For a while now, my Instagram and Facebook feeds have been filled with Valencia-tinted photos of impressive home-cooked meals. And they aren’t just basic home-cooked meals. Dishes with names like “Spicy Ponzu-Glazed Catfish” and “Black Garlic-Shoyu Ramen” are popping up on my feeds.

Surprisingly, it’s my friends who are new to cooking, who are whipping up these creative and tasty looking dishes. While the culinary world deems it “cooking-by-the-numbers,” it’s no secret that the meal kit delivery business is all the rage for certain people. Last month, Fortune magazine wrote that Blue Apron is considering an IPO in the near future. But will meal delivery kits’ popularity continue to grow among consumers? And should the restaurant or grocery retail industry be concerned that this trend may take away business?

First, let’s look at some broader insights about U.S. adults and meal kit delivery services. In the beginning of July, we launched the following two questions to understand how U.S. adults are using these services:

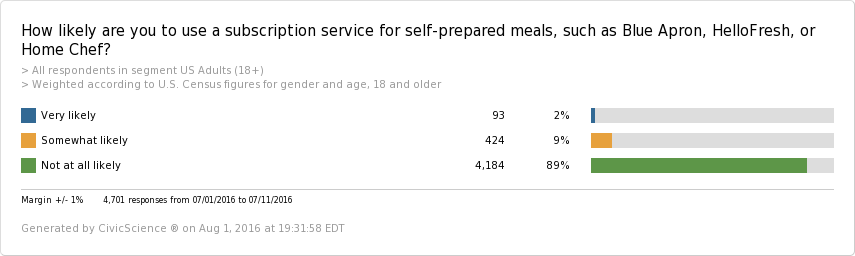

Question 1

Here we see that a little over 1 in 10 U.S. adults are likely to use a subscription service for self-prepared meals.

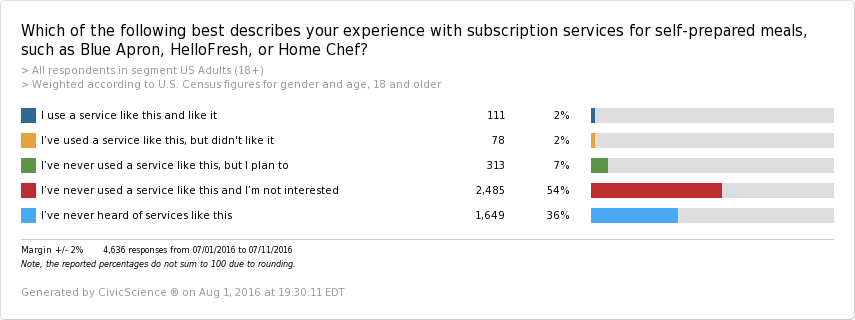

Question 2

Topline results reveal that about 2/3 of adults have heard of these services. Only 4% of U.S. adults have used a service like this, while 7% plan to use one. Based on these numbers, it seems the delivery meal kit industry will continue to grow and has an opportunity to almost double.

Key Insights on Likely Subscribers

- Women and Millennials are slightly more likely to use meal delivery kits. However, women and those in the Generation X age bracket are more likely to be aware of these self-prepared meal subscriptions.

- Adults who live in cities are more likely to use these types of services, but those who live in cities and suburbs are equally likely to have heard of such services.

- Notably, those with a household income (HHI) of at least $100k are the most likely to indicate they would use in-home meal delivery services.

- Adults interested in fast food menu items featuring local ingredients are more likely to be interested in these services.

- Amazon Prime Members who use the service at least monthly are the most likely to use a subscription service for self-prepared meals.

- Other lifestyle habits such as buying locally grown food, shopping at Whole Foods, and seeking out new food all correlate with using these services.

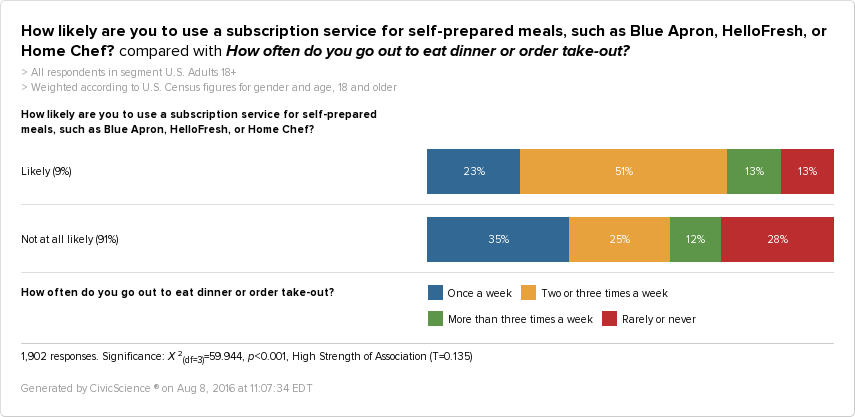

Our data also reveals that those who are likely to use these services are more likely to go out to eat or order take-out. In fact, likely meal kit subscribers are 2x more likely to get take-out two or three times a week.

Meal kit delivery users are more likely to eat at fast casual restaurants and have a more favorable opinion of restaurants like Panera, Boston Market, and Noodles & Company. It wouldn’t be surprising to see these likely users substituting their frequent meals out with meal kit deliveries. As meal kit delivery services become more popular, we may witness people cutting back on their take-out and eating out habits.

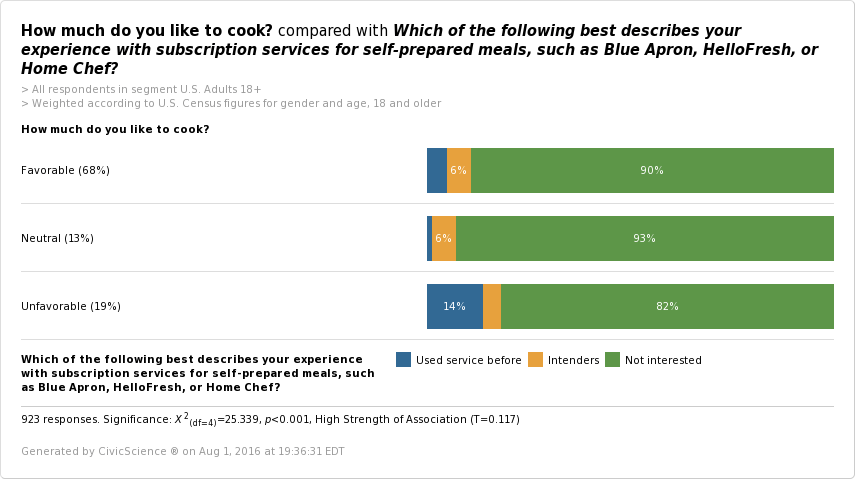

Here is another interesting finding: those who have an unfavorable opinion of cooking are the most likely to have tried meal kit delivery services in the past.

For these consumers, I’m willing to bet that time, convenience, and perhaps even a lack of confidence in the kitchen are barriers to cooking. Maybe for some, the self-prepared meal subscription services make the cooking process more enjoyable.

My casual observation of my friends’ dinner habits seems to be supported by our data. Before services like Blue Apron, HelloFresh, and Home Chef, many of them were relying on Chipotle for dinner. Of course there is a big difference between launching Postmates to have dinner delivered from your favorite restaurant versus cooking dinner yourself from a box containing a recipe and fresh ingredients.

There’s no denying that consumers have an interest in the service. Many investors are betting these boxed meal services will disrupt the restaurant and grocery retail industries. According to our data, it’s very possible this may occur. As meal delivery kits become more popular, we may see consumers swapping out some of their take-out trips with the fresh recipes meal kits have to offer. Time and more data will tell.