The Gist: The proportion of people who consider Bitcoin money has markedly increased over the past year. Beyond the current speculative investment returns, Bitcoin’s comparison to gold is possibly one contributing factor to the increased acceptance rate.

Overview

Speculative investment returns for cryptocurrencies like Bitcoin have been off the charts during 2017.

Important Disclaimer: Usually, we do not use our engagement questions for research purposes, but the question type and the number of responses reduce potential biases for this topic. Additionally, I will merely be commenting on trends in the question, not making research propositions.

Bitcoin as Money

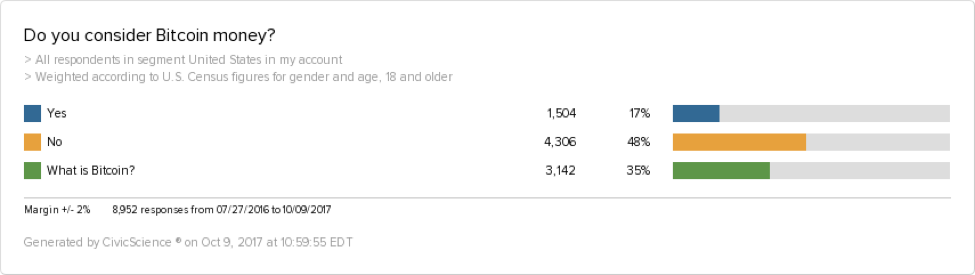

17% of respondents do consider bitcoin to be money, which is fairly strong given Bitcoin’s short 8-year history.

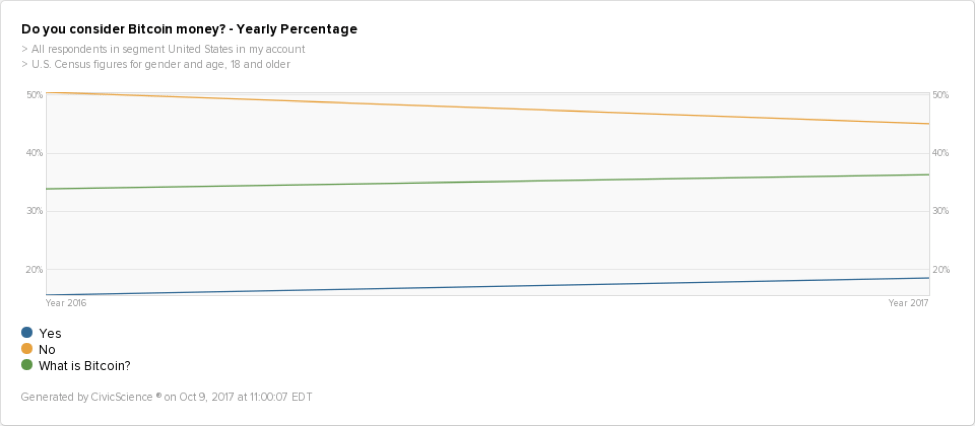

Respondents who do not consider bitcoin money decreased from 50% in 2016 to 45% in 2017, and respondents who do consider bitcoin money increased from 16% to 19% over the same time period.

Digital Gold

As previously stated, the aforementioned question is typically not stringent enough for research purposes, so we will not draw too many conclusions from it. However, one point of interest should be noted. Bitcoin has been dubbed as “digital gold” due to its similar characteristics to the physical counterpart. Furthermore, Bitcoin’s increased acceptance rate as money may be attributable, in some way, to sentiment towards gold as a financial safe harbor given the current state of the economy.

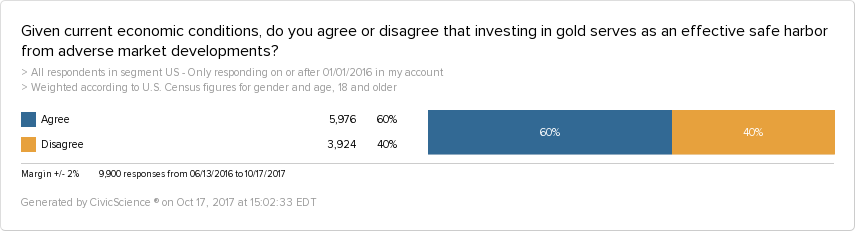

60% of respondents agree that investing in gold is an effective safe harbor given current economic conditions, while 40% disagree.

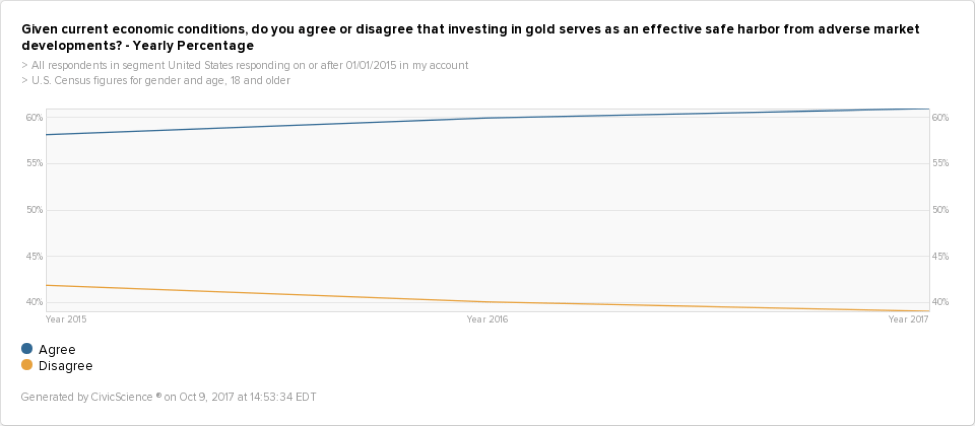

Respondents who agree that investing in gold is an effective safe harbor given current economic conditions have increased from 58% of respondents in 2015 to 61% in 2017.

Conclusion

The number of respondents who consider Bitcoin as money has demonstrably increased over the past year. Aside from high investment returns and a slew of other factors not considered here, Bitcoin’s linguistic comparison to gold might be one contributing factor to its increased acceptance rate. Only time will tell, but given how far Bitcoin has come in such a short time, it will surely be interesting to monitor.