CivicScience regularly tracks Americans’ continuously shifting expectations for the economy and their personal finances in the short-term, such as within the next six months to a year. Businesses need to know how consumers expect to spend in the months ahead. But what about in the long-term? What do Americans anticipate their financial situation will look like at the end of their careers as they transition into retirement?

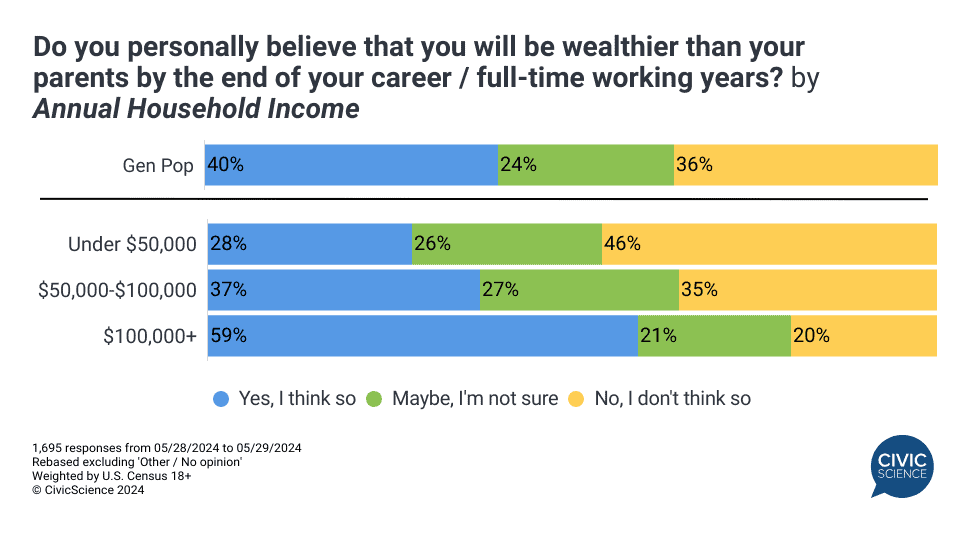

New data show that 40% of U.S. adults believe that they will become wealthier than their parents by the time they reach retirement. That figure outpaces the roughly one-third of Americans who believe they will have less wealth upon retirement. It’s clear that current wealth status plays a significant role in expectations. Higher earners with an annual household income of $100K or higher see themselves on a wealth-growth trajectory, while lower earners making under $50K yearly envision going in the opposite direction.

Join the Conversation: Do you expect to be better off financially than your parents?

Age and Gender Highlight Extreme Differences

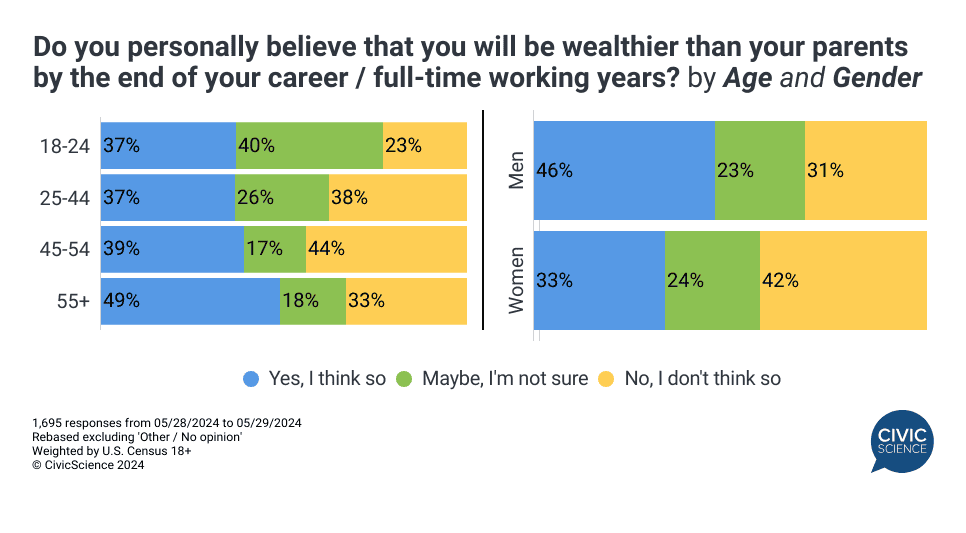

Of course, age is also a differentiating factor. The current inflationary climate, coupled with the student loan debt crisis, has made it more difficult for many young adults to afford basic living expenses, let alone buy a home and save for the future. With their careers ahead of them, Gen Z adults are the most uncertain about their future wealth, while Millennials are split between those who believe they’ll be wealthier than their parents and those who believe they won’t be. On the other hand, Gen X is the least hopeful they’ll be wealthier than their parents.

Alarmingly, there is a large gap between expectations among men and women – 42% of U.S. women say they do not think they will retire with more wealth than their parents, compared to 31% of U.S. men. Women are a full 13 points less likely than men to foresee a wealthier future, and are overall more inclined to believe they will have less wealth than more.

To put these numbers into perspective, Americans have been losing confidence in savings and investments over the course of this year. Recent data show a growing percentage do not believe they are saving enough today to comfortably retire, and many expect to keep working well into their retirement-age years. This difference is even more stark among men and women – in May, just 30% of women said they were at least ‘somewhat’ confident they were saving enough to live comfortably in retirement, compared to 45% of men.1

Take Our Poll: How often do you compare your financial circumstances to those of friends and family?

The Pandemic’s Effect

The pandemic has had a disproportionate impact on certain segments of the population. As a whole, women’s wealth expectations have remained the same since July of 2022, while men saw an increase of five points. Expectations among Gen X have fallen during this same time period, whereas adults under age 45 are seven points more likely to believe they will acquire more wealth than their parents during their working years.

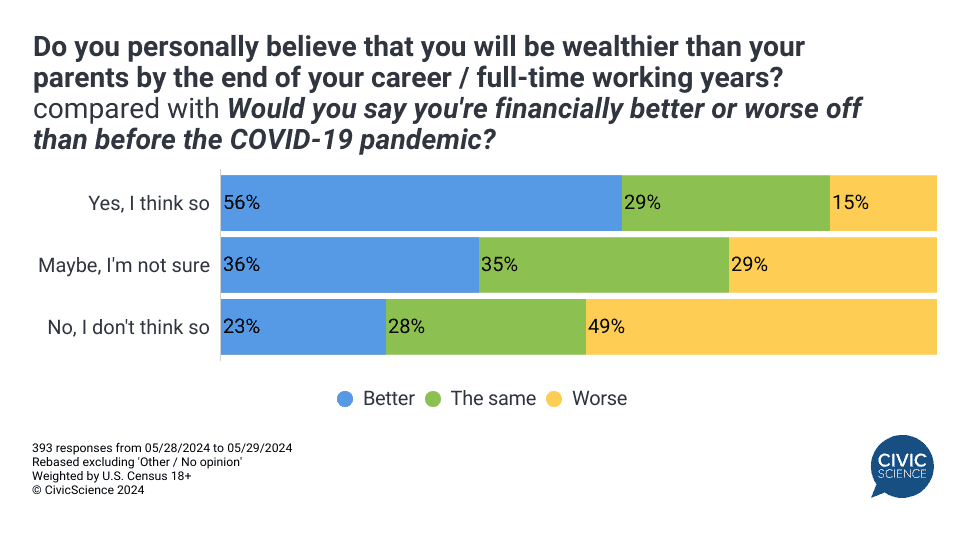

Additional data show a clear correlation between how a person’s financial state changed over the course of the pandemic and their perception of the future. More than half of those who believe they will be wealthier than their parents say their financial situation has improved than since the start of the pandemic, while the exact opposite is true for those not expecting to be wealthier.

Expectations for wealth are largely individual, although macro trends emerge that help to forecast a view of how different segments of the population view their short- and long-term financial futures, impacting their consumer behavior today.

Attitudes change before behaviors do. To stay ahead of how your customers, key consumer segments, and competitor’s customers are feeling about their finances, get in touch.

- n=2,953+ responses from 05/01/2024 to 05/31/2024 ↩︎