Lately, Amazon is rivaling even Donald Trump as the pervasive force in my news feed. There was Whole Foods, then subscription apparel boxes, then Nike, then the announcement today of a Geek Squad competitor. Don’t forget the President’s Twitter barb at Amazon a couple weeks ago – a news feed two-for-one. And it’s Prime Day. Oh, and I heard that the New York Times is moving to just two content sections: ‘Trump’ and ‘Amazon,’ respectively. Ok, the last bit was a joke. But you get my point.

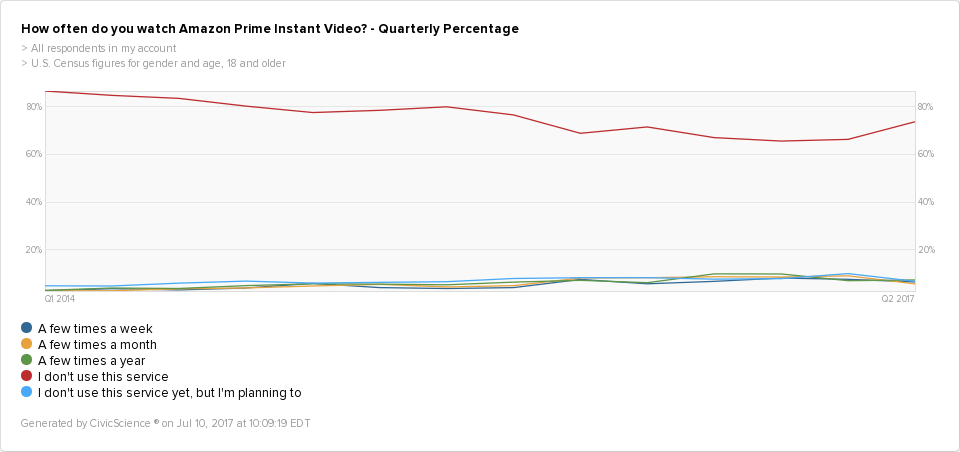

One thing being overlooked in all of this noise is a noticeable cooling off of Amazon’s Prime Instant Video streaming service. Even while Hulu, YouTube, and other media shops are making news with ‘over-the-top’ streaming services – and perhaps because of this activity – we are seeing a clear negative trend in Amazon Prime Instant Video (APIV) usage. See for yourself:

Since we started tracking Amazon Prime Instant Video usage in early 2014, you can see a consistent downward trajectory in the red line (“I don’t use this service”), with a brief exception during the 2nd quarter of 2016. Non-usage fell again in Q3 and Q4 of 2016, then climbed slightly in Q1 and steeply in Q2 of this year. Even when taking out the seasonal dip we see in Q2, the rate of reported APIV usage has declined by 1 percentage point since the beginning of 2016.

Also noticeable, though jumbled in the graph, is that none of the usage rate answers have shown positive movement for at least 6 quarters. At best, you could say that APIV usage is flat – and in an emerging market where several big players are vying for share, flat is bad.

NOT LEVERAGING AMAZON PRIME MEMBERSHIP

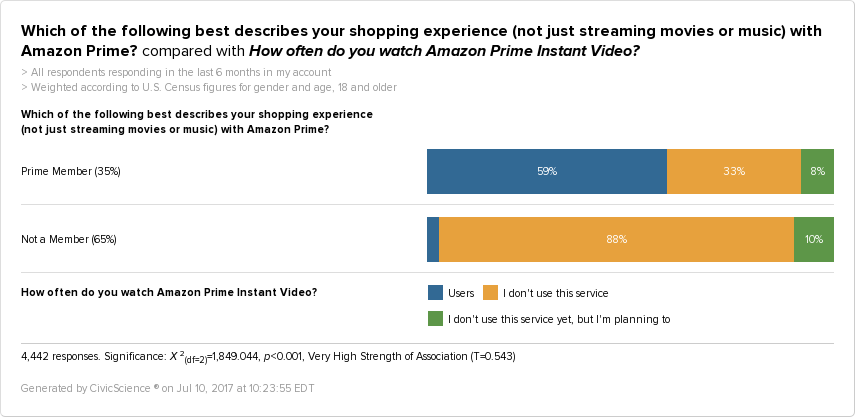

Particularly troubling for Amazon is that these numbers aren’t improving, even as overall Amazon Prime subscriptions continue to climb. According to CivicScience data, the percentage of U.S. adults who live in a household with Amazon Prime has increased from 35% to 40% in the past year. The percentage who use Prime ‘at least weekly’ has grown from 12% to 14% during that same period.

What does that have to do with APIV? Well, one of APIV’s biggest competitive advantages is that it’s available to all Prime members at no additional cost. But Amazon hasn’t been able to convert enough of its Prime users into regular streaming video viewers – or at least that conversion rate has slowed.

As you can see above, according to our data from the past 6 months, just 59% of Amazon Prime members reported watching APIV even a few times in the past year. That number is actually down 5% from the six months prior.

WHY THE LACK OF GROWTH?

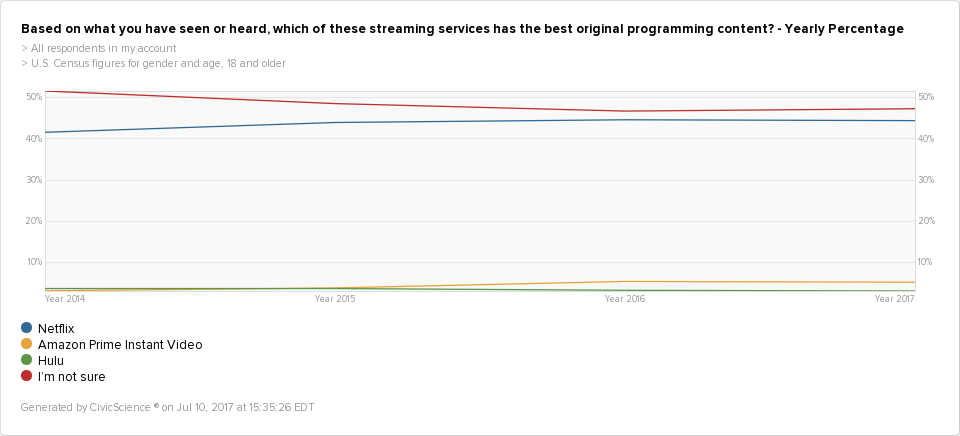

There are any number of possible reasons for this less-than-stellar trend for APIV. It could be a lack of enthusiasm for Amazon’s original programming content:

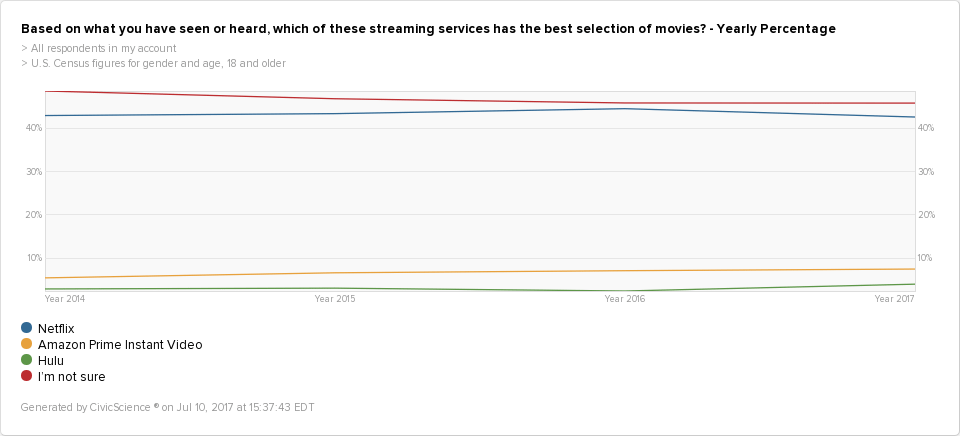

Or their selection of movies:

The safest bet is that Amazon Prime Instant Video hasn’t been able to fend off the flurry of competition in the streaming market. There’s no guarantee they can’t turn the tide in their favor – count out Jeff Bezos at your own peril. But, at least right now, it’s obvious why Amazon isn’t stealing headlines in the streaming content game, even while they steal headlines for everything else.