The Gist: When it comes to debt, credit card debt dominates, especially affecting middle-class Gen Xers.

As the old Ben Franklin adage goes, nothing is certain in life except death and taxes. Today, we might as well throw “debt” in there, too.

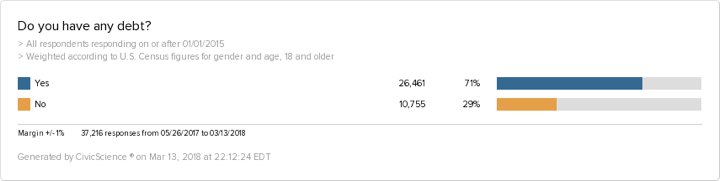

Our data weighs in on current estimates that most American adults have some form of debt.

Of that 71%, we looked at five different types of debt (not including medical debt) and found that more people have credit card debt than any other type, followed by mortgage debt. Here’s a closer look:

- 57% have credit card debt

- 45% have mortgage debt

- 44% have auto loan debt

- 25% have student loan debt

- 10% have home equity debt

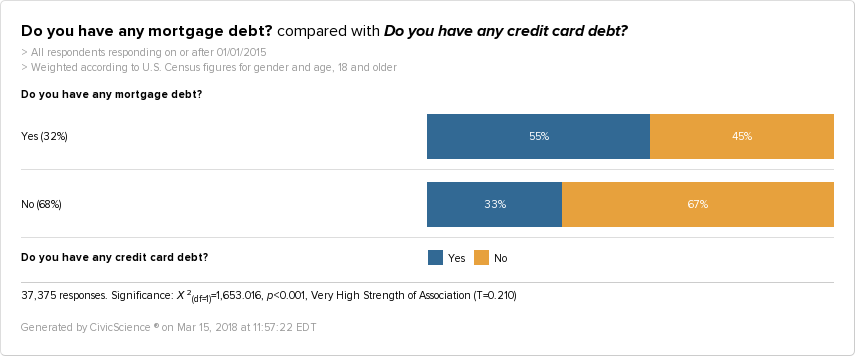

What’s interesting to see is that if you have one of these types of debt, there’s a greater chance you will also have another. For example, those who have mortgage debt are much more likely to have credit card debt and auto loan debt than those without mortgage debt.

In most cases, our data shows those who have one of these types of debt are almost twice as likely than those without it to have another type of debt (with exceptions related to home equity and student loan debt).

Who’s in Debt?

Digging a little deeper into what’s behind these numbers, here’s what we learned.

Educated, employed middle class is debt-ridden.

The cost of an education may be more than just the cost of student loans. Looking at debt and education level amongst U.S. adults, we see that there are more people with bachelor’s degrees in debt.

Only 24% of those with bachelor’s degrees have student loan debt; however, 45% have credit card debt.

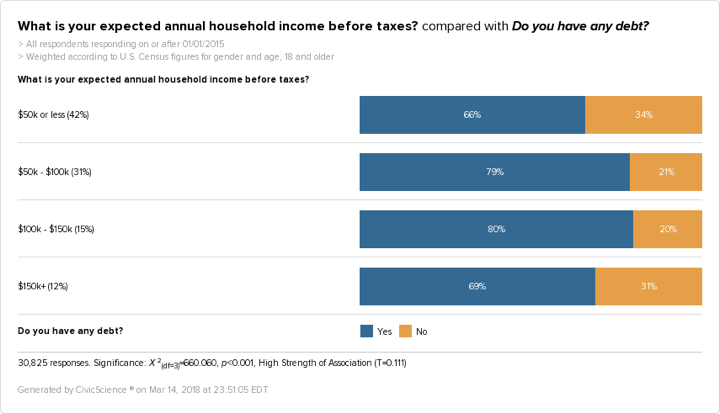

Correspondingly, even though our data shows a correlation between education and income (67% of people with bachelors or associate degrees make $50K and above per year, compared to 78% of those with graduate and professional degrees), it appears that higher-than-average incomes don’t lead to a lowered chance of being in debt.

Take a look:

With the exception of home equity debt, there are more $50-150K earners with credit card, mortgage, auto loan, and student loan debt than any other income group.

Our data shows this group is much more likely to own homes and purchase new cars than employed people who make $50K or less per year — hence, more debt. But credit card debt is not as easily explained.

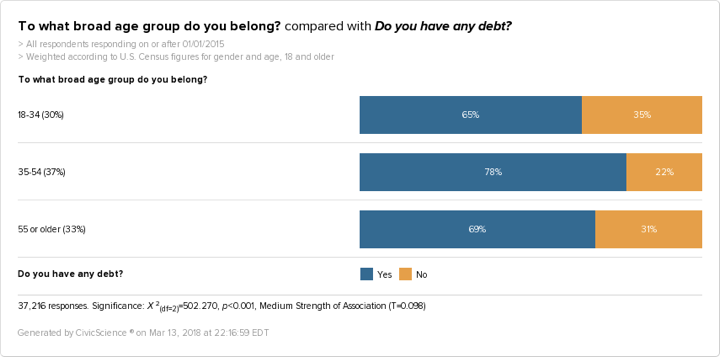

Gen Xers are hit hardest by debt.

As expected, more Millennials carry student loan debt (30%) than Gen Xers (18%) or Baby Boomers. Even so, Gen Xers are more in debt than any other generation.

Our numbers also show that 46% of Gen Xers have credit card debt, compared to 40% of Baby Boomers and 34% of Millennials.

Millennials seem to be doing pretty well in comparison, but are they bound to accumulate more debt as they age? If this data serves as some sort of predictive model, then we might be able to say debt peaks mid-life, between 35 and 54, and then drops as you get older.

Yet, it’s not so black and white. When it comes to Gen Xers, they have six times more debt than their parents did at their age, as stated by Pew, leading to a greater likelihood their retirement funds will be significantly less than they should be.

Time will tell what debt will look like for Millennials, as they face their own unique set of socio-economic circumstances and develop behaviors, such as saving habits.

We’ll be watching to see how those behaviors shape what they buy and how they interact with the economy.