The Gist: Research findings are challenging perceptions that Millennials are bad at saving.

A positive twist in the unfolding drama of the Millennial generation? Last week, Fortune discussed new survey research headed by Bank of America, which found that savings among Millennials aged 23-37 are rising and 1 in 6 has at least 100K in savings, including 401K and other retirement funds.

Wait – what? (Was our reaction). That’s a sizeable chunk for a young generation still trying to figure itself out.

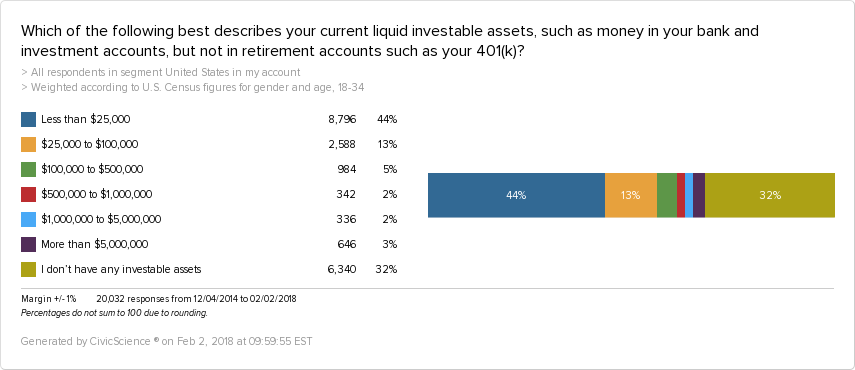

Getting into the spirit of things, we took a closer look at what our research had to say about Millennials and savings. In comparison, we looked at Millennials ages 18-34. Also, we looked at liquid assets only.

Here’s what we found:

- 13% of Millennials (18-34 yrs) have between $25K and $100K

- 5% of Millennials have between $100K and $500K

- 44% have less than $25K

- 32% have no investable assets

It’s crucial to point out that 18-24 year-olds—many of whom are in college or just entering the workforce—make up a considerable portion of these figures: 40% of those with less than $25K and 55% of those with no savings, to be exact.

That said, who are the 18% of Millennials squirreling away $25-500K in the bank? Here are a few highlights for your viewing pleasure.

They make more money than those with less in savings.

Not exactly surprising. But get this—at least 34% of $25-100K savers make $50,000 or less per year.

They tend to spend less.

When it comes to spending, 44% of $25-100K savers and 46% of $110-500K savers describe themselves as “Tightwads” versus “Spendthrifts.” Those with less than $25K in savings are quicker to spend.

They are less likely to have debt, but not by much.

70% of $25-100K savers currently have some form of loan or debt, compared with 75% of those with savings less than $25K.

In fact, defying expectations, we found that Millennials today, in general, are less likely to be in debt than their big brothers/sisters or parents (Gen Xers and Baby Boomers).

Still, are Millennials’ saving behaviors on an upward climb? In terms of liquid assets, our data shows things have been relatively stagnant in the past two years.

However, when you compare young U.S. adults with older generations, there are about half as many Millennials (6-7%) between the ages of 25-34 who report having zero savings in the bank than there are Gen Xers ages 35-54 (13-14%). They even beat out Baby Boomers here (11-14%).

Is this a good portent? Or, as they age, are Millennials likely to incur the expenses and debt akin to older generations? Stay tuned.