Bundles and mergers have begun to take the video-on-demand streaming industry by storm, with a significant example set by the new ESPN-Fox-Warner Bros. Discovery sports platform in the works. The next domino sure to make waves if/when it falls is a rumored merger between Paramount+ and Comcast-owned Peacock. Such a merger would offer stiff competition for Netflix.

Paramount+ Users Look Primed to Win in Merger

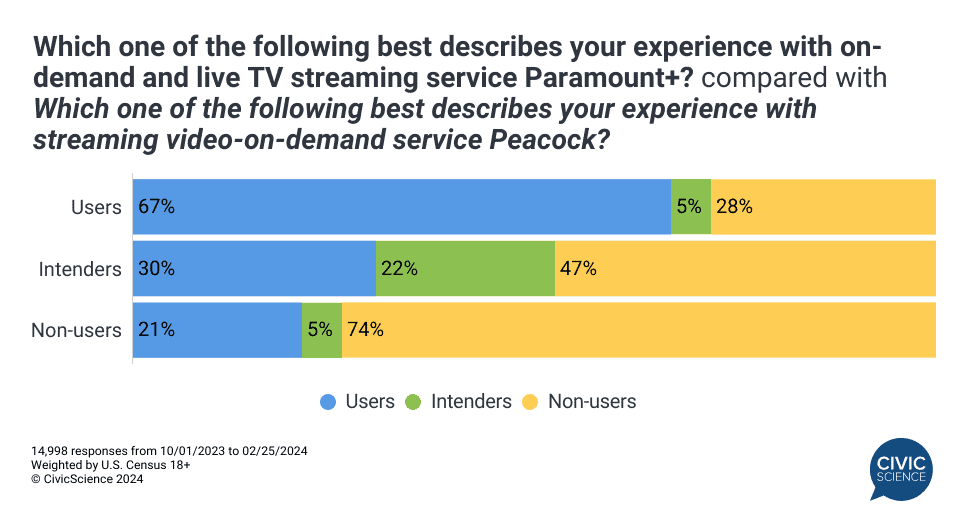

Notably, a potential merger could offer significant advantages to Paramount+ users. CivicScience data reveal that 72% of Paramount+ users also use or plan to use Peacock. Even among those intending to subscribe to Paramount+, 52% are either current users or intend to use Peacock as well.

The Paramount+ and Peacock merger could also create a new dynamic in the competition for the ability to stream NFL playoff games exclusively. Peacock’s stream-only broadcast this past season was a massive win for the platform which they could capitalize on together with Paramount+ in the future. The competition is fierce in this regard, as Amazon Prime Video will jump into the fray with a stream-only playoff game of its own next season. And speaking of Amazon, should a deal with Peacock fail to come to fruition, CivicScience polling shows an even higher percentage of Paramount+ users also use or intend to use Amazon Prime Video (78%).

Join the Conversation: How would you rank Paramount+ among all streaming services?

A Way To Combat Stream Churn?

Stream churning is certainly not a new issue, but with inflation forcing cost-cutting measures and increased instances of stream fatigue, churning is on the rise in early 2024. So far, in 2024, 56% of Americans who use streaming services say they’ve signed up for a video streaming service to watch something and then canceled/paused their membership after watching it in the last year, marking a nine percentage point increase from 2023. Notably, both Paramount+ and Peacock are each significantly more likely to report higher churn rates among users and intenders, with 69% and 68%, respectively, noting at least one instance of churning a subscription within the past year.

Despite Potential Benefit of Reducing Subscriptions Required, Consumers Are Leery

Though bringing two streaming platforms together into one service may alleviate at least some need for carrying multiple subscriptions, how much will that new platform cost? Will it outweigh the cost of holding the services separately? According to CivicScience data, more than three-fourths of streaming users are at least ‘somewhat’ concerned about the cost of platforms following mergers – 34% say they’re ‘very’ concerned.

Taking things a step further, data gauging how consumers feel mergers might impact the average American finds a plurality (42%) believe it will have no impact. Still, respondents are more likely to feel mergers will have a negative impact on them (30%) than a positive one (27%).

The data show that a Parmount+-Peacock merger would make sense and benefit Paramount+ users, given their overlap using Peacock. Amazon Prime Video would be a wise backup consideration as well. However, pricing such a platform in today’s economy demands careful consideration, as consumers are wary of costs and have proven they’re not afraid to switch or cancel subscriptions.

CivicScience’s database of over 500K crossable polling questions allows clients to explore consumer insights and discover trends before they happen. Click here to see it in action.

Take Our Poll: Have you “cut the cord” (i.e., signed up for streaming services only instead of cable / satellite TV)?