Since CivicScience began tracking Netflix users in 2014, the percentage of U.S. adults who identified themselves as non-users but “planning to” subscribe to the service (ie. “Intenders”) remained remarkably consistent. These Intenders hovered between 7-8% of the online population, until early 2018. The number then began falling slightly, to a low point of 5% of U.S. adults in Q1 of 2019, before settling at 6% for the past five months. There’s evidence that this declining Intender audience was an early indicator of flat-to-negative Netflix user growth in Q2.

As we have seen with other brands and in other markets, analyzing these Intenders can provide a roadmap for new customer acquisition, either for Netflix or its primary competitors. Given that only about 38% of online U.S. adults have yet to use Netflix, the current 6% of self-reported Intenders represents a meaningful portion of the achievable market.

Over the next four weeks, CivicScience will be publishing a weekly report on interesting attributes and insights pertaining to different Netflix audience (or non-audience) segments, based on 280,718 Netflix subscribers and 33,663 Intenders in our database.

Here’s what we’re seeing about the latest Netflix Intenders:

They’re older

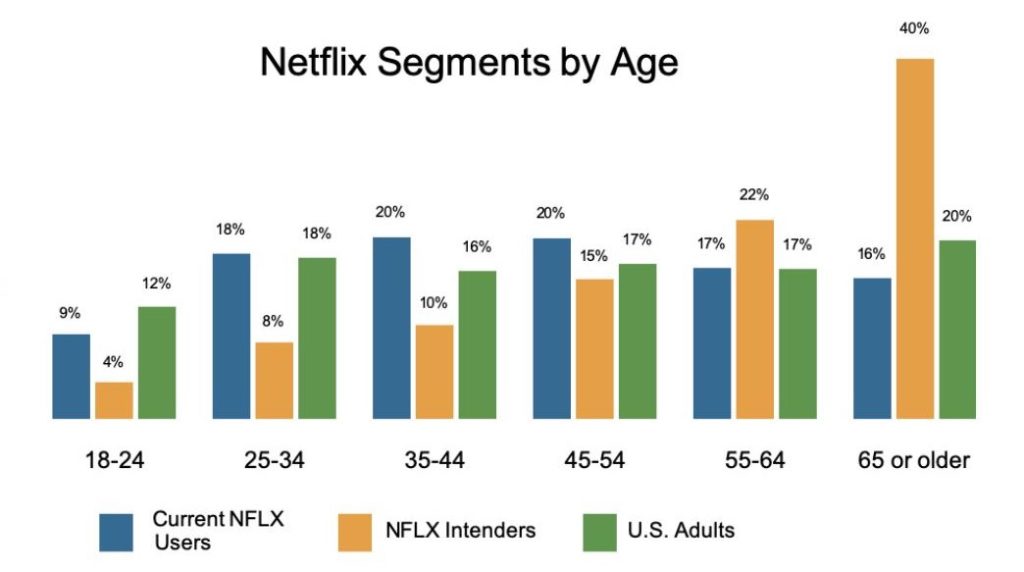

This one makes perfect sense but also colors many of the other insights we find about Netflix Intenders. While only 33% of current Netflix viewers are over the age of 54, a whopping 62% of Intenders are 55+. Unsurprisingly, 37% of Intenders are grandparents, compared to just 22% of current subscribers.

They’re complete Luddites

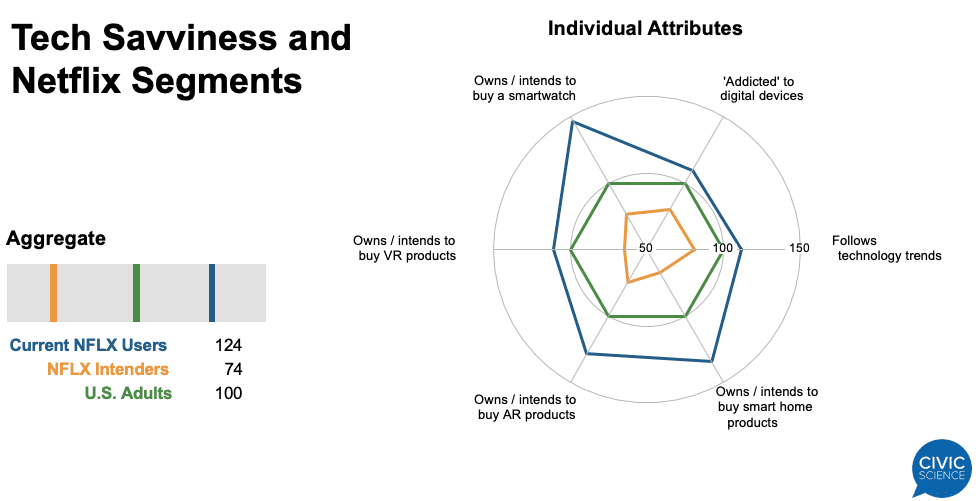

In other not-so-shocking news, Netflix Intenders are way behind the tech adoption curve. While also a proxy for their older age, these late-comers are even less tech-savvy than their Netflix-using peers. They’re much less likely than the average U.S. adult to own a smartwatch, smart home products, VR or AR, or even use a DVR. They’re likewise much less likely to be influenced by social media, though Facebook and Pinterest are still pretty popular with this crowd. It’s clear that the more Netflix can be integrated into their existing electronic footprint – streaming ready TVs, for example – the easier it will be to bring them into the Netflix fold.

They’re really into news and the financial markets

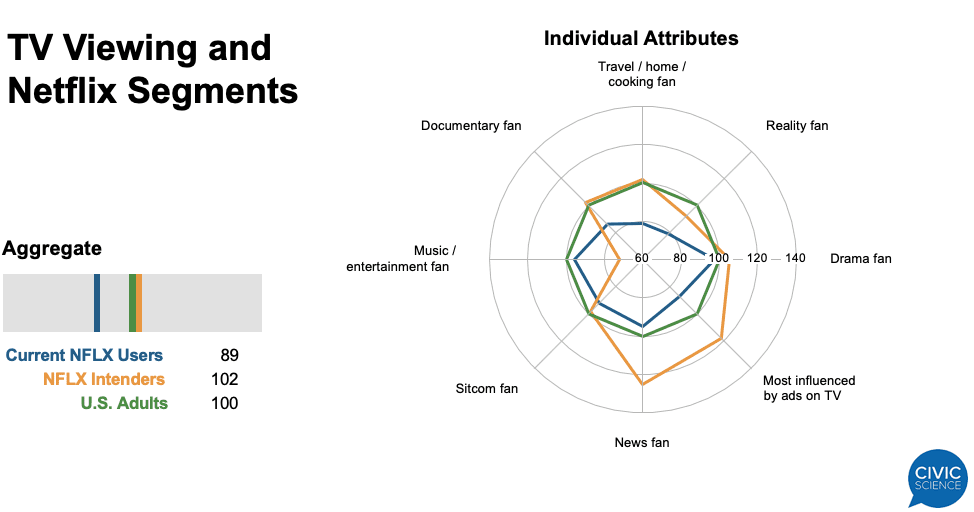

Overall, with the exception of reality and music/entertainment genres, Intenders look a lot like the rest of the U.S. population when it comes to their content preferences. But one area where they over-index significantly, especially compared to current Netflix users, is news. They love news. We see in other indices that they follow the financial markets and financial news way more than average as well. This remains a difficult hurdle for Netflix to overcome as it competes with linear TV.

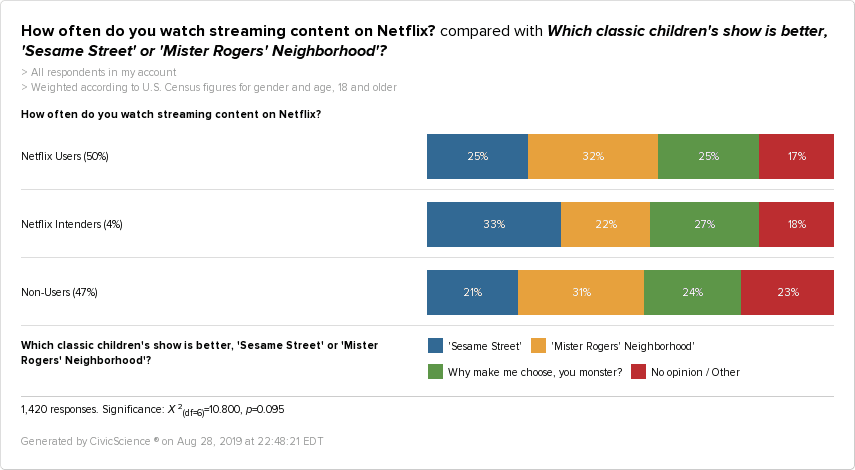

But they’re not just older people and technophobes. When we normalize for these base demographic characteristics, we find other traits that differentiate Netflix Intenders from the crowd. They’re more likely than average to still be living at home with mom and dad – makes sense, if they’re waiting to move before signing up for their own account. NBA Fans are more likely than non-fans to be Intenders, as well. So are people who live in urban areas, particularly in the US Midwest. They’re more likely than average to donate to religious charities. And last but not least…

They love Sesame Street.

Who knew?

P.S.- To download the full Netflix Intender DeepProfile™ report, find it here.