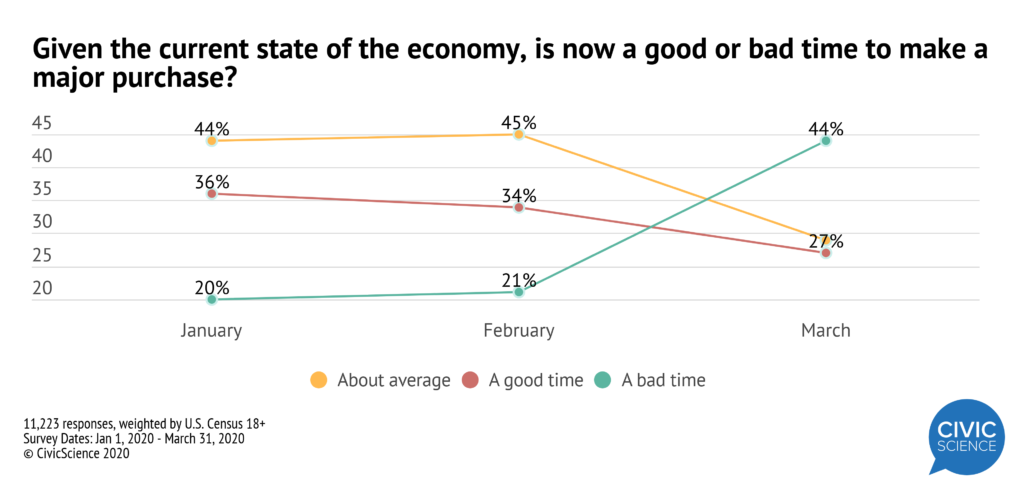

If someone suggests tomorrow that you should remodel your home or buy a new car, there is a very good chance that you’ll immediately reject the idea. A recent CivicScience survey shows that 44% of adults in America say now is a bad time for a major purchase.

In January, that number was at 20%, meaning that 80% of U.S. adults thought it was either a good or average time to spend big. The rapid change in economic sentiment is no surprise given how the coronavirus has stalled daily life and confirmation of a recession is still ringing in our ears. What does this mean for companies whose business models rely on selling big-ticket products or contracts?

What does this mean for companies whose business models rely on selling big-ticket products or contracts?

Putting Pedal to the Metal

The automotive industry is doing what it can to stay afloat, but the next few months look dire. To combat declining new car sales, car manufacturers are trying to attract customers with wild deals, some as wild as 0% interest on an 84-month loan. Are these incentives working to encourage consumers to buy new?

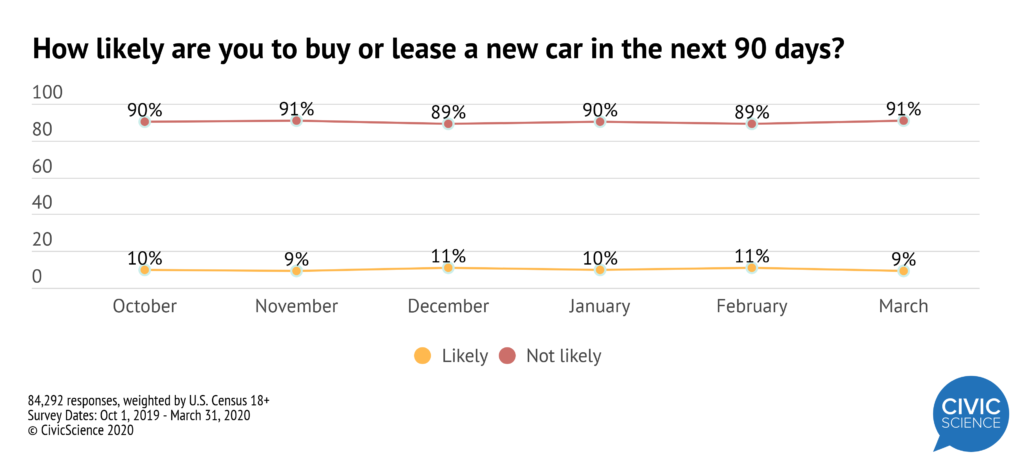

CivicScience data show that consumer likelihood to buy or lease a new or used car has remained relatively unchanged since October. Yet in January, consumer interest in used vehicles began to climb while interest in new vehicles began to fall. Consumers might still be in the market for a car – regardless of the state of the economy – but it appears their desire for a ride that’s fresh from the manufacturing plant is faltering.

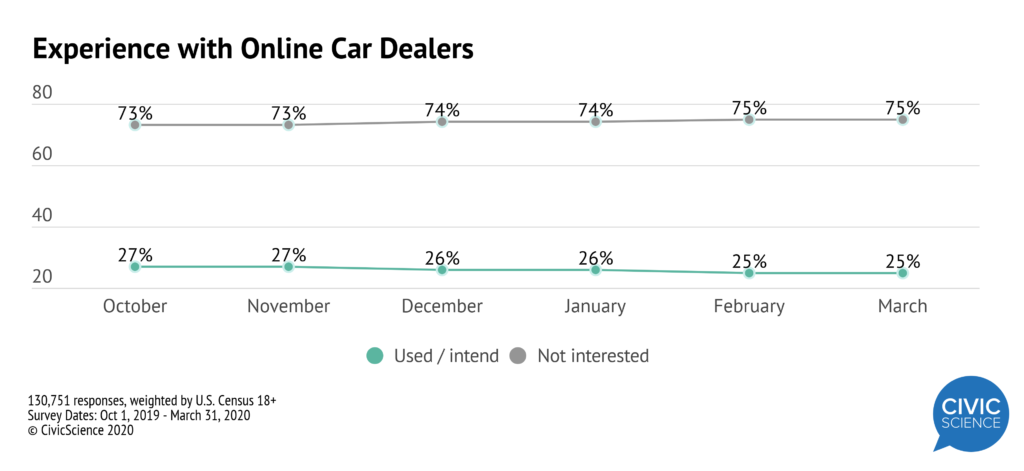

Yet in January, consumer interest in used vehicles began to climb while interest in new vehicles began to fall. Consumers might still be in the market for a car – regardless of the state of the economy – but it appears their desire for a ride that’s fresh from the manufacturing plant is faltering. Online car dealers like Carvana seem like the proper way to buy a car while practicing social distancing and remaining in quarantine. CivicScience looked at usage and intent and found that a quarter of U.S. adults say they have used or intend to use an online car dealer. Looking at the 6-month history, intent and usage hasn’t varied much. In fact, there has been a slight increase in those who say they are not at all interested in an online car dealer. It does not appear that the coronavirus pandemic has encouraged more online car sales.

Online car dealers like Carvana seem like the proper way to buy a car while practicing social distancing and remaining in quarantine. CivicScience looked at usage and intent and found that a quarter of U.S. adults say they have used or intend to use an online car dealer. Looking at the 6-month history, intent and usage hasn’t varied much. In fact, there has been a slight increase in those who say they are not at all interested in an online car dealer. It does not appear that the coronavirus pandemic has encouraged more online car sales.

Consumer Sentiment

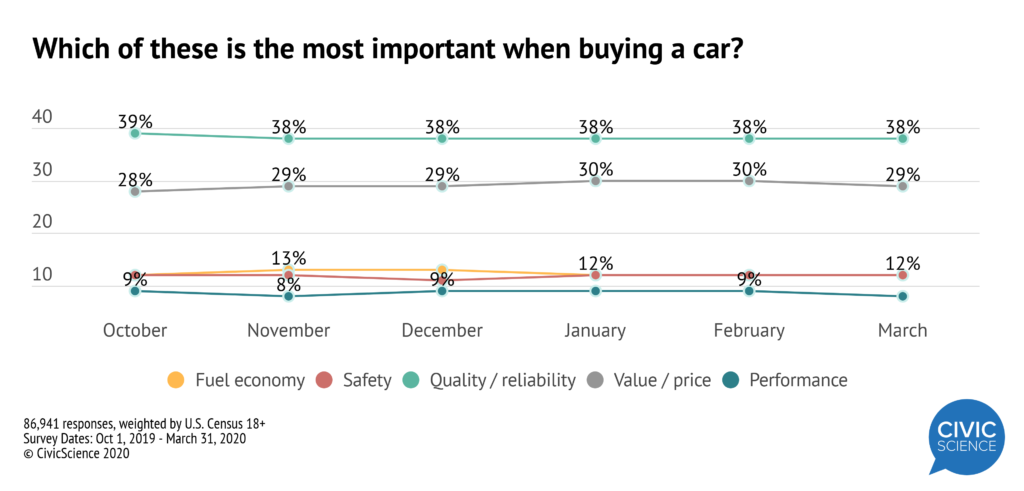

Consumers have been fairly consistent with what they prioritize when buying a car. For nearly 6 months, quality and price have been the top two considerations for the general population in the market for a car, new or used. Between February and March, as the ripples of the pandemic began hitting farther and wider, the importance of price went down slightly. Weekly numbers from the last 30 days suggest the importance of price will dip for just a short time, but only finishing out the month of April will give us a clear picture.

Weekly numbers from the last 30 days suggest the importance of price will dip for just a short time, but only finishing out the month of April will give us a clear picture.

It is important to account for changes in beliefs about quality and price because when these core pillars of someone’s personal spending shift, it tells us that something bigger is at play. Quality and price aren’t two considerations before a major purchase we expect to change week to week like emotions or preferences.

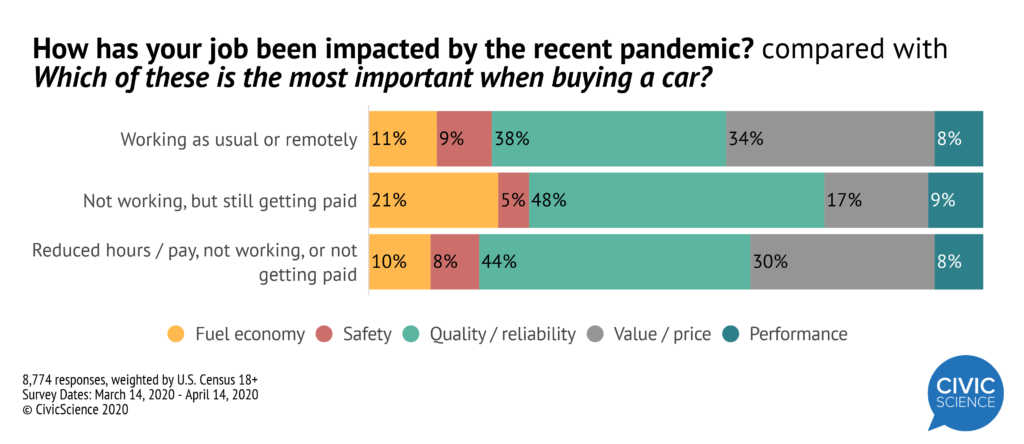

Current employment situations appear to be a factor in what people think is important when buying a car. People who are not working but still getting paid during the coronavirus pandemic over-index in prioritizing fuel economy and under-index when it comes to price. This group fell way behind the gen pop in consideration of price, and way above for fuel economy. Maintaining a paycheck to not work is a certain kind of luxury that not many people can relate to. This situation only applies to 5% of U.S. adults during this pandemic. Most people are experiencing more and more instances of reduced hours, furloughs, or lost jobs.

This group fell way behind the gen pop in consideration of price, and way above for fuel economy. Maintaining a paycheck to not work is a certain kind of luxury that not many people can relate to. This situation only applies to 5% of U.S. adults during this pandemic. Most people are experiencing more and more instances of reduced hours, furloughs, or lost jobs.

People who expressed concern about their employment situations gravitated towards used vehicles over new vehicles. But when asked about intent to actually purchase one in the next 90 days, only 10% were likely to pull the trigger. Even people who expressed no concern about their job situation were predominantly unlikely to make a used car purchase in the next 90 days.

The numbers are nearly identical when compared to intent to buy a new car in the next 90 days, suggesting that across the board, hardly anyone is going to be pulling a new set of wheels into their driveway anytime soon.