This is just a sneak peek at the thousands of consumer insights available to CivicScience clients. Discover more data.

Financial literacy isn’t just a skill for those in the highest tax brackets. In fact, it has been argued that understanding how to use financial tools can increase resilience and improve overall quality of life, making it relevant for everyone. But, when it comes to money, not everyone has the same access to education or experiences.

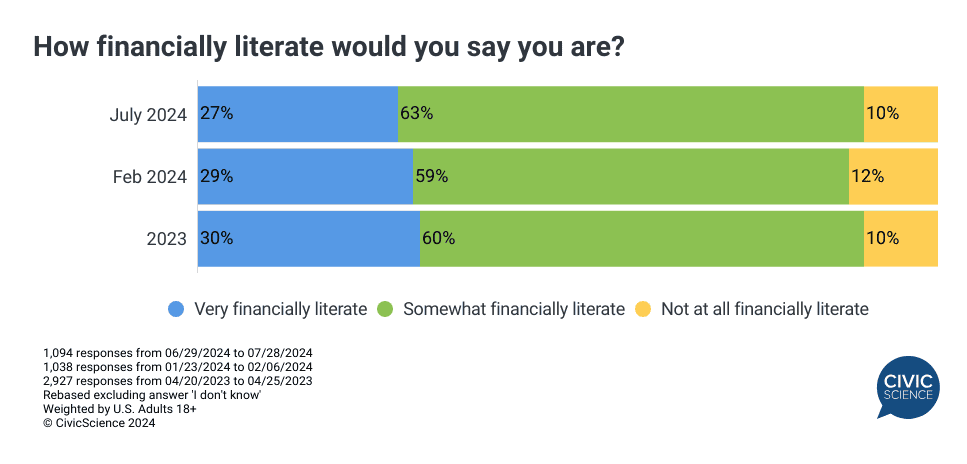

As the latest CivicScience data show, most people consider themselves ‘somewhat’ financially literate. However, self-reported financial literacy continues to decline. Those who consider themselves ‘very’ financially literate have decreased from 29% earlier this year to 27% now.

Join the Conversation: How would you rank your financial literacy?

Top Financial Products in 2024

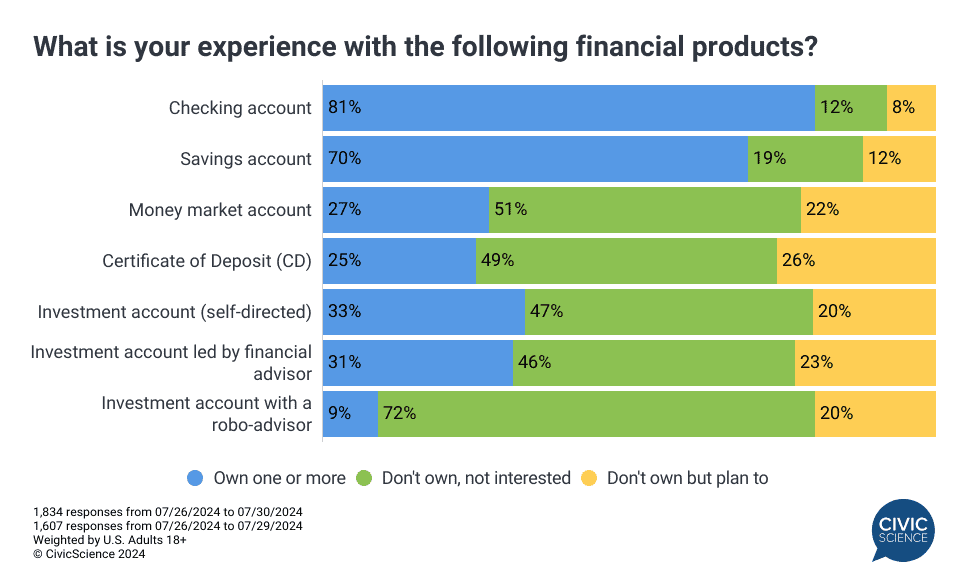

Financial literacy levels in 2024 have a role to play when it comes to financial products. In a look at some of the most common financial products, personal checking accounts rank as the most popular among Americans, with 81% of respondents owning one or more checking accounts and 8% planning to open one. Savings accounts come in second, with 70% owning one and 12% planning to do so.

A money market account or a certificate of deposit (CD) each offer alternative ways to safely accrue interest on savings. However, roughly 1-in-4 U.S. adults currently invests in either of these products, with 27% owning a money market account and 24% owning a CD. Interest is highest in CDs, though, with more than one-quarter of Americans planning to open an account.

In terms of investment accounts, the largest percentage of U.S. adults (33%) have a self-directed account, slightly outnumbering the percentage of those who have an investment account led by a financial advisor (31%) and well above those with a robo-advisor (9%). So even as financial literacy declines, Americans seem more committed to managing their own investments.

The above data paints a fairly straightforward picture, with Americans opting for the traditionally understood financial products – such as savings and checking accounts – at a higher rate than the products that would require more education or understanding to engage with.

Life With Loans

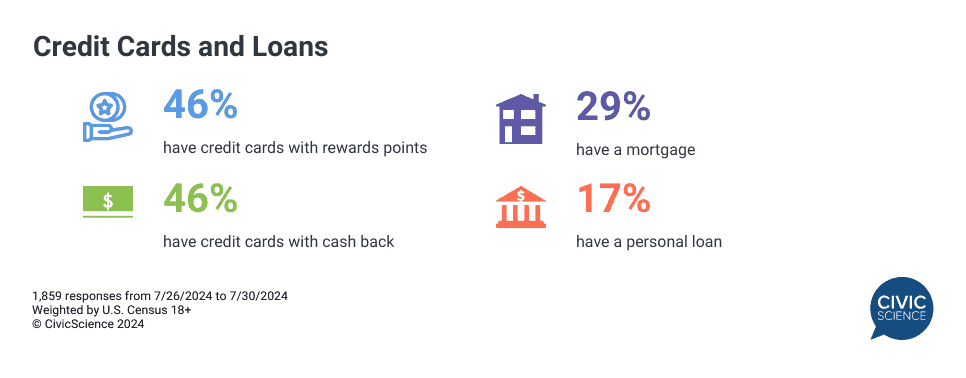

Of course, financial products extend beyond those designed to increase financial resources, and Americans are no strangers to the world of money lending. Americans have become increasingly reliant on credit cards over the years and many are interested in cards with benefits and perks. In fact, nearly half of Americans (46%) have a credit card with rewards points and/or cash back. Meanwhile, 29% have a mortgage, with an additional 20% planning on getting one, and 17% have a personal loan.

Financial Knowledge Abounds, Retention Does Not

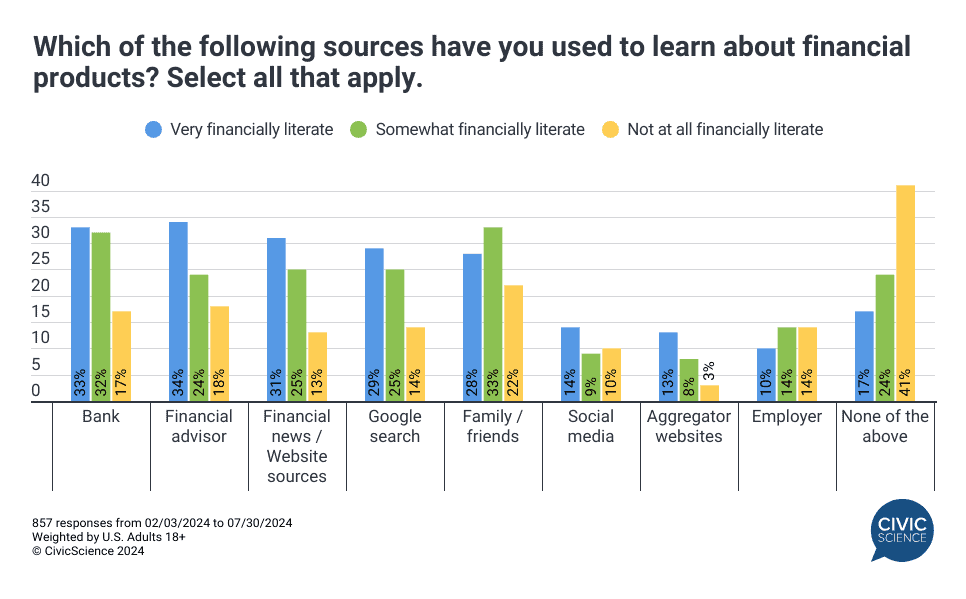

What is contributing to the consistent drop in financial literacy, which could impact the use of financial products? It could be the method through which Americans are attempting to learn about financial products. While banks are among the leading sources for learning about financial products (32%), family and friends are even more relied upon (33%) – a noteworthy piece of data considering the decrease in those who consider themselves knowledgeable in this arena. That’s followed by Google searches (31%) and financial news sources (26%).

A closer look reveals these differences among varying levels of financial literacy. Those who consider themselves to be ‘very’ financially literate are the most likely to learn about financial products from financial advisors, while those who are ‘somewhat literate’ or ‘not literate’ are the most likely to look to family and friends for their financial education. Enlisting the help of a financial advisor could be key to improving financial literacy, yet ongoing CivicScience tracking shows that as of 2024, 51% of U.S. adults have never met with a financial advisor, including 43% of adults aged 55 and older.1

Weigh In: Do you have a financial advisor?

At a time when financial literacy is on the decline, it’s worth noting the trends that rise to the surface. While the majority of Americans are putting their trust in personal checking and savings accounts, Americans continue to invest – albeit with nearly a third taking their bets on a self-directed investment account. Such a range of behaviors amidst consistent trends of waning financial literacy begs the question of how Americans will continue to interface with financial products in the future and how banks and financial institutions can better reach consumers.

Interested in how your brand can drive winning market strategies by leveraging insights like these?

- 723,714 responses from January 16, 2020 to July 31, 2024 ↩︎