The PNC-CivicScience Investor Sentiment Index (“ISI”) is a “living,” survey-based measurement of U.S. adults’ current attitudes and expectations related to the U.S. financial markets, investment climate, and market outlook. The primary goal of the ISI is to monitor changes in consumer and investor attitudes, to better anticipate investment trends, market movements, and overall U.S. economic health.

A Snippet of Our Latest Reading:

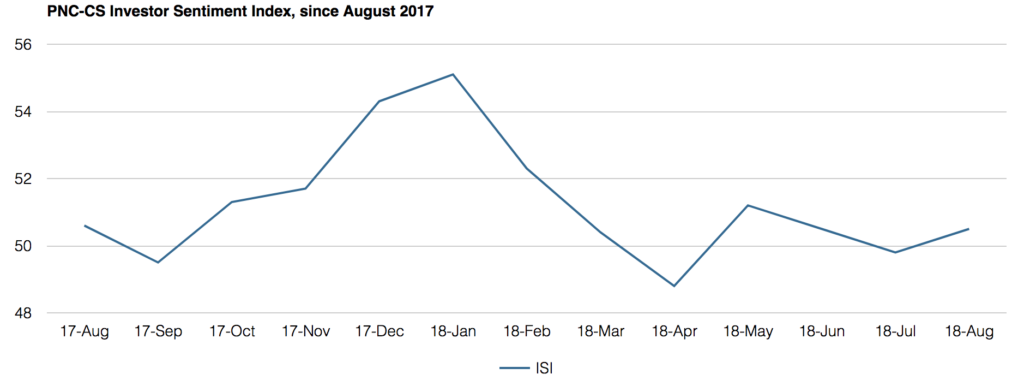

The PNC-CivicScience Investor Sentiment Index (PNC-CS ISI) ticked higher in August, reflecting a stabilization of sentiment after two months of decline. Investor optimism, as measured by the poll, had been steadily rising from September 2017 through January 2018. After peaking in January at 55.1, sentiment began to fade, falling to a 2018 low of 48.8 in April. Since then, the index has fluctuated within a fairly narrow range, with the August reading of 50.5 up slightly from the 49.8 July reading.

The August 2018 results reflect a slight uptick in optimism from poll participants. Trade war uncertainties continued to drive some market volatility, but trade progress with Mexico has galvanized hopes of a new NAFTA deal. Further constraining investor sentiment were renewed concerns in emerging markets, specifically within Turkey. On the positive side, fundamentals remain sound as the U.S. economy reported an upwardly revised 4.2% real GDP growth in the second quarter and earnings growth of nearly 25%.

Earnings estimates continue to look very strong for the second half of 2018, and investors appear to be focused on the positive fundamental story playing out within the United States. Stocks have recovered all of what was lost earlier in the year, despite ongoing headline risks. The S&P 500® posted several all-time highs in August, closing up 3.7% on the month and 10.4% year to date as of August 29, 2018. Domestic markets continue to benefit from a strong economic backdrop, historically robust earnings, and late-cycle fiscal stimulus.

As mentioned, second-quarter earnings season wrapped up in August. Overall, results were strong on both the top and bottom lines. Revenue growth of nearly 10% outpaced first-quarter results while earnings growth was just shy of 25%, with positive contributions from all sectors. Importantly, earnings estimates have not wavered when looking out to the third quarter, fourth quarter, and beyond. For the coming quarter, the market expects earnings growth to again eclipse 20%, and we agree.

The U.S. consumer remains strong, as we saw upward revisions to both personal income and the household saving rate. Incomes are rising thanks mainly to tighter labor markets and higher wages. The PNC Economics team expects wage growth to be even stronger in the second half of the year through early 2019. Additionally, with the upward revision to personal income, the household saving rate doubled in 2017 to 6.7%, indicating to us that consumers are in a position to increase spending in line with expected wage growth over the near term.

Lastly, labor productivity accelerated 2.9% quarter over quarter, the fastest pace since 2015; unit labor costs fell 0.9%, the weakest pace since 2014. Though productivity data are highly variable, the increase is supportive of the notion that tax reform is translating into increased capital expenditures, which carries the potential to boost productivity, keep a lid on unit labor costs (that is, inflation), and extend the current economic cycle. Get the full reading.