle ($12.99 / mo.), without the added bonus of ESPN+. The interesting part of this is that 40% of Hulu subscribers surveyed from January 1 to May 31 this year said they also subscribe to Disney+, and another 15% intend to do so.

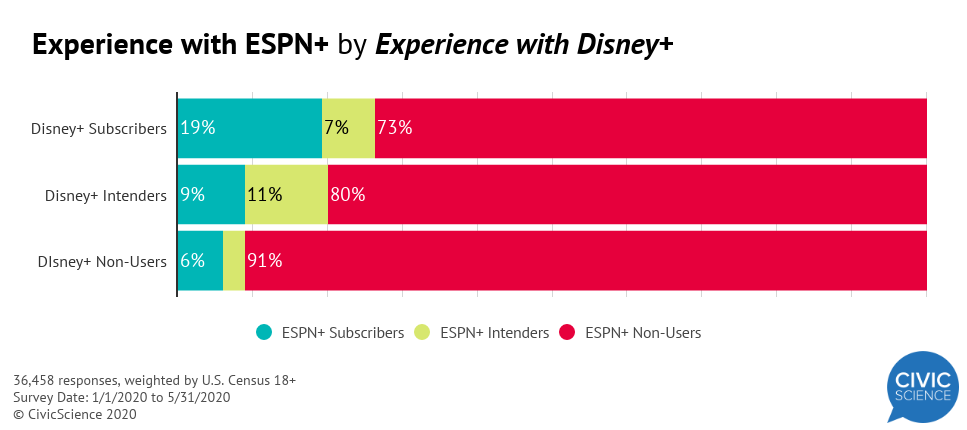

When it comes to Hulu users’ experience with ESPN+, however, the crossover is far less significant, which makes one wonder whether the sports network is the barrier to subscribing to the bundle. Only 4% of current Hulu users say they intend to sign up for ESPN+, on top of the 14% of current subscribers among Hulu users. The same principle goes for Disney+ users, where one-fifth currently have ESPN+ but only 7% more intend to subscribe. Perhaps most existing Hulu and Disney+ users simply figured they just wouldn’t watch ESPN+, so they wouldn’t bother signing up for the bundle — even if it would essentially give them the sports service for a penny per month.

It seems that interest in the bundle is contingent on interest in ESPN+, and interest in ESPN+ is fairly limited to die-hard sports fans. For example, those who’ve played fantasy sports are four times more likely to have signed up for the streaming bundle than those who haven’t.

The good news for Disney here is that use of and interest in the bundle are fairly high among those who’ve played fantasy sports. The bad news is that this represents only about one-fifth of the U.S. adult population.

Parents in Large Households More Likely to Subscribe

As for those who do subscribe to the bundle, it appears to be most popular among those living with larger families. Subscribers and intenders were both more likely than non-users to live with three or more other people. Only 7% of subscribers live alone, compared with 20% of non-subscribers.

Further evidence of this: Excluding grandparents, parents were more likely than non-parents to subscribe.

Overall, it seems as though the public’s perception of the Disney streaming bundle — Hulu, Disney+, and ESPN+ — is tied inextricably to public perception of ESPN+. While it has gained some traction among staunch sports fans and parents, most Hulu and Disney+ users don’t have the bundle and don’t plan to get it.