Writing about Millennials is like emptying my dishwasher. It seems like I have to do it all the time. I don’t enjoy it while it’s happening. It’s fairly rewarding when I’m done. And then I realize I’m going to have to do it all over again tomorrow or the next day. It never stops.

But it’s also very necessary. Millennials are an economic force, not just in their size as a cohort, but in their ability to jolt consumer markets seemingly overnight. They’re very opinionated about brands but also very fickle. They’re much less loyal on average than Xers or Boomers – Millennials will love a brand one minute and turn on it the next.

That’s why what we see in our Chipotle data is so unusual.

I saw a story earlier this week where the analyst team at investment research shop, Hedgeye, had moved Chipotle to a “Long” stock after a seemingly interminable period as a “Short.” Presumably, the departure of Founder/CEO Steve Ellis is creating reason for hope.

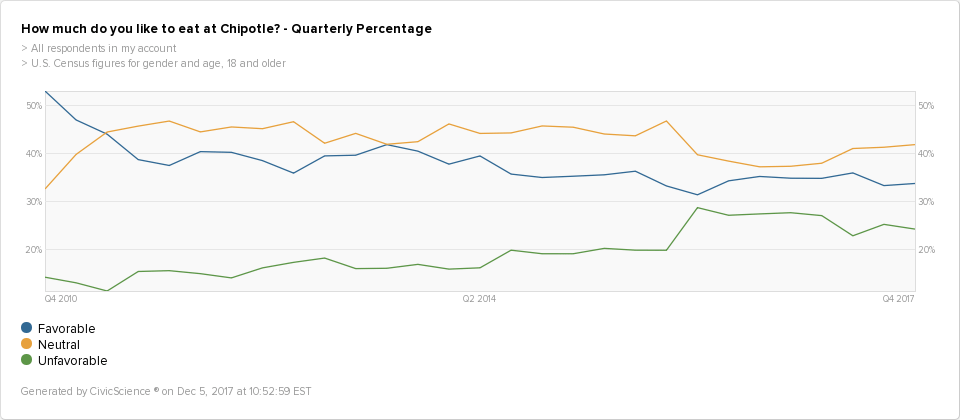

Indeed, after cratering in late 2015, consumer sentiment toward Chipotle had mostly leveled off over the past 7 quarters, with just one brief hiccup in Q3 of this year. Below is our chart of quarterly Chipotle favorability among U.S. adults since 2010. The largest number of consumers are neutral toward the brand, with favorable and unfavorable sentiment almost reaching parity in Q4 2015, then separating again, ever so slightly.

Notice in the last third of this chart how the blue line (Favorable) climbed slightly, then flattened out, for the most part. The green line (Unfavorable) began to fall, right around the same period. Neutral attitudes fell abruptly (meaning people just became much more opinionated about the brand) throughout 2016 before rebounding throughout 2017.

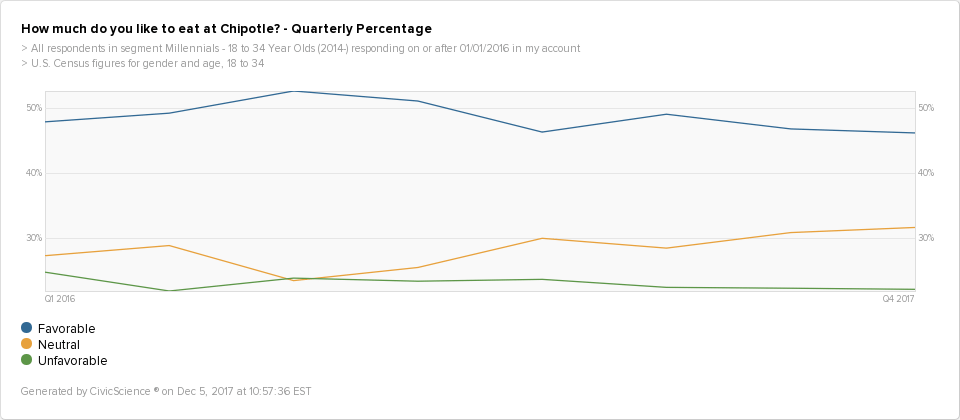

We see a more revealing picture when we look just at Millennials’ attitudes toward Chipotle. Let’s look at the trend line among 18 to 34-year-olds since the beginning of 2016.

When we examine the Millennial numbers, we can understand where Chipotle’s shifts are coming from. First, notice that net favorability among Millennials (Favorable v Unfavorable) peaked at nearly 5 to 1, while among the GenPop only a few percentage points separate the good from the bad. No surprise, Millennials drive Chipotle’s popularity.

As you can see in the second chart, favorability among Millennials has fallen consistently since the second quarter of 2016 – even as the GenPop numbers stayed flat. In almost all cases, we would view this as irreversibly grim. When Millennials sour on a brand, it tends to be permanent.

But, remarkably, we see virtually no change in the Unfavorable numbers among Millennials during that same period. All of those lost positive ‘feels’ fell into the bucket of Neutral, which rose nearly 10 pull points in the past 6 quarters.

We could be seeing something here that we almost never see from the Millennial cohort: Indifference. While it may have become somewhat less cool to eat at Chipotle these past several quarters, it hasn’t become decidedly uncool. Millennials haven’t turned on the brand. They can be won back.

Sentiment among Gen Xers (see: Moms with kids), meanwhile, has shown promising improvement over the past two years – Unfavorable numbers fell nearly 20% among this group since early 2016. Favorability rose 10%.

If I’m on the $CMG management team, all of this gives me reason for hope. It gives Hedgeye and others more fuel for their “Long” recommendation.

And it reminds me that I need to fill my dishwasher.