CivicScience is a consumer analytics and advertising platform that captures over one million survey responses daily. Turn real-time data into actionable insights here.

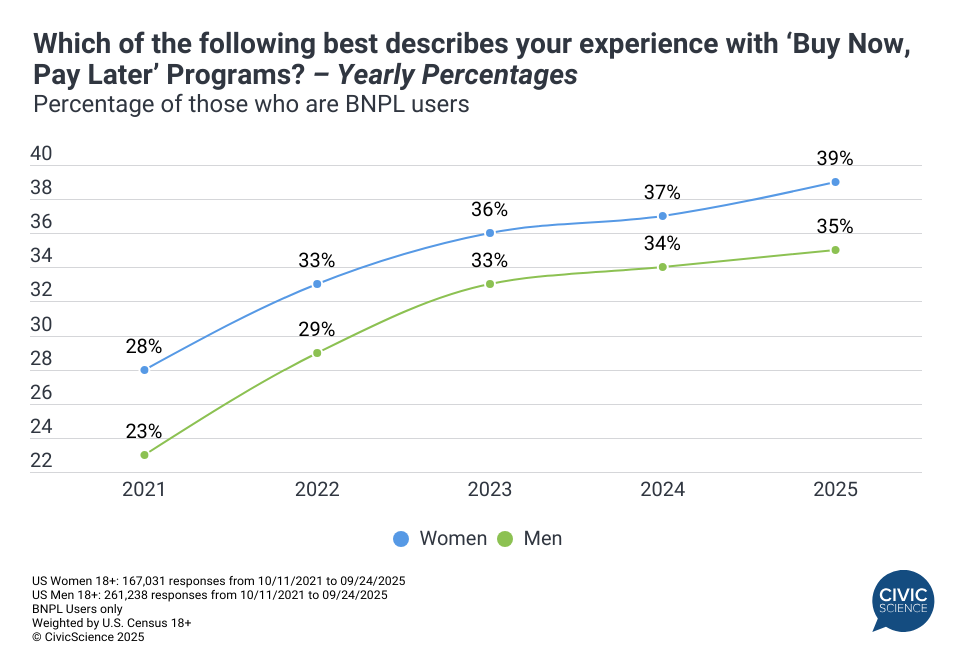

1. Women outpace men in Buy Now, Pay Later (BNPL) usage, and the gap is widening as holiday shopping ramps up.

Marketing Buy Now, Pay Later (BNPL) specifically to younger women as “cute debt” through pastel aesthetics, influencer campaigns, and informal, “cutesy” language has emerged as a new trend amid the growth of BNPL usage overall. With this trend in mind, CivicScience explored how women’s BNPL usage compares to men’s. Ongoing tracking reveals women have continually outpaced men as BNPL users. And while the gap between them narrowed to just three percentage points in 2023, it’s diverging once again in 2025 (through the end of Q3).

When it comes to reasoning for using BNPL services, women are most likely to say that these services make their purchases feel more affordable and are also more inclined to cite that BNPL helps them with budgeting and money management. Men, meanwhile, are more likely to point to convenience and the ease of using it over credit cards.

This also has implications for the holiday shopping season. Additional CivicScience data show women holiday shoppers are also slightly more likely than men to say they are ‘more’ likely to use BNPL for holiday purchasing this year compared to last year (28% to 26%, respectively).

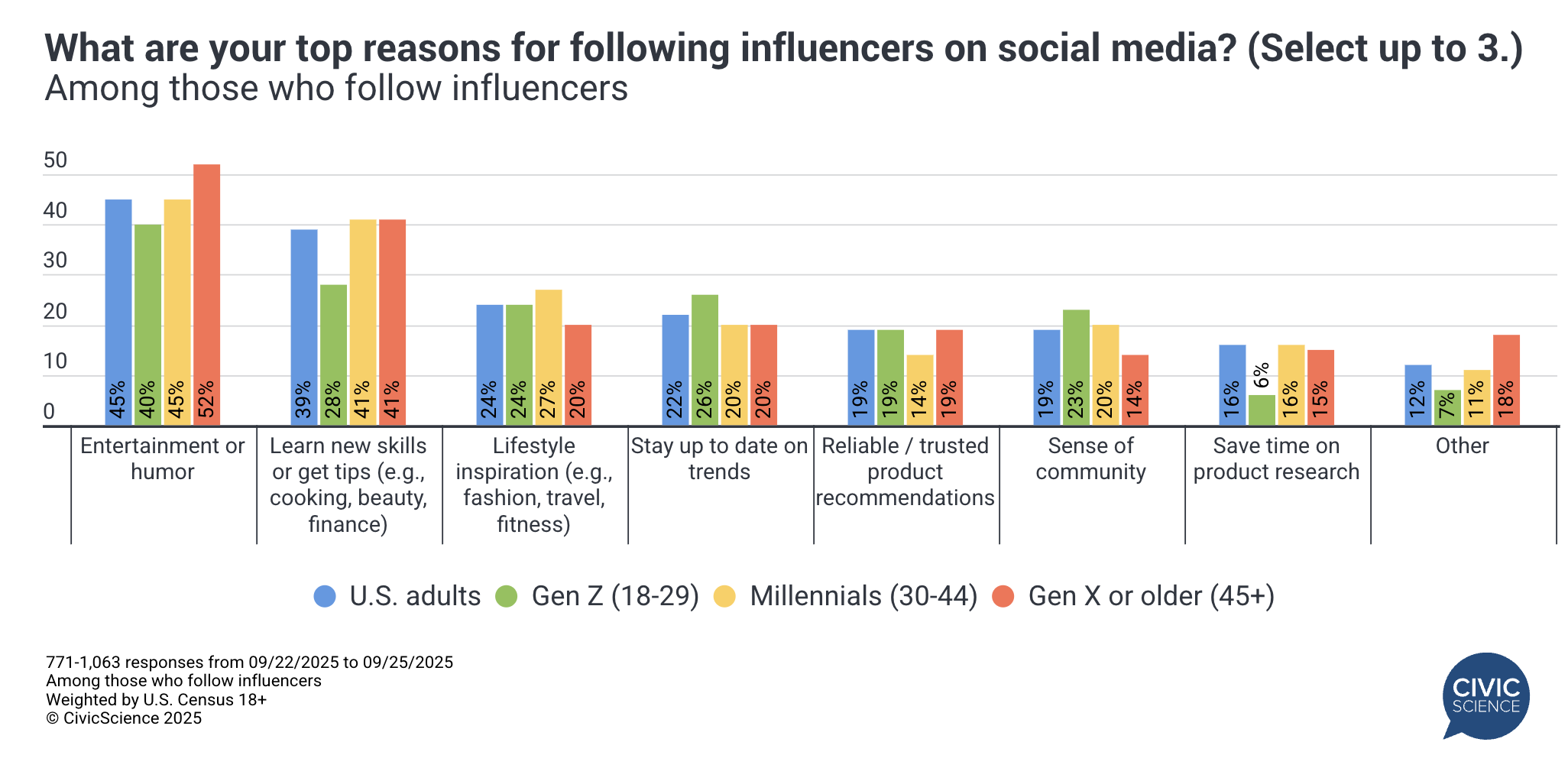

2. Many say they’re following influencers either for entertainment or to learn new skills and tips.

CivicScience survey data shows that social media influencers are increasingly shaping consumer behavior among younger and older consumers alike. Following influencers isn’t just about finding product recommendations, though. Many followers (45%) say they follow influencers for entertainment, humor, or to learn new skills—like cooking, beauty, or personal finance—interests especially common among audiences 45+. Gen Z, by contrast, leads in following influencers for the sense of community and to keep up with trends.

Take Our Poll: Have you ever tried to become an influencer?

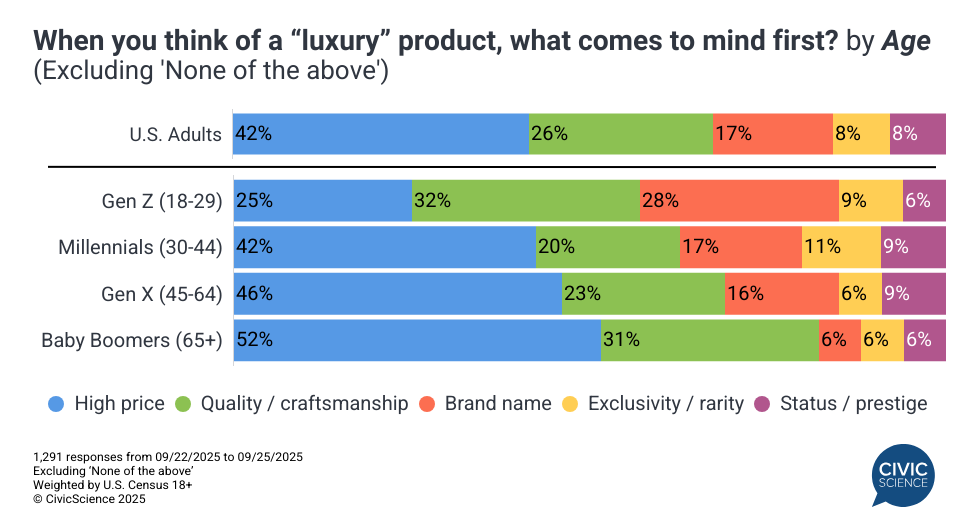

3. While a higher price is a key factor in driving what Americans consider to be a “luxury” product, definitions differ significantly by age.

When it comes to defining what qualifies as a “luxury” purchase, price unsurprisingly stands out as the most important factor for most consumers, followed by quality and brand name. However, these perceptions vary across demographics. Women and older adults are more likely to associate luxury with high cost, whereas Gen Z adults are significantly more likely than Baby Boomers to define luxury by brand name recognition. These insights demonstrate how economic pressures are shaping consumer definitions of value and influencing where—and how—they choose to cut back.

Weigh In: Do you consider yourself to be a “luxury” shopper?

Owning the world’s largest, real-time database of declared consumer intent, CivicScience helps advertisers and media companies reach the right audience with the right content at exactly the right time.