When it comes to online gaming storefronts, one rises to the top: Steam. The platform launched in 2003 and never looked back.

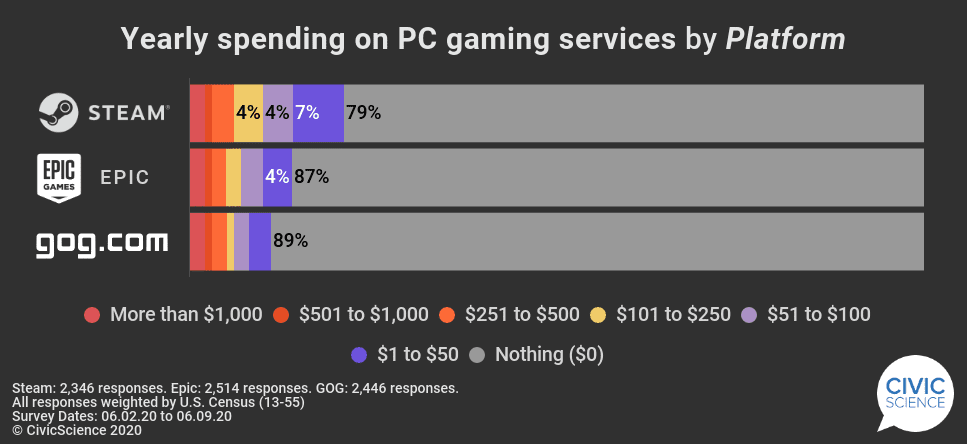

But the PC gaming ecosystem is larger and more complex than that, with many users buying games from multiple services — often spending hundreds of dollars per year.

According to a recent CivicScience survey of thousands of Americans under the age of 55, Steam’s competitors — including GOG.com and the newer Epic Games Store — are nipping at its heels.

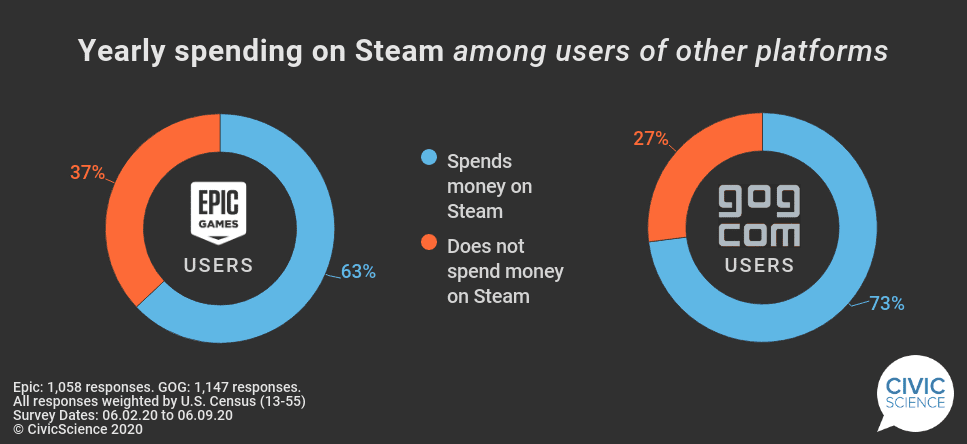

With each service offering its own exclusive games and its own specialties, it’s no surprise that there is a ton of crossover between these three platforms. Strong majorities of those who spend money on the Epic Games Store (63%) and GOG.com (73%) say they also spend money on Steam.

Conversely, just about one-third of Steam customers say they also buy from the Epic Games Store, and a bit more than one-quarter of Steam spenders say they also spend on GOG.com. This shows Steam’s preeminence in the online computer gaming sector — its own customers aren’t necessarily using its competitors’ services, while most of its competitors’ users do, in fact, also use Steam.

Social Media

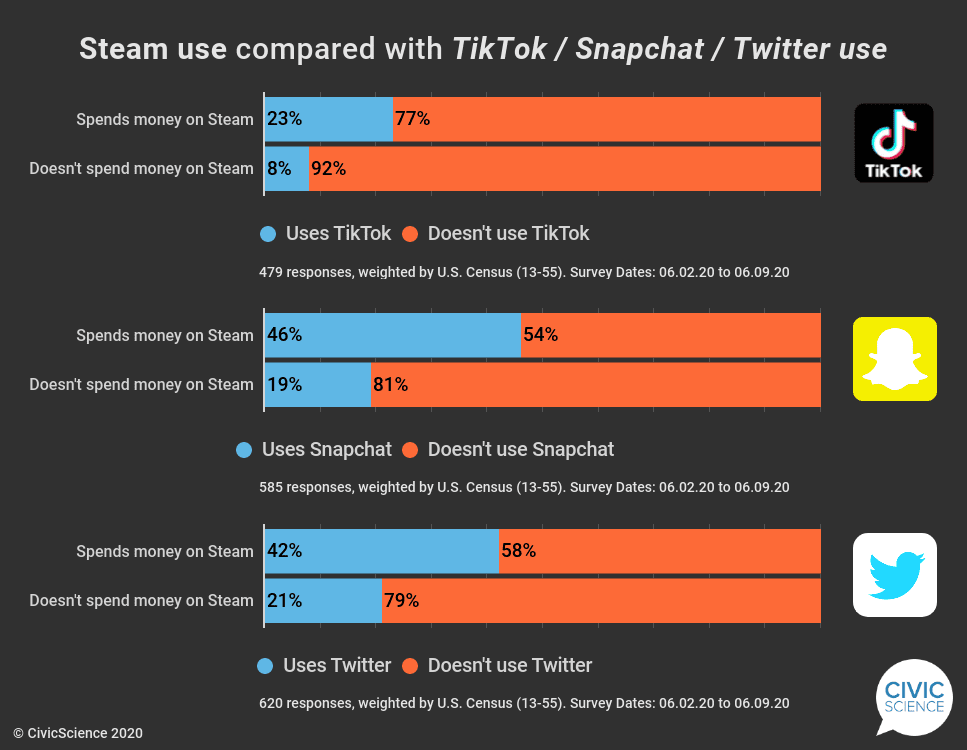

Given that most GOG.com and Epic Games Store customers also have a Steam account, we’ll be focusing on Steam users as we take a deep dive into social media usage among PC gamers.

It turns out that Steam users vastly over-index — even among their peers below age 55 — for use of TikTok, Snapchat, and Twitter, but not for Facebook or Instagram.

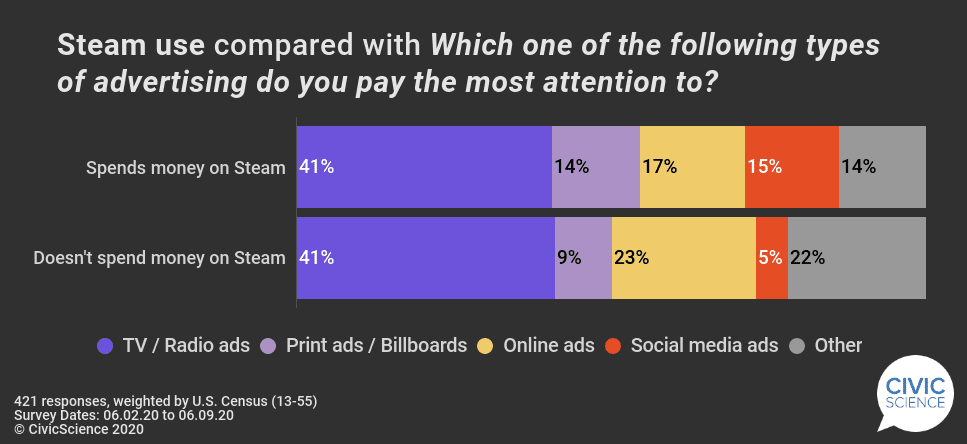

Steam users were also three times more likely than others to say that the ads they most often pay attention to are social media ads. Interestingly, they were somewhat less likely to say they pay attention to general internet ads the most.

The upshot? PC gamers are active on social media — particularly TikTok, Snapchat, and Twitter — and they’re more likely than others to pay attention to ads on social media platforms.

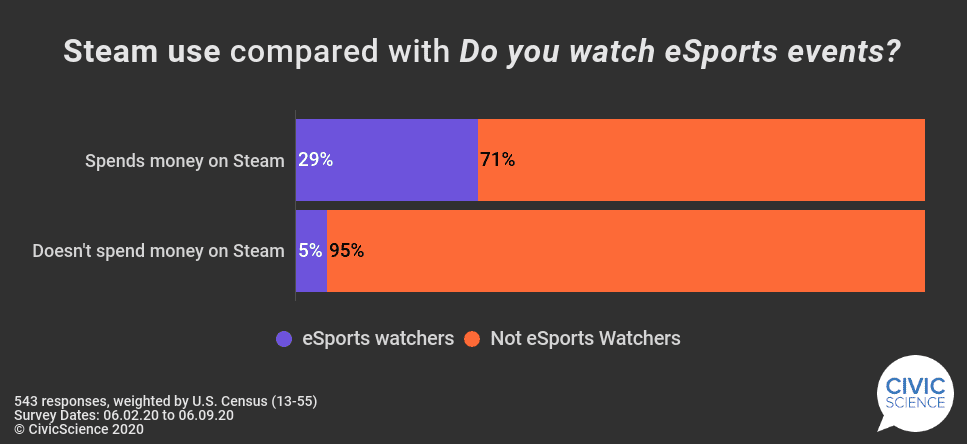

They’re also nearly six times more likely than their peers under 55 to watch eSports.

Demographics

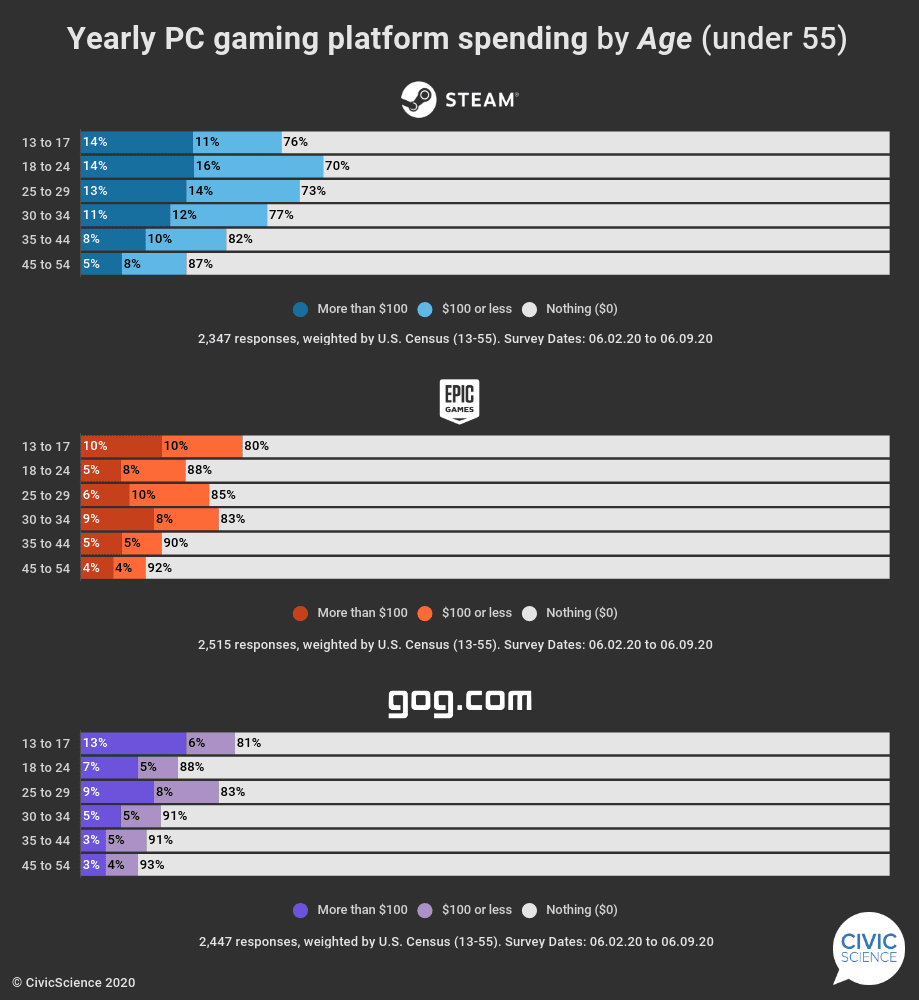

When comparing spending on online gaming platforms with respondents’ ages, we see some interesting patterns. Steam appears to have the broadest appeal across user age groups, with use waning steadily among older respondents. Meanwhile, Epic Games Store purchasing peaked around age 35, while GOG.com seemed to find most of its support from users under 30. Note that all three platforms have strong support from the 13-17 age bracket.

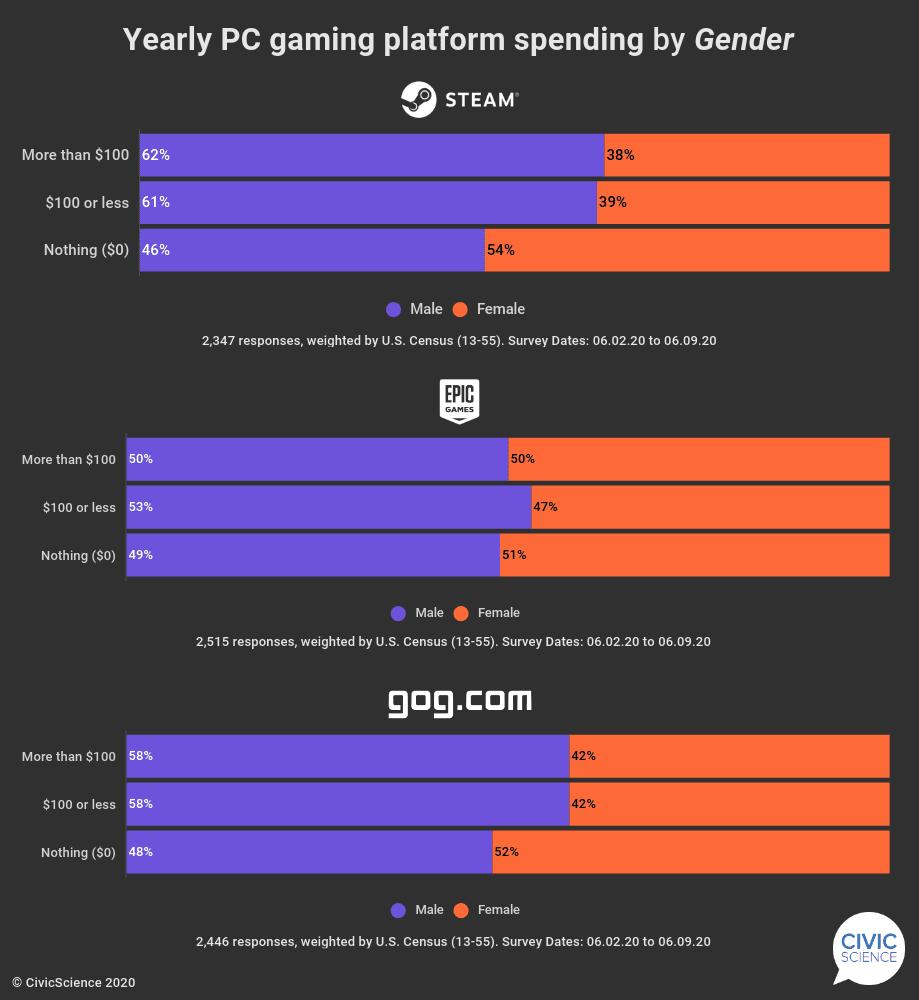

Spenders tended to be male on Steam and GOG.com, but Epic Games Store customers were more evenly split between men and women.

We’ll leave you with some final insights about Steam users as compared to their peers (also under the age of 55): they’re more likely to say they don’t identify as heterosexual / ‘straight’ [31% vs. 23%]; they’re more likely to use food delivery services (Grubhub, Postmates, etc.) [37% vs. 19%]; and they’re more likely to go to the movies once a month or more [22% vs. 12%].

Overall, about one in five Americans under the age of 55 is using Steam, with that number rising to 30% among the 25-to-29 post-college age bracket. And CivicScience data show that Steam users’ behavior is quite unique, even among their peers.