The Gist: While there’s interest in services like MoviePass across the board, it doesn’t look like the massive disruptor theaters are making it out to be.

If you’ve been anywhere near a megaplex lately, you might’ve noticed several patrons paying with a red branded “MoviePass” debit card at the ticket counter. If you’re an avid movie-goer, you’re probably paying with one too.

To the unindoctrinated, MoviePass is a monthly subscription service, where for a $10 flat monthly fee, members can see a movie a day in theaters. MoviePass has been around for about six years but garnered massive interest in the last six months when it dropped its monthly rate from $50 to its current $9.95 pricing.

Even for the most casual moviegoer, the new pricing is compelling. The average movie ticket in the US is just shy of $9, meaning most users are already saving money after their first movie. In the last month, alone 500,000 new subscribers joined the service.

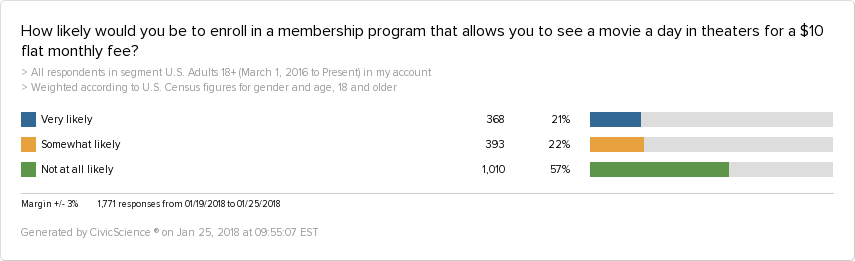

A little under half of U.S. Adults have some level of interest in MoviePass. Even the 21% being “Very likely” to enroll in this service is a significant amount. It could have significant ramifications for theaters, studios and MoviePass itself.

Now, even with a beginners understanding of profitability, this company’s model seems confusing. MoviePass is losing money after most people’s first trip to the theater. The company is generating revenue by means beyond membership (selling data to cinemas, working with studios to advertise to subscribers.) MoviePass claims the pricing model will function similar to that of a gym membership–people pay a fee each month and very few exercise.

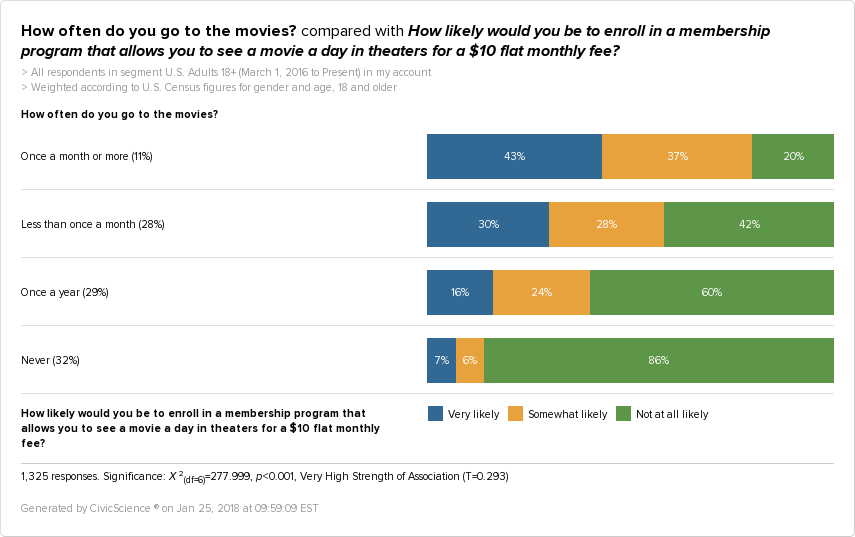

Does this model line up? We took a look at the interest in the subscription in relation to how often people visit the movies.

Yes, nearly half of frequent moviegoers (43%) are interested in MoviePass. However, 30% and even 16% of infrequent moviegoers who say they’re “Very interested” in MoviePass’ offerings. Less frequent moviegoers might enroll in the service, but it’s unlikely they’ll become super users or cost MoviePass too much.

With the boom of MoviePass membership, studios and theaters have rightfully started to panic. However, given our data, we’re not so sure MoviePass is the massive disruption it’s been pitched as. It’ll likely lead to higher film viewing, but wasn’t that what theaters were clamoring for anyway? Also, with customers feeling like they’ve saved a few bucks on admission, it’s likely they’ll spring for concessions–where the real theater money is made.