Sleep is a topic that never goes out of style. In the past, CivicScience has studied everything from mattresses and popular sleep products to poor sleep quality among consumers, and still, the conversation around sleep – and getting enough of it – continues to evolve.

So, what does the sleep conversation look like in 2024?

Americans are averaging less sleep.

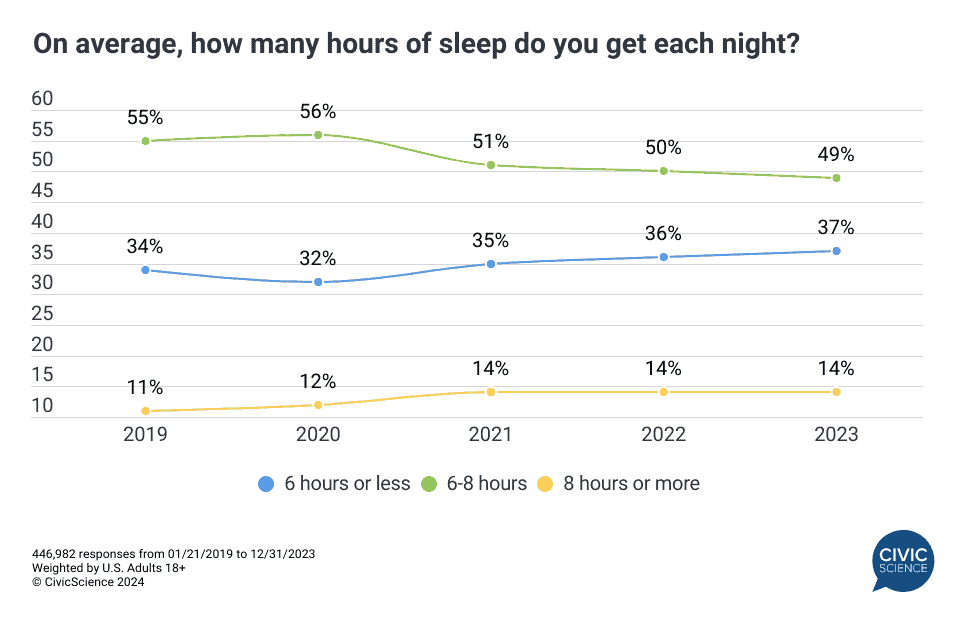

Current CivicScience data show that nearly two-thirds of the U.S. adult population gets six or more hours of sleep each night, but 37% report less than six hours.

A look at the data over the last five years shows that the percentage of those getting six hours of sleep or less each night rose five percentage points since 2020. Meanwhile, those getting 6-8 hours of sleep each night decreased seven points in that same time period.

Of course, sleep quality isn’t just a factor of how much sleep you get, but also how easily you fall asleep and stay asleep. As it stands, 69% of people say they have trouble sleeping at least ‘a few nights a month,’ with 21% experiencing trouble sleeping ‘every night.’

Join the Conversation: How many hours of sleep do you need in order to function?

Can a new mattress solve your sleep problems?

Another key factor in sleep is the quality of the mattress. And based on the data, it seems many Americans – 24% to be exact – are in the market for a new one. Mattress buying trends have seen a shift since last year. Whereas 16% of U.S. adults said they would buy their next mattress online last year, 20% say the same in 2024 (and 64% prefer to buy mattresses in stores).

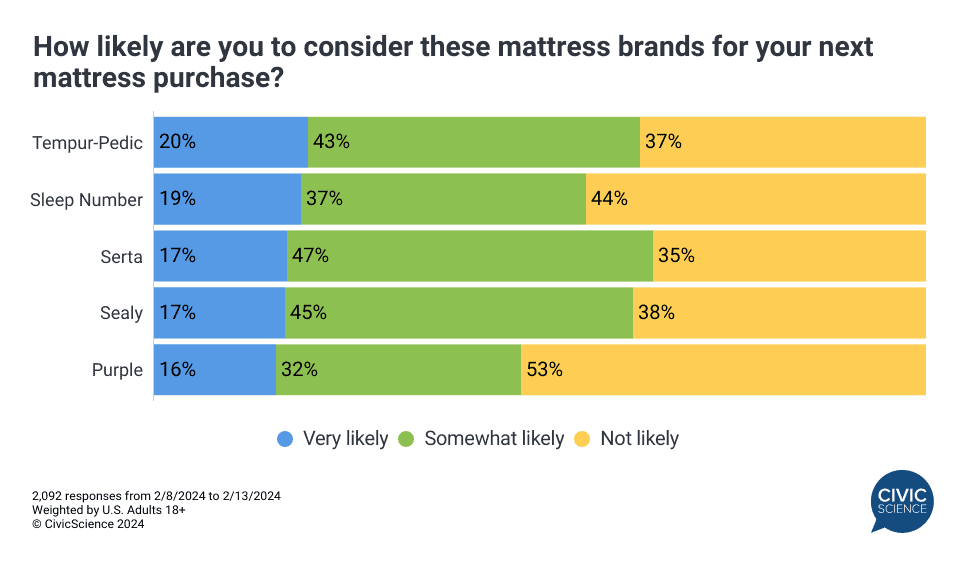

Among top mattress brands, Serta and Sealy are the most widely owned by Americans, followed by Tempur-Pedic, Sleep Number, Purple, and Casper.

However, with so many Americans in the market for a new mattress, which brands are garnering the most interest among shoppers? Tempur-Pedic is currently in the lead, with 20% of respondents ‘very likely’ to consider the brand for their next mattress. Following Tempur-Pedic is Sleep Number (19%), Serta (17%), Sealy (17%), and Purple (16%). This suggests that a new mattress company may wind up knocking Serta off of its lead.

According to the data, ‘good reputation and reviews’ are of top importance when buying a new mattress, with 34% of shoppers citing this as their priority, followed by ‘getting a deal’ (21%) and ‘trying it out in a store first’ (20%). Shoppers are less likely to be concerned with organic or natural mattress materials, a trial period, or the delivery/return process.

Of course, with President’s Day and the annual sales just around the corner, it’s worth noting that mattresses are the second-most popular item to shop for during the holiday, taking second only to tech and electronics.

The emotional and health impacts of sleep.

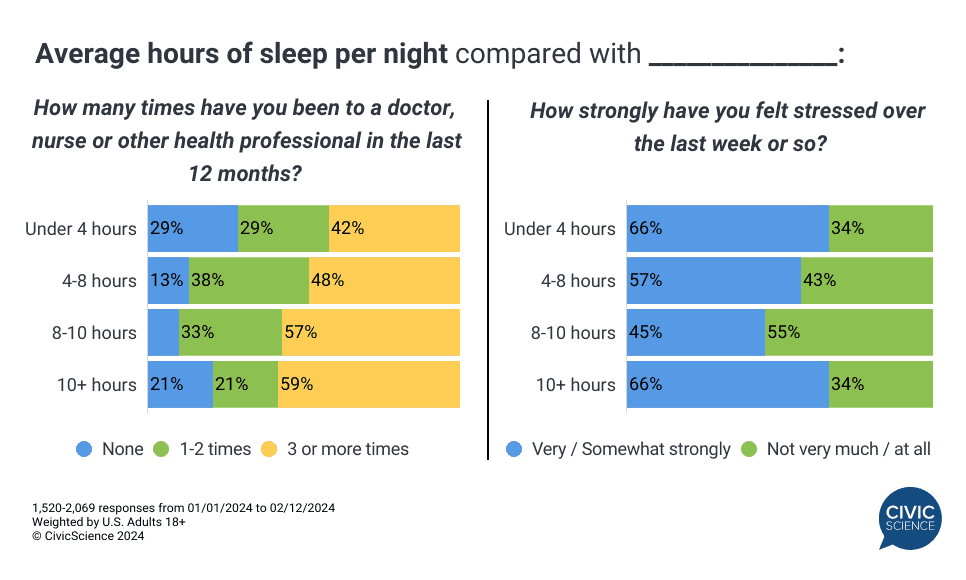

Given the connection between sleep and health, it’s worth noting that those who normally sleep under four hours a night report going to the doctor the least in the last 12 months. Meanwhile, those who typically sleep 10 or more hours are going to the doctor the most.

Additional data show that 26% of those who sleep less than four hours nightly consider themselves to be ‘very healthy,’ and another 45% say they’re ‘pretty healthy.’ So while science wouldn’t necessarily support it, minimal sleepers seem to feel like they’re doing just fine.

Additionally, there’s an interesting emotional aspect of sleep to consider. While 61% of Americans say they sleep for self-care, 66% of those who sleep under four hours a night are more likely to experience stress, compared to 45% of those who average 8-10 hours.

Simply put, Americans’ relationship with sleep is complicated. With so many different factors to consider – mattress comfort, stress, and everything in between – it can be difficult to pinpoint exactly what is leading to minimal sleep hours or poor sleep quality. But what is clear is that sleep isn’t getting any better, and in the meantime, Americans are willing to open their wallets to find a solution.

Take Our Poll: Would you ever purchase a mattress online? 🛏️

Looking for more insights like these? Find out how CivicScience solutions can help your brand get ahead of the curve.