Whether through a bank or a third-party finance app, like Zelle or Venmo, online banking has become a necessity for most during lockdowns.

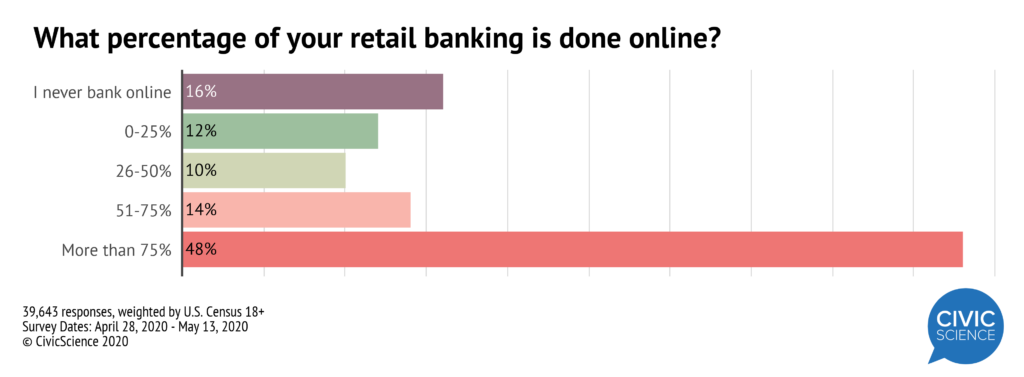

A survey of more than 39,000 U.S. adults found that 84% of people are carrying out their retail banking online and the majority are doing so more than 50% of the time. CivicScience’s weekly and monthly tracking show a steady increase in the number of people conducting more than 75% of their banking transactions online.

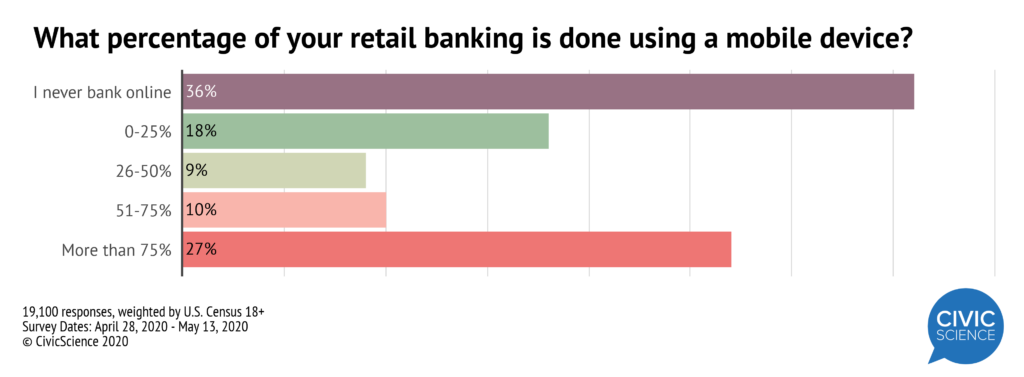

Mobile banking (tracked differently than online banking) is quickly becoming the preferred way to bank remotely; 64% of people are now using a mobile device to interact with their bank accounts.

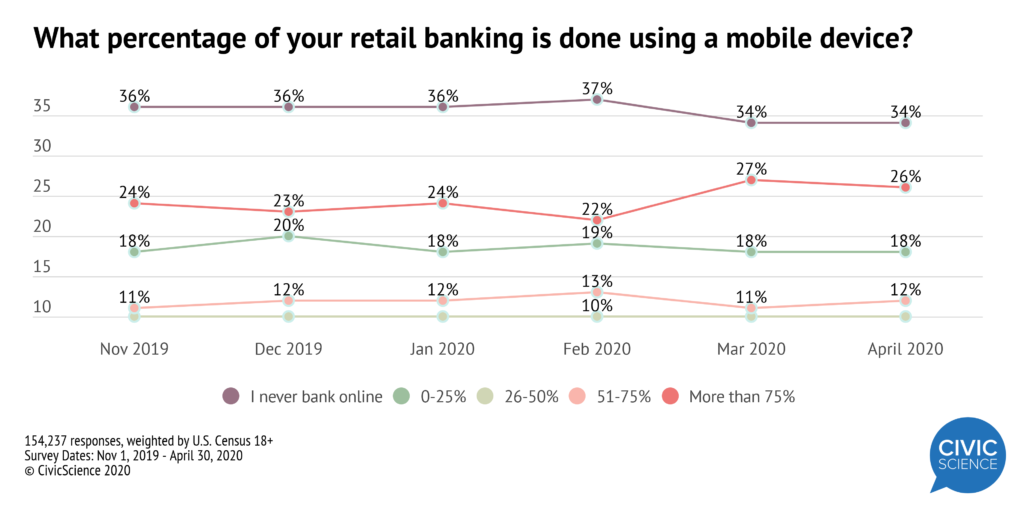

While online banking has seen a few percentage points of overall growth since the start of lockdowns earlier this year, it’s mobile banking that has witnessed the most change. Those who do 75% or more of their banking on a mobile device shot up from 22% in February to 27% in March.

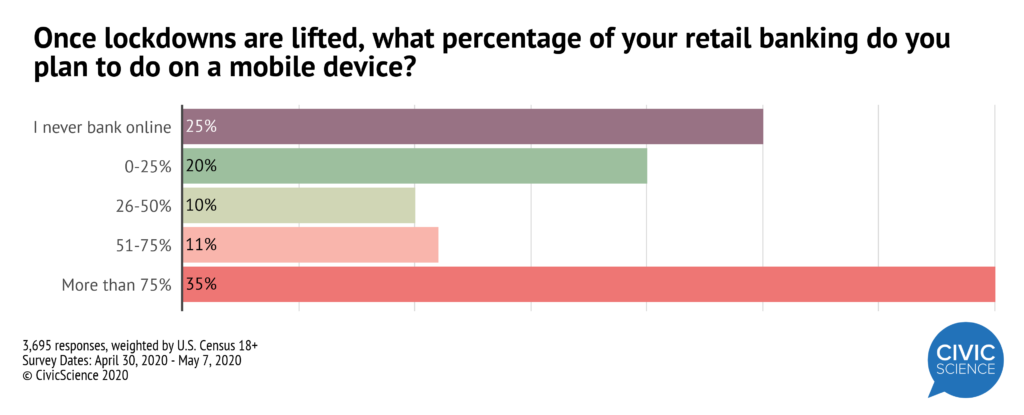

And based on how people plan to bank in the near future, mobile banking is only going to keep growing. Seventy-five percent of U.S. adults say they plan to use a mobile device (at some frequency) for retail banking after lockdowns are lifted.

More than one-third of respondents say they plan to carry out over 75% of their banking via mobile. Only 25% of people say they never bank online (and don’t plan to).

Who Plans to Do the Most Mobile Banking? Hint: Not Gen Z.

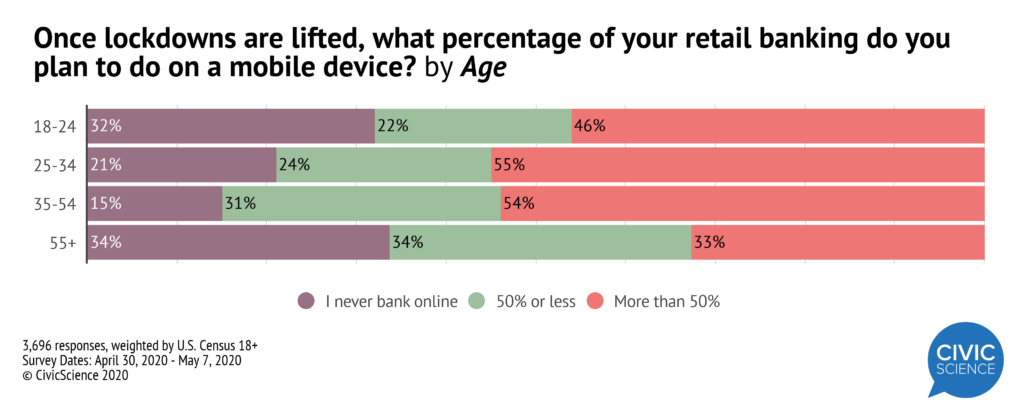

Indeed, all age groups have witnessed growth in mobile banking, with Millennials being the biggest mobile banking users at the moment — but it’s Gen X who plans to do the most mobile banking once lockdowns are lifted.

Despite the huge age gap, Gen Z and Baby Boomers are both much less likely to take up mobile banking, and even online banking altogether.

However, there are differences between the two. The data show that Baby Boomers actually plan to do significantly more mobile banking in the future when compared to their current usage rates, whereas Gen Z plans to do about the same or slightly less.

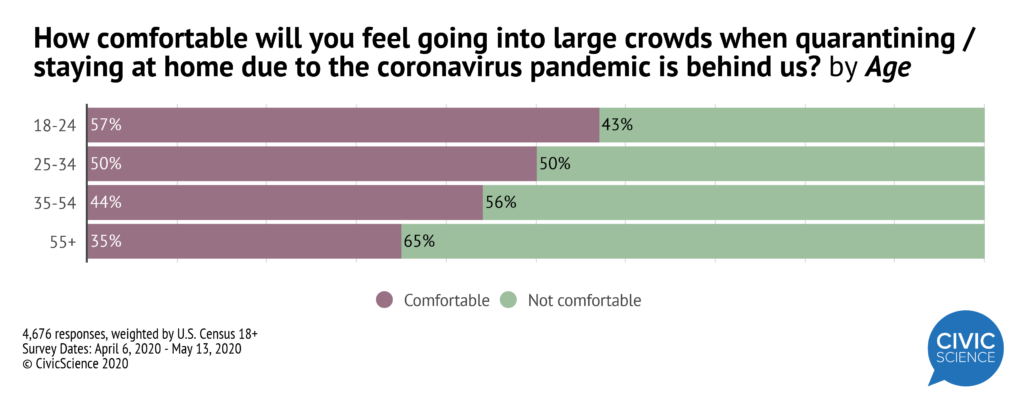

Past CivicScience research found that Gen Z are surprisingly the most likely age group to visit banks in person. Couple that with findings that Gen Z feel the most comfortable with going into large crowds after lockdowns end, while Baby Boomers (naturally) feel the least comfortable.

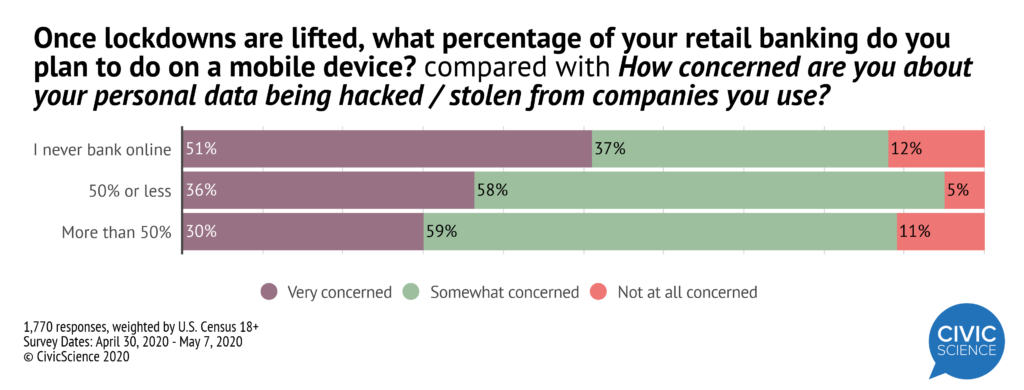

Mobile banking may gain a stronger foothold yet among Baby Boomers, whose poorer adoption of mobile banking has likely been based in part on security concerns. Data show they are the most likely to be concerned about their personal data being hacked or stolen.

Likewise, the survey reveals that mobile banking correlates with security fears; the greater your concern over data theft, the less likely you are to use mobile banking apps.

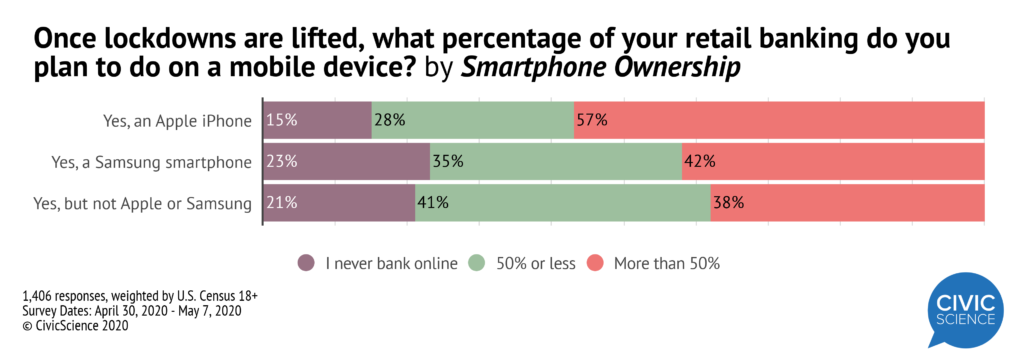

Intent to Use Mobile Banking by Smartphone

The survey also shows that mobile banking is poised to grow across both Android and iOS platforms. Currently, iPhone users have a lead when it comes to mobile banking. Among smartphone owners, 75% of iPhone users say they use a device for mobile banking at some frequency. That’s compared to 61% of Samsung users and 56% of other Android or smartphone users.

While that’s a sizeable difference, the reality is that more than half of all smartphone users are now using their phones to do at least some mobile banking. Considering current data show 82% of U.S. adults own a smartphone, that’s a lot of mobile banking.

Based on survey results, that trend may only intensify after lockdowns. Both iPhone and Android users plan to do more mobile banking, totaling 85% of iPhone users, 77% of Samsung users, and 79% of other Android or smartphone users.

Where will mobile banking go from here? Inevitably, coronavirus lockdowns are fast-tracking mobile banking adoption in the U.S. (and worldwide) and it seems positioned to keep growing, even as lockdowns end. However, security concerns and comparably low adoption among Gen Z are also part of the equation.