Finances can be scary and uncertain no matter what, but especially during a pandemic and a period of mass unemployment.

When CivicScience asked Americans which financial situation would be the scariest to them, the biggest percentage of respondents answered that losing their job would be it (32%). This is followed up closely by major unplanned out-of-pocket expenses (29%).

Before diving in to the correlations with recent data, it’s worth noting that this has shifted a bit since CivicScience first asked the question back in 2018. Fear of investments losing value increased, and fear of job loss has interestingly decreased by four percentage points since then. Could it be due to the fact that many have indeed lost their job in recent months, and the fear has become a reality?

The data point to this theory being a very likely part of the story. When looking at Americans who were employed during pre-COVID times and how the pandemic has impacted their job status, those who are not working now are much more likely to be concerned about big unexpected expenses and investments losing value (as well as a drop in their credit score) than those who are gainfully employed.

Life Stage Determines Financial Worry

While many age correlations with the survey are clear (those who are 55+ are less worried about losing their jobs than their counterparts) others stood out.

Those who are 55 and older are the most concerned about their personal financial information being stolen. While this older cohort is also the most likely to worry about their investments losing value as retirement nears, those aged 18 to 24 are right there with them. With recent studies showing that the younger generation is amped on investing this just backs it up further.

Those in the 35 to 54 age group are the most worried about losing their jobs, a concern that steadily rises with age from 18 to 54.

While age largely determines someone’s biggest money fear, the data show that gender roles come into play as well. Men are more likely to report they’re most concerned about a drop in the value of their investments, while women over-index in their concern about unexpected expenses.

And it’s not job loss that necessarily scares those in lower-income brackets the most, it’s out of pocket expenses. The more one makes, the less likely they worry about these sort of major costs, and the more likely they are to be concerned about the value of their investments. You’ve gotta have money to invest it, after all.

Not only are finances often scary, but they’re stressful. Though this is likely a proxy for age, those who are most concerned about investments losing value and having their personal financial information stolen are the least stressed (i.e., likely older and wealthier).

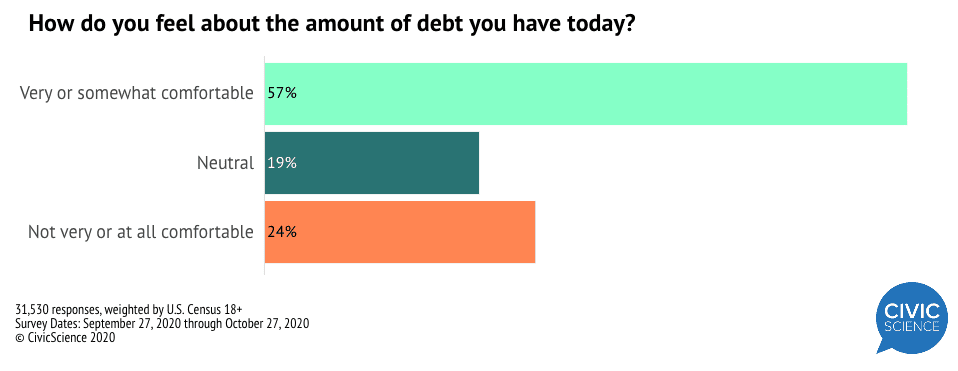

Another big correlation is debt. Overall, the majority of adults report they are at least somewhat comfortable with the amount of debt they have (57%), while 24% are not comfortable with it.

Those who are worried about investments and compromised financial information are the most comfortable with the current amount of debt they have. Again, this could be a proxy for wealth and life stage, but it’s notable that those who are worried about credit score, unexpected costs, job loss, and being denied a loan are more likely to be uncomfortable with the amount of debt they have.

Lastly, the CivicScience survey unveiled a correlation between health insurance coverage and financial fears that highlights healthcare in the U.S. in a nutshell. Those who receive their health insurance via their employer over-index as being worried about losing their job compared to those who don’t receive their health insurance through an employer. The un-insured, however, are fittingly worried about a large out-of-pocket expense they did not plan on.