Qualifying parents are getting ready to receive their first child tax credit payment, a result of a provision within the American Rescue Plan that aims to support parents of school-age children. The parent support measure is certainly a popular one. Previous CivicScience polling indicated more than half of U.S. adults — parents as well as non-parents — supported the expansion of the child tax credit to include 17-year-olds.

The payments are set to be delivered mid-July so CivicScience surveyed qualifying parents on how they will disperse the incoming cash.

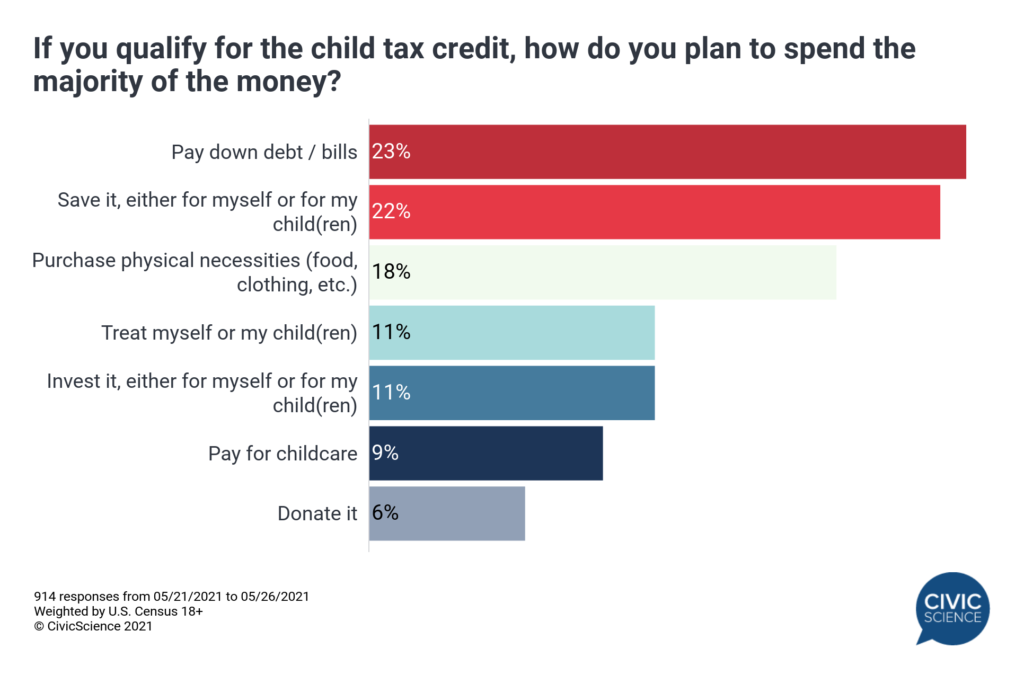

Similar to how consumers chose to spend stimulus payments and tax returns, the most popular way to use the majority of the money is to pay down debt or bills (23%) or to save it (22%).

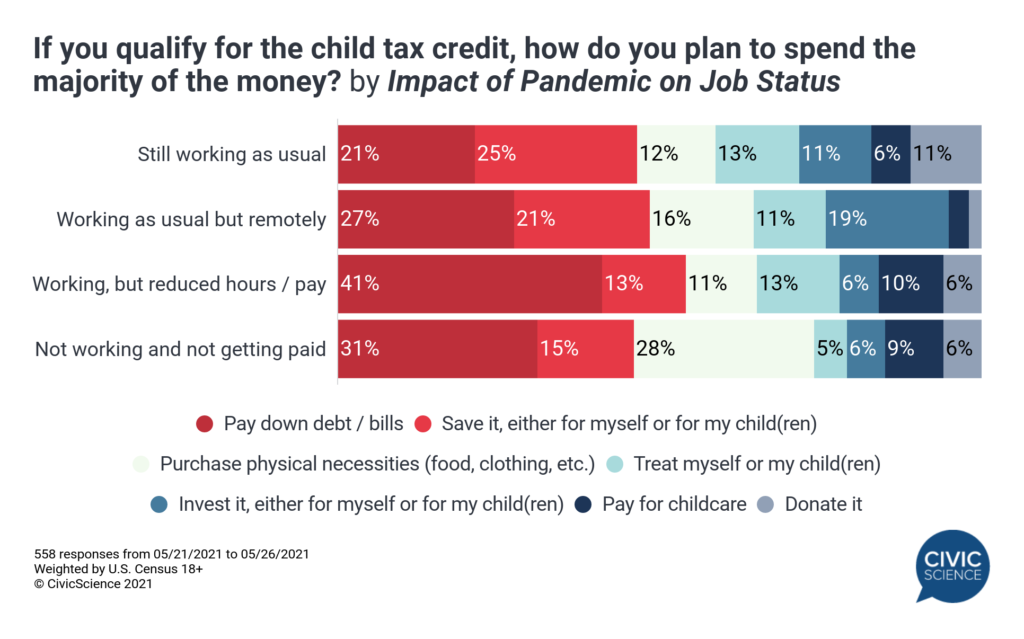

How parents choose to spend the new money has a lot to do with job status. While only 10% of survey respondents indicate they will use the money to afford childcare, the data show people who aren’t working or are working less hours or not getting paid as usual are the most likely to choose childcare. This could indicate that the cost of childcare is the reason some parents are not currently working. Or that they chose not to work because they weren’t comfortable sending their child into a group setting during the pandemic.

Parents working from home are the least likely to use the money for childcare. They are significantly more likely to invest the payments (20%).

The tax credit is primarily going towards necessities and debt or bills for people who are unfortunately without their usual paycheck or who are working less or not at all.

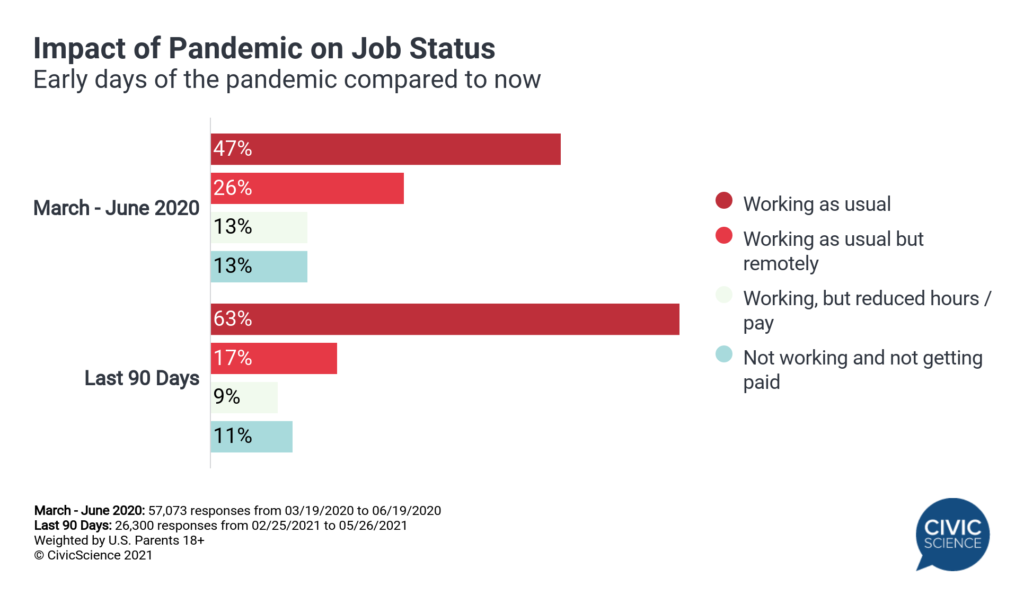

At this point, it’s interesting to look at how far families have come in terms of recovery. During a 90-day period at the start of the pandemic, parents reporting job loss or reduced hours or pay made up 26% of parents 18 and older. This number has thankfully dropped six percentage points, but 20% of parents still struggling is still quite a hefty segment of the population.

This is the primary reason why reducing debt and building up savings are clear goals among parents right now. Waning social distancing guidelines and mask mandates are positive milestones in America, but individuals and families are still reclaiming financial security and holding it tightly.