When the pandemic began to wreak economic havoc in early March, CivicScience data showed aggressive swings in the expectations consumers had for their personal finances. Anticipations among the general population to invest, save, reduce debt, and generate income were impacted significantly between late February and mid-March, exemplified by colossal spikes in financial pessimism – sentiment that, as of late, seems a bit more scattered, as different groups of consumers could be seeing a silver lining.

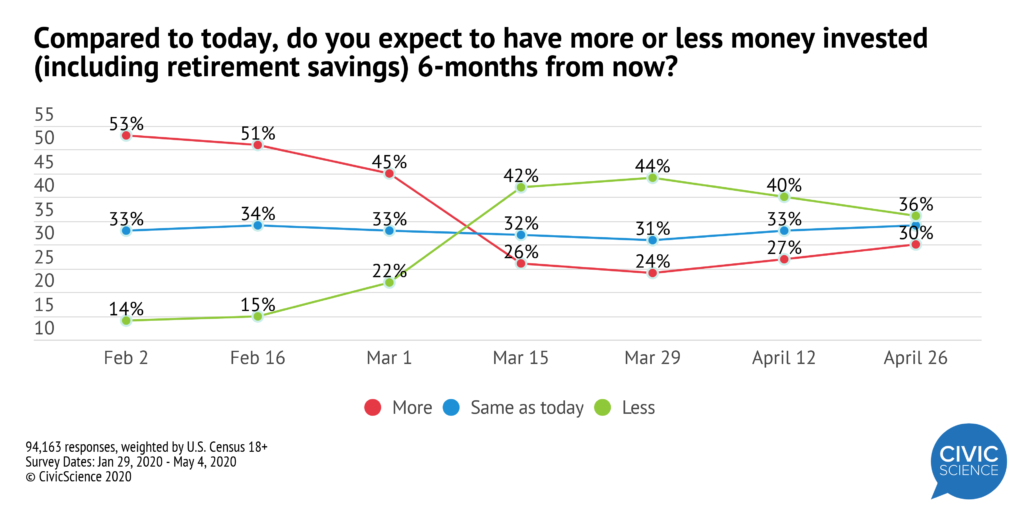

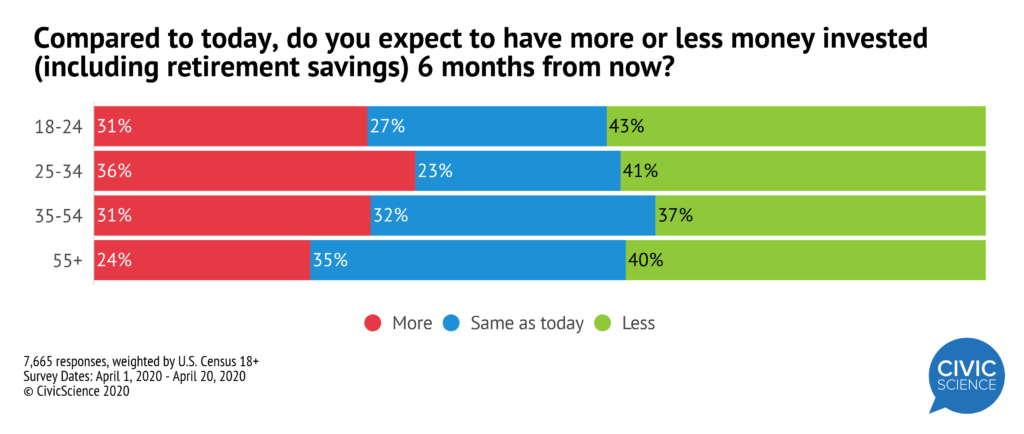

Take a look at how those expectations have changed through April. Despite investment pessimism continuing its upward trend through April, it appears to have been stagnated by a particular group of consumers who might be eyeing up cheap assets, as more and more people seem to be torn on whether now is a time to buy in, cash out, or stay put – most notably, Millennials, who showed the strongest inclination to be increasing their investments through April, or at least considering their options.

Despite investment pessimism continuing its upward trend through April, it appears to have been stagnated by a particular group of consumers who might be eyeing up cheap assets, as more and more people seem to be torn on whether now is a time to buy in, cash out, or stay put – most notably, Millennials, who showed the strongest inclination to be increasing their investments through April, or at least considering their options.

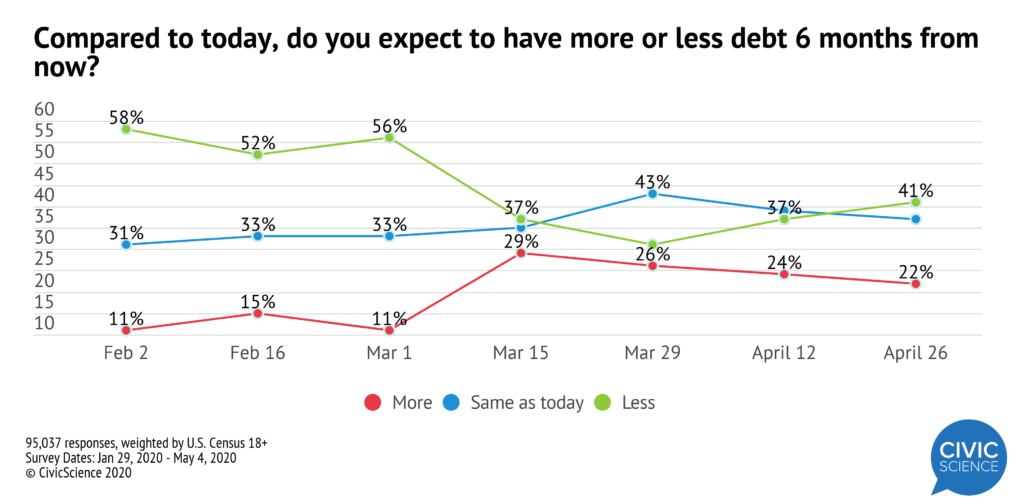

Expectations around debt situations have also grown increasingly volatile. Leading up to the pandemic, more than half of consumers in America believed they would be able to reduce their debt over the following six months. That confidence was crippled between March 1st and March 29th, as the percentage of those anticipating less debt dropped from 56% to 30%. What’s changed since then? Collectively speaking, we saw some of that initial panic over personal finances wear down through April as a majority of consumers began to feel their debt situation wouldn’t change either way by the end of summer (though it’s worth noting that it’s the first time this year we’ve seen anticipation for debt to remain unchanged exceed anticipated debt reduction).

What’s changed since then? Collectively speaking, we saw some of that initial panic over personal finances wear down through April as a majority of consumers began to feel their debt situation wouldn’t change either way by the end of summer (though it’s worth noting that it’s the first time this year we’ve seen anticipation for debt to remain unchanged exceed anticipated debt reduction).

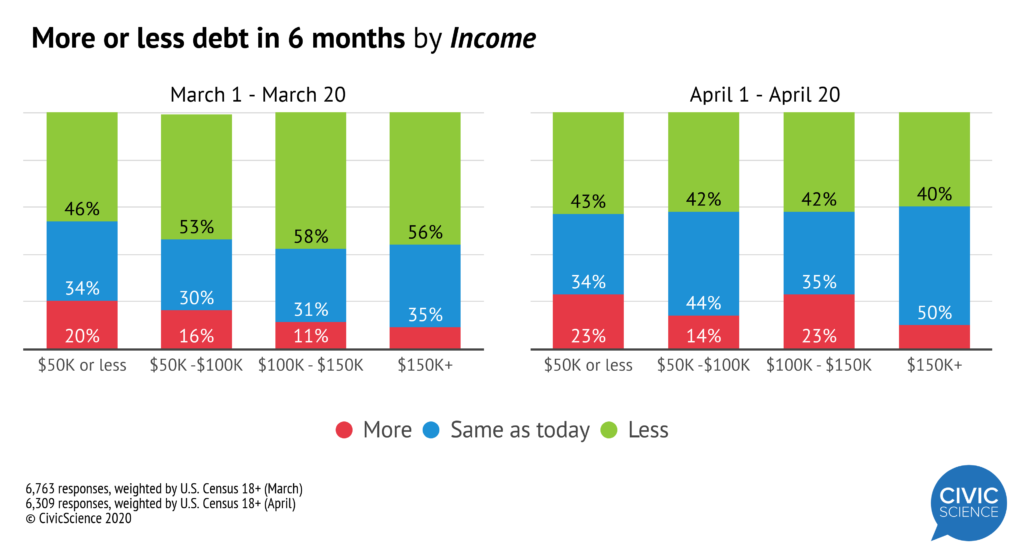

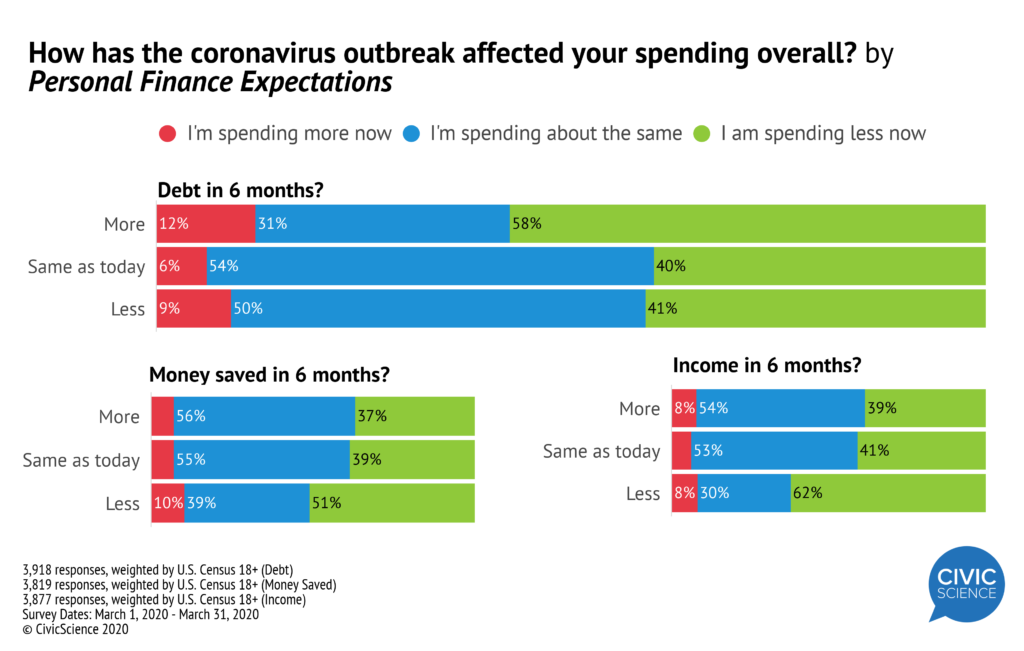

While debt expectations swung toward status quo for most, the interesting find here was that expectations for debt to increase grew significantly among the upper middle class – specifically those earning between $100k-150k – more than doubling from 11% to 23% during the same 20-day periods in March and April. April saw consumer spending adjustments begin to plateau. Looking back at sentiment in March, the consumers spending less were largely the same people anticipating more debt, a smaller income, and less money saved – making plenty of fiscal sense.

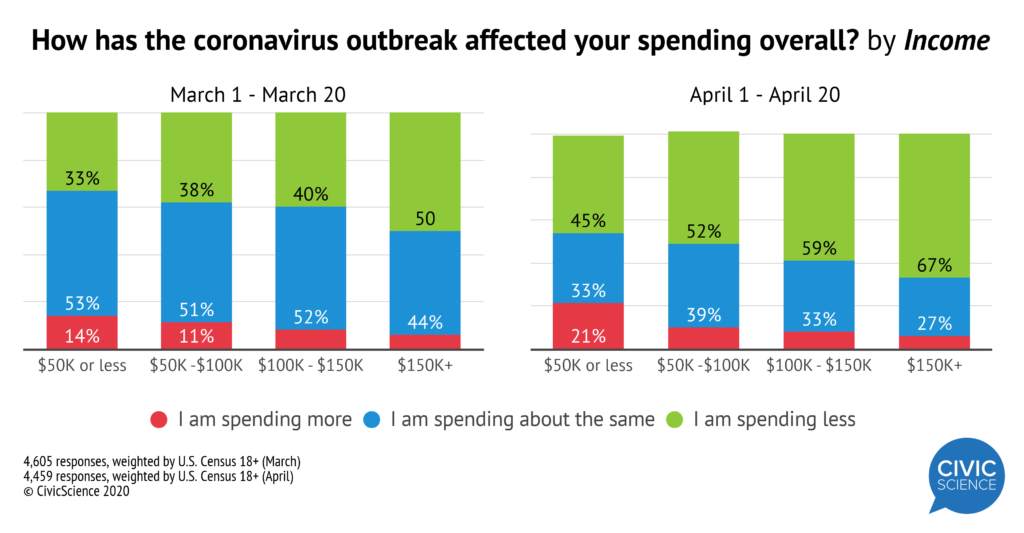

April saw consumer spending adjustments begin to plateau. Looking back at sentiment in March, the consumers spending less were largely the same people anticipating more debt, a smaller income, and less money saved – making plenty of fiscal sense. Looking at how that spending data has evolved through the lens of income reveals an interesting contrast.

Looking at how that spending data has evolved through the lens of income reveals an interesting contrast.

Despite a majority still reducing spending, those who report earning the least amount of money (<$50k / year) are actually the most likely of the income groups to say they are spending more as a result of the pandemic – and increasingly so. Between March and April the number of low-income earners spending more as a result of the pandemic jumped 50% while those in each of the other income brackets mostly reported typical or reduced spending. Whether that continues through May can’t be assured, but it will be interesting to monitor nonetheless. All in all, financial attitudes are changing differently for different people. Widespread panic around job security, diminishing supplies of goods, and general fear of being in public were surely key drivers of the initial adjustments consumers made to those attitudes in March – all of which is changing course. Getting to the root of the “how and why” behind the evolution of that change will be instrumental in answering the “what’s next?” question, and ultimately begin to point us towards a finish line (or an extended caution lap) somewhere out there.

All in all, financial attitudes are changing differently for different people. Widespread panic around job security, diminishing supplies of goods, and general fear of being in public were surely key drivers of the initial adjustments consumers made to those attitudes in March – all of which is changing course. Getting to the root of the “how and why” behind the evolution of that change will be instrumental in answering the “what’s next?” question, and ultimately begin to point us towards a finish line (or an extended caution lap) somewhere out there.