Purchasing a home and maintaining a mortgage typically requires a home insurance policy. But with home insurance premium rates up 23% since the start of 2023, and expected to reach record highs this year, consumers are certainly feeling the impact.

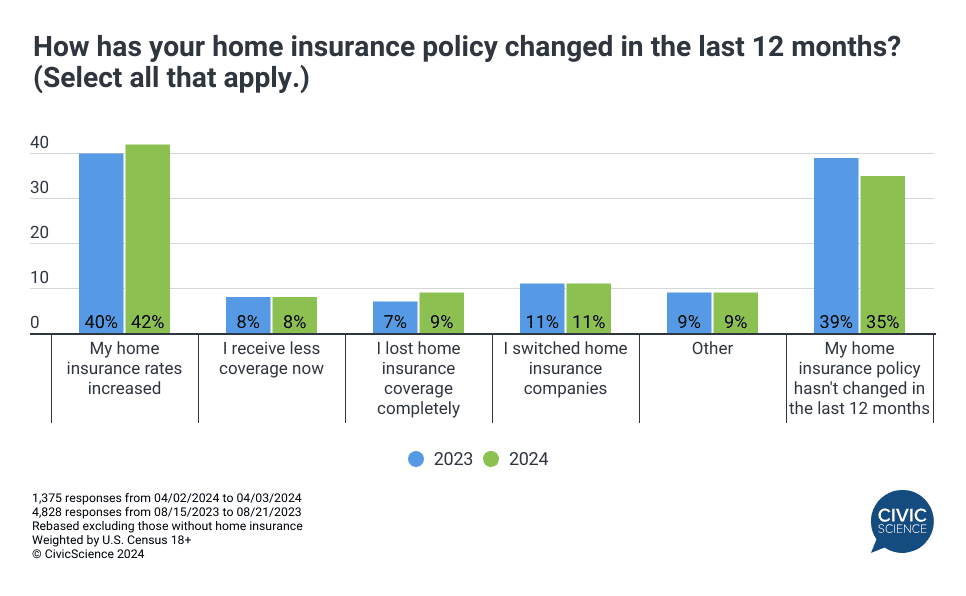

CivicScience consumer data find that a total of 42% of U.S. adults say their insurance rates increased in the last 12 months, up from 40% who said the same in August. And while homeowners are just as likely to report downgraded coverage or switching insurance companies, nearly 1-in-10 now report they lost home insurance coverage completely – an increase of about 29% since August.

Join the Discussion: Have you found it more difficult to get home insurance in the past five years?

The risk of adverse weather events such as hurricanes and floods puts some homeowners at a greater disadvantage, and data show people living in the U.S. South were the most likely to say their rates increased and/or were dropped by their insurer in the last year. However, sources report that destructive weather events are increasing in frequency across the country, and so are insurance premiums.

Among homeowners, April data show 32% of policyholders do not feel confident that their insurance will cover their homes if damaged by an extreme weather event (n=1,281 responses). A comparison of six leading home insurance providers finds that those insured by Nationwide and Travelers were the most likely to feel confident in their coverage, while those with Geico or Liberty Mutual were the least confident.

Homebuyers Feel the Pressure of Insurance Costs

To what extent are high insurance costs, or in some cases, limited or unaffordable insurance coverage impacting the housing market? Among those who plan to buy a home in the next 12 months, 35% express strong concern over being able to obtain home insurance that would protect their home from severe weather events, with an additional 26% of future buyers feeling ‘somewhat’ concerned. Just 40% say they’re ‘not at all’ concerned, down 16 points from August (n=821 responses from 4/2/24-4/4/24).

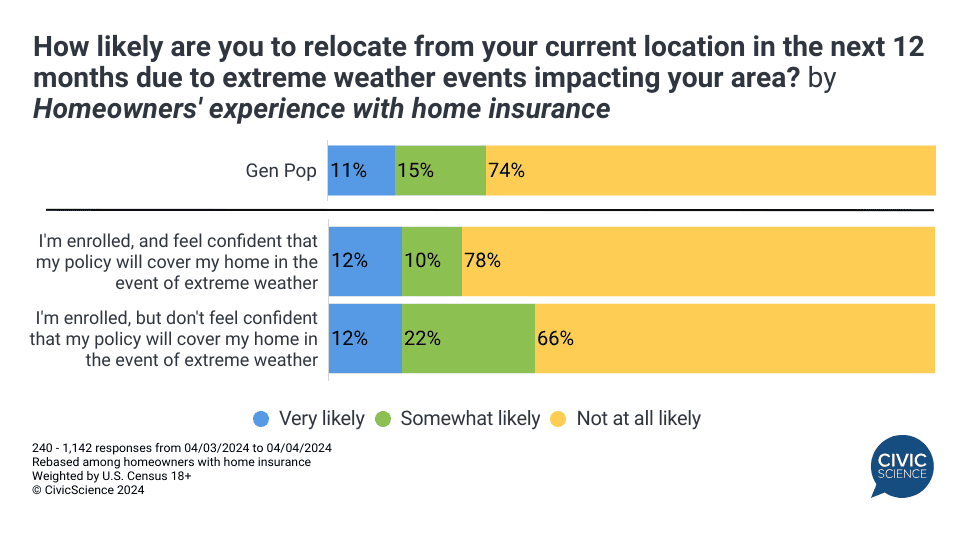

This growing concern could lead some to pick up and leave high-risk areas altogether. More than one-quarter of U.S. adults say they are considering moving from their current location due to extreme weather events. That number rises to over one-third of people who have home insurance but don’t feel confident in their coverage.

Additionally, 30% of those living in the U.S. South and 33% of those in the U.S. West are likely to move this year because of extreme weather in their region.

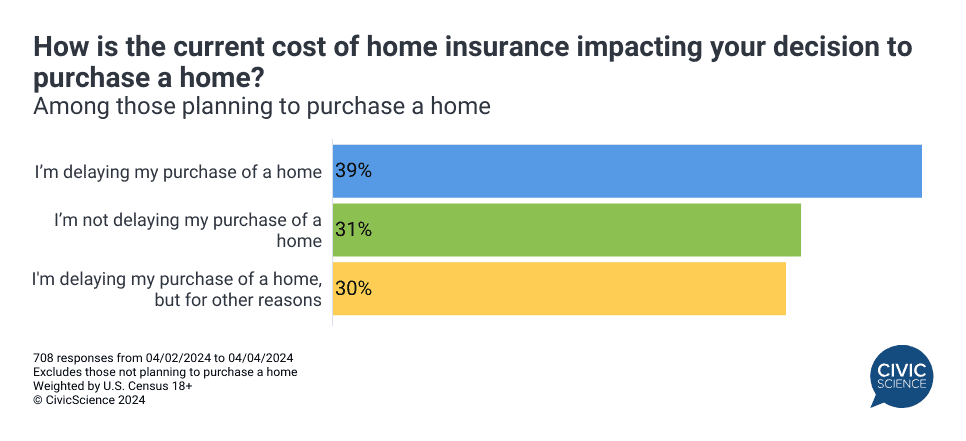

While weather isn’t the only variable jacking up insurance costs – inflation is to blame as well – high prices are causing many potential homebuyers to put their plans on ice. A total of 39% of those in the market say they are delaying their purchase of a home due to high home insurance costs, while an additional 30% say they are delaying buying a home but for other reasons. Just 31% are not planning to delay making a purchase, which aligns with October data that found around 30% of people who had wanted to buy a home in the next 12 months were actually carrying through with their plans, while the majority were stalling due to cost concerns.

Home insurance emerges as another challenge for consumers, adding to the mix of high home prices, interest rates, and the limited availability of homes. Those living in high-risk areas are more inclined to move to lower-risk areas, yet general rising costs are impacting a significant percentage of homebuying Americans across the country.

Weigh In: Have you had a positive or negative experience with home insurance?

To learn how your target consumers are responding to the shifting insurance and housing markets, get in touch.