The HPS-CivicScience Economic Sentiment Index (“ESI”) is a “living” index that measures U.S. adults’ expectations for the economy going forward, as well as their feelings about current conditions for major purchases. The primary goal of the Index is to accurately measure movements in overall national economic sentiment and to provide a more sophisticated alternative to existing economic sentiment indices. Unlike other prominent indices that release consumer sentiment estimates infrequently, the HPS-CivicScience Index is updated in real time as responses are collected continuously every hour, every day. Large-scale cross-tabulation of survey responses and consumer attributes enable more granular analyses than are currently possible through prevailing measures.

Excerpt From the Latest Reading:

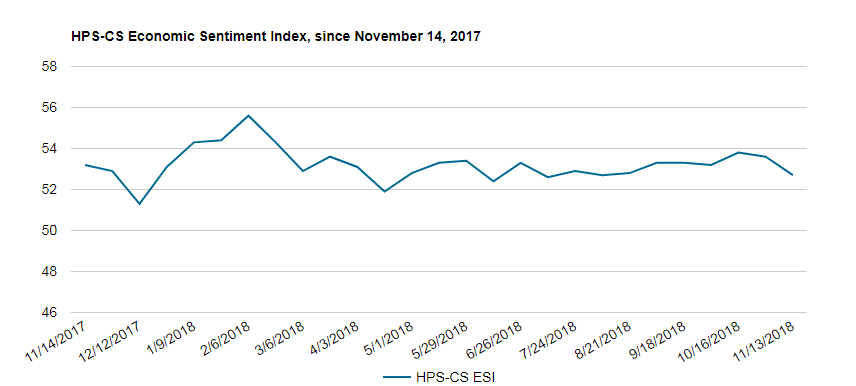

Consumer confidence fell by 0.9 points to 52.7 over the past two weeks, according to the HPS-CivicScience Economic Sentiment Index (ESI). Economic sentiment toward the labor and housing market experienced the largest declines as overall consumer confidence fell for the second week in a row, amid market volatility and mixed economic data.

Four out of the ESI’s five indicators decreased during the reading period. Consumer confidence in the labor market experienced the largest decline, dropping by 1.9 points to 49.2. The decrease in confidence in the labor market was almost matched by a 1.7 drop in housing market confidence, which fell to 47.0, almost the indicator’s lowest level this year. Consumer confidence towards the broader economy fell by 1.0 point to 49.0. Economic sentiment towards making a major purchase fell slightly, declining 0.1 points to 52.5. Confidence in making a major purchase was the only indicator to rise, increasing 0.4 points to 65.9.

The decline in consumer confidence comes amid a more turbulent and volatile economic outlook. In recent weeks, stock market volatility has increased, housing market data has disappointed, and interest rates have continued to move upwards.