CivicScience engages directly with consumers, collecting over one million survey responses daily, to turn real-time insights into high-performing advertising campaigns. See how leading brands use CivicScience to drive campaign performance here.

While toys aren’t just a seasonal category, toy shopping takes on a life of its own during the holiday season. Each year brings around a new hot toy that children–and adults–clamor for. With so many ways to track down that perfect gift, understanding consumers’ shopping plans and spending intentions offers valuable insight into what to expect from toy buyers this season.

More Toy Shoppers Are Looking to Big Box Store Websites This Year

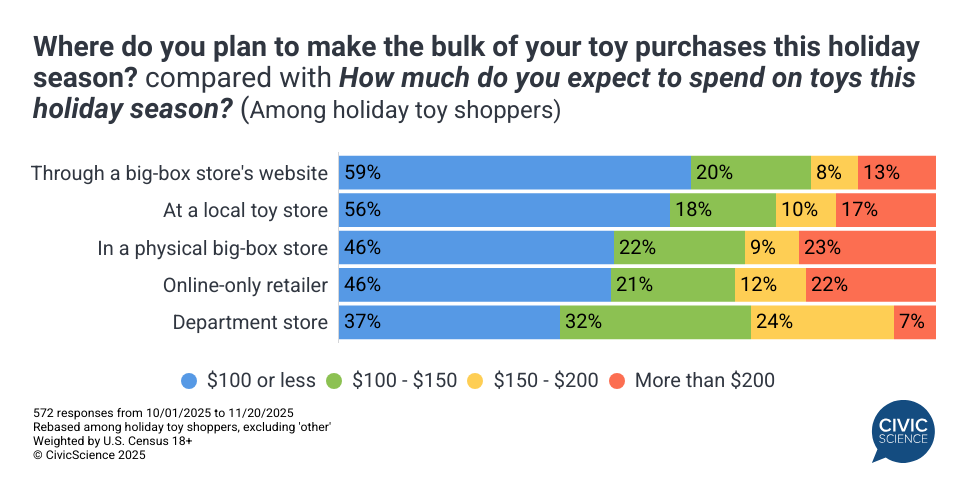

New CivicScience data show that big box stores–both in person and online–are popular choices for shoppers to make the majority of their toy purchases this holiday season, aligning with the Gen Pop. The percentage of Americans choosing to shop at big box stores through their specific website saw the biggest jump, from 18% in 2024 to 25% today. Meanwhile, despite edging out big box stores by one percentage point, online-only retailer shopping dropped nine percentage points in the same time frame.

Those who prefer going into a brick-and-mortar big box store for toy shopping skew female, low-income, and are most likely aged 45-64. Meanwhile, those who prefer shopping online through big box store websites skew male, middle-income ($50K-$100K), and Gen Z aged 18-29. This suggests that in-person and online messaging may benefit from adapting to these different demographics.

Shoppers Turn to the Internet for Inspiration and Support

Holiday toy shoppers who research the toys they want before they shop are most likely to use online reviews, but at a lower rate than those who are not purchasing toys this year. Instead, holiday toy shoppers are more likely to watch unboxing videos and professional toy ratings to help guide their toy purchases. Social media recommendations carry slightly more weight with this group, and another 20% ask family and friends.

Further highlighting toy shoppers’ affinity for turning to online resources is their approach to using generative AI for gift inspiration. Holiday toy shoppers outpace non-shoppers (and the Gen Pop) in their intent and usage of generative AI to brainstorm holiday gift ideas and find products by a considerable margin.

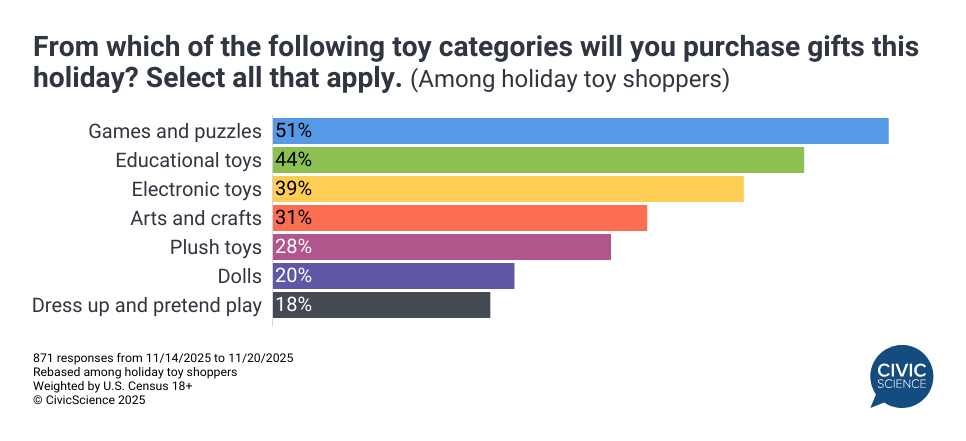

Games and Puzzles Lead Toy Purchasing Intent

When it comes to the type of toys that gifters will purchase, games and puzzles outpace all other toy categories, with 51% planning to include them in their holiday shopping haul. Educational toys take second place (44%), while dolls (20%) and dress up (18%) are far less common.

Notably, those who intend to purchase games and puzzles lead in spending ‘more’ on holiday gifts overall this year. They’re also far more likely to report they’ve already started their holiday shopping.

How Much Will Toy Shoppers Spend?

Fresh intent data show that nearly half of toy buyers (49%) intend to spend $100 or less, yet a notable 20% plan to spend more than $200 on toys this year–figures that are roughly on par with last year. This suggests that despite ongoing economic uncertainty, shoppers are not willing to compromise on their toy budget.

Additionally, physical big box toy shoppers outpace all other retailer shoppers in their plans to spend over $200 on toys this holiday season.

Toy purchasing remains an important part of holiday shopping for many Americans. Amidst the ever-changing news cycle, holiday toy buyers remain steadfast in their commitment to spending on the toys that will make their loved ones’ Christmas dreams come true. However, these shoppers are not going it alone. They lead in watching unboxing videos and getting inspiration from ChatGPT. This means that before they head to the store or land on a retailer’s website, there are ample opportunities to cut through the noise, get in front of these consumers, and influence their spending decisions for the remainder of Q4 and beyond.