CivicScience engages directly with consumers, collecting over one million survey responses daily, to turn real-time insights into high-performing advertising campaigns. See how leading brands use CivicScience to drive campaign performance here.

1. An increasing share of Americans say they’ve experienced extreme weather in 2026, and where they turn to for updates varies by age and location.

Extreme weather is becoming a more common reality for Americans, particularly in the Midwest. The share of Midwesterners saying they’ve been affected by freezing temperatures jumped from 26% in early 2025 to 34% in early 2026, alongside increases in severe rain or snow across both the Midwest (31%) and Northeast (25%). While the South and West have seen more modest changes, the data point to a broader rise in exposure to intense weather nationwide.

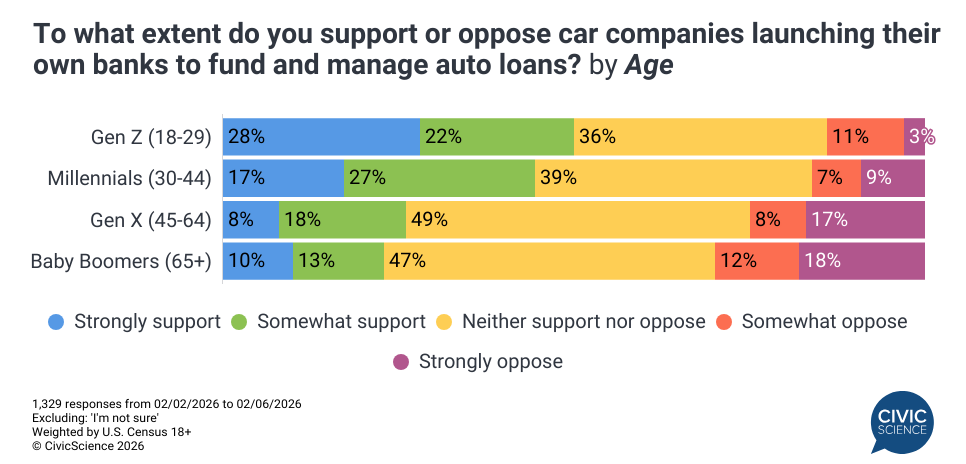

When it comes to staying informed about extreme weather, preferred sources vary by age and geography. Local TV news remains the top source overall (43%), especially among Baby Boomers and suburban residents. Younger consumers, however, are turning to digital platforms: Millennials lean on social media, Gen Z is most likely to check emergency management websites, and rural residents increasingly rely on weather apps.

Let Us Know: How often do you check the weather forecast?

2. Proposed 10% cap on credit card interest rates draws broad public support.

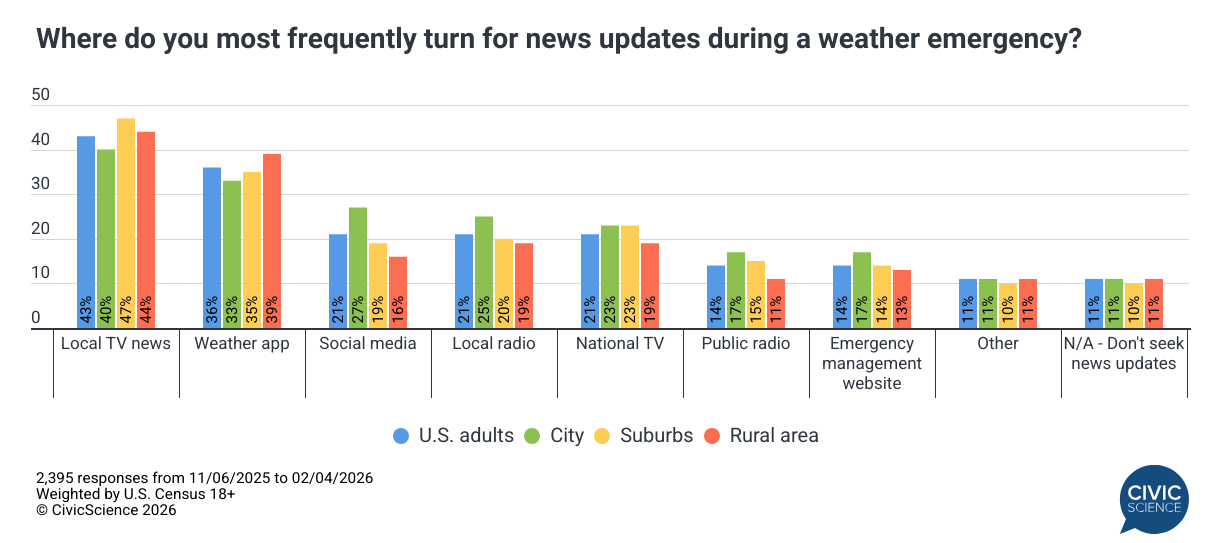

There is significant bipartisan momentum in the U.S. for a 10% cap on credit card interest rates, a move supported by 63% of the adult population. This broad public backing is remarkably consistent across both political and financial lines: 64% of Republicans and 63% of Democrats favor the cap, while 65% of consumers support it regardless of whether they’re comfortable or uncomfortable with their current level of debt. The data suggests that high interest rates are a universal pain point for consumers, creating a rare bridge of consensus in a polarized market.

Weigh In: To what extent do you support or oppose the idea of capping credit card interest rates?

3. Amid FDIC approval for Ford and GM to launch their own banks to manage auto loans, younger consumers are embracing non-traditional banking models.

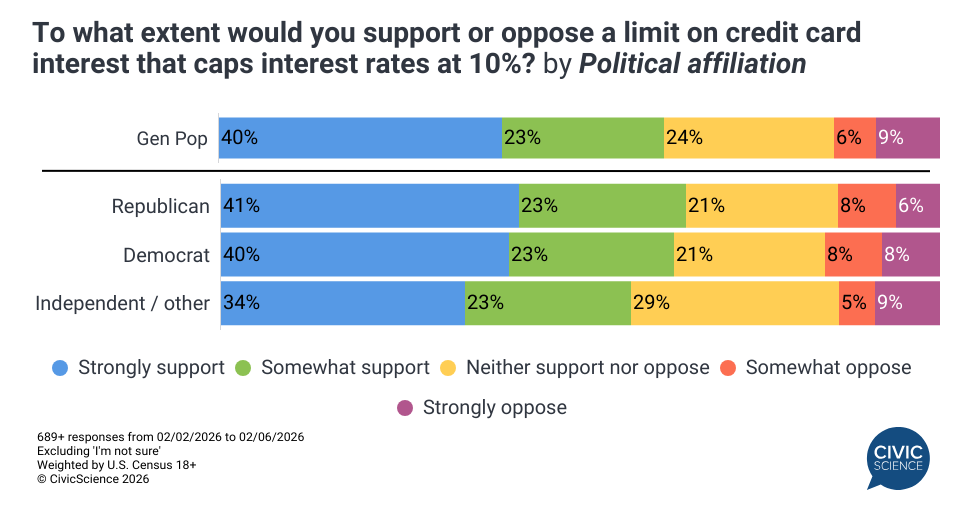

The automotive finance landscape may be on the verge of a shift following the FDIC approval for Ford and General Motors to establish banking arms to fund and manage auto loans. While public sentiment toward this move is more reserved than for credit card rate caps, it remains cautiously optimistic, with 35% supporting and 43% remaining neutral.

Support is strongest among younger consumers, with half of Gen Z (50%) and 44% of Millennials favoring the “automaker-as-banker” model, along with 43% of Republicans. This indicates that while the general public is still processing the impact, younger, tech-savvy consumers are leading the charge in embracing non-traditional banking solutions to navigate the rising costs of auto financing.